Printed on October thirtieth, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which can be considerably increased than the market common. For instance, the S&P 500’s present yield is barely ~1.2%.

Excessive-yield shares might be notably useful in supplementing earnings after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

GeoPark Restricted (GPRK) is a part of our ‘Excessive Dividend 50’ collection, which covers the 50 highest-yielding shares within the Certain Evaluation Analysis Database.

We’ve got created a spreadsheet of shares (and intently associated REITs, MLPs, and many others.) with dividend yields of 5% or extra.

You may obtain your free full listing of all securities with 5%+ yields (together with necessary monetary metrics similar to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our listing of high-dividend shares to evaluation is GeoPark Restricted (GPRK).

Enterprise Overview

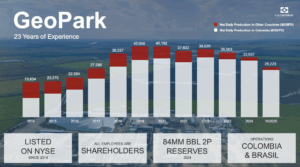

GeoPark Restricted, primarily based in Bogotá, Colombia, explores and produces oil and gasoline in Colombia, Ecuador, Argentina, and Brazil. Based in 2002, it has a market capitalization of $326 million and is thought for its excessive operational effectivity, together with an 81% drilling success charge and low working prices of $13 per barrel in 2023-2024. Round 90% of its manufacturing is money circulation optimistic even at Brent costs of $25-$30, making it a low-cost, aggressive producer.

Nevertheless, GeoPark’s efficiency is extremely delicate to grease and gasoline worth swings, leading to unstable outcomes and losses in 4 of the final 10 years. Its effectivity and low prices make it sturdy operationally, however market cycles drive monetary outcomes.

Supply: Investor Relations

The corporate reported Q2 2025 income of $119.8 million, barely above expectations, and a web lack of $10.3 million, pushed by a one-time impairment in Ecuador. Excluding this cost, web revenue was $20.7 million, pushed by value reductions, decrease depreciation, and tax advantages. Adjusted EBITDA was $71.5 million, with a 60% margin, reflecting disciplined capital and value administration.

Manufacturing averaged 27,380 boepd, supported by $23.9 million in capital expenditures targeted on drilling and workovers in core blocks. The corporate captured $12.5 million in effectivity financial savings, divested non-core Ecuadorian property for $7.8 million, and maintained a powerful steadiness sheet with $266 million in money and a 1.1x leverage ratio.

GeoPark hedged 87% of anticipated 2025 manufacturing, incomes a $4.9 million acquire, and declared a quarterly dividend of $0.147 per share. Administration continues to deal with value effectivity, strategic divestments, and disciplined capital allocation to drive long-term development regardless of market volatility.

Supply: Investor Relations

Development Prospects

Since its founding, GeoPark has steadily expanded manufacturing from zero to roughly 37,000 barrels per day, demonstrating a powerful operational monitor document. The corporate’s latest entry into Vaca Muerta, Argentina—a area with ~16 billion barrels of largely undeveloped reserves—positions it for important future development. GeoPark plans to greater than triple manufacturing on this space, rising output from 6,000 barrels per day in 2024 to 19,500 barrels per day by 2029.

Regardless of its development potential, GeoPark stays extremely delicate to grease and gasoline worth volatility, a problem frequent to most producers within the area. Previous efficiency has mirrored this cyclical publicity, with earnings fluctuating sharply in response to market circumstances. The corporate’s means to keep up low prices and disciplined capital allocation can be key to navigating these swings whereas pursuing growth.

Wanting forward, oil costs are anticipated to stay average attributable to OPEC’s output restoration and the worldwide shift towards clear vitality. However, GeoPark is more likely to profit from a low base impact in 2025, with projected manufacturing and income development of round 8%, pushed by operational effectivity and the event of recent reserves in Vaca Muerta.

Aggressive Benefits & Recession Efficiency

GeoPark’s key aggressive benefit lies in its low-cost construction and excessive operational effectivity. With working prices of round $13 per barrel and a market-leading drilling success charge of 81%, the corporate can generate optimistic money circulation even at low oil costs, giving it resilience in a extremely cyclical trade. Its strategic deal with core property, disciplined capital allocation, and cost-optimization applications additional strengthens its place relative to friends in Latin America.

Nevertheless, GeoPark stays delicate to the volatility of oil and gasoline markets, which may result in sharp swings in earnings in periods of falling costs. Whereas its low-cost operations assist mitigate the affect of downturns, the corporate has skilled losses in 4 of the previous ten years. Regardless of this, its monetary self-discipline, hedging methods, and portfolio diversification permit it to navigate recessions and preserve long-term development potential.

- 2008 earnings-per-share: $1.03

- 2009 earnings-per-share: -$0.20

- 2010 earnings-per-share: $0.11

Dividend Evaluation

The corporate has an annual dividend of $0.59 per share. At its latest share worth, the inventory has a excessive yield of seven.3%.

Given the corporate’s 2025 earnings outlook, EPS is predicted to be $0.90 per share. In consequence, the corporate is predicted to pay out roughly 66% its EPS to shareholders in dividends.

Closing Ideas

GeoPark benefited in recent times from above-average oil costs pushed by the Ukrainian disaster and important OPEC manufacturing cuts. Nevertheless, now quickly restoring output, which might restrict near-term features. The inventory is projected to supply a median annual return of 13.5% over the following 5 years, supported by a 7%+ dividend yield and eight% earnings-per-share development, partially offset by a modest -0.6% valuation headwind.

The inventory carries a maintain score and is appropriate just for buyers who can tolerate intervals of low oil costs, which put strain on efficiency. Slowing oil demand from China might additional weigh on the inventory. GeoPark’s historic underperformance versus the S&P 500—–31% versus +87% over 5 years and +85% versus +219% over the previous decade—serves as a cautionary reminder of the dangers related to investing within the firm.

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.