Printed on November sixth, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which can be considerably larger than the market common. For instance, the S&P 500’s present yield is barely ~1.2%.

Excessive-yield shares will be notably useful in supplementing revenue after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Fidus Funding Company (FDUS) is a part of our ‘Excessive Dividend 50’ collection, which covers the 50 highest-yielding shares within the Certain Evaluation Analysis Database.

We now have created a spreadsheet of shares (and carefully associated REITs, MLPs, and so on.) with dividend yields of 5% or extra.

You may obtain your free full record of all securities with 5%+ yields (together with vital monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our record of high-dividend shares to evaluate is Fidus Funding Company (FDUS).

Enterprise Overview

Fidus Funding Company is an externally managed enterprise improvement firm (BDC) that gives tailor-made debt and fairness financing options to lower-middle-market firms.

The agency targets cash-flow-positive companies with predictable revenues of $10 million to $150 million yearly, emphasizing firms with defensible or main positions of their industries.

By specializing in this area of interest, Fidus goals to assist the expansion and stability of firms with robust fundamentals and sustainable enterprise fashions.

Headquartered in Evanston, Illinois, Fidus Funding Company generates roughly $95 million in whole funding revenue yearly.

By its strategic financing method, the corporate leverages its experience to construction investments that stability threat and return whereas fostering long-term worth creation for each its portfolio firms and shareholders.

Its concentrate on disciplined funding choice and customised monetary options positions Fidus as a notable participant within the decrease middle-market financing house.

Supply: Investor Relations

The corporate reported robust Q2 2025 outcomes, with adjusted web funding revenue of $20.0 million ($0.57 per share) and whole funding revenue of $39.97 million, up 12% yr over yr.

The corporate invested $94.5 million in new debt and fairness positions and obtained $109.3 million from repayments and realizations. The board declared third-quarter dividends of $0.57 per share, together with a base of $0.43 and a supplemental $0.14.

The portfolio contains 92 lively firms and 5 exited investments, valued at $1.1 billion. About 71% of debt investments are variable-rate, with a weighted common yield of 13.1%.

New investments spanned software program, supplies testing, plumbing, and environmental consulting, reflecting Fidus’ concentrate on lower-middle-market companies with predictable money flows and resilient fashions.

Fidus holds $91.2 million in money and $140 million of unused credit score capability, offering liquidity for future investments.

Administration stays centered on disciplined capital deployment, producing engaging risk-adjusted returns, rising web asset worth, and returning revenue to shareholders by means of dividends and its reinvestment plan.

Development Prospects

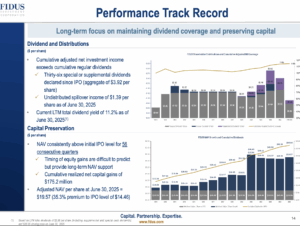

Fidus Funding Company has demonstrated constant progress by sustaining steady web funding revenue (NII) by means of a disciplined yield unfold between its funding returns and debt prices.

Since its IPO in 2011, the corporate’s web asset worth per share has elevated from $14.46 to $19.50, reflecting long-term worth creation regardless of occasional durations when dividends exceeded beneficial properties.

Fidus has proven flexibility in its dividend technique, briefly decreasing its quarterly dividend in 2020 earlier than regularly restoring it to $0.43 per share, whereas additionally paying supplemental and particular dividends totaling $0.27 in 2021, $0.56 in 2022, $1.20 in 2023, and $0.70 in 2024.

Wanting forward, Fidus is well-positioned to profit from larger rates of interest, which ought to improve its revenue from debt investments, although progress in NII per share could also be restricted by its already excessive revenue base.

The corporate’s disciplined method to capital deployment, its concentrate on lower-middle-market firms with resilient money flows, and its strategic stability between common and supplemental dividends assist sustainable shareholder returns.

General, Fidus’ observe report and portfolio administration technique counsel it might proceed to generate engaging, risk-adjusted returns whereas steadily rising its web asset worth.

Supply: Investor Relations

Aggressive Benefits & Recession Efficiency

Fidus Funding Company’s aggressive benefit lies in its disciplined concentrate on decrease middle-market firms with predictable money flows and defensible market positions.

By tailoring debt and fairness options to every portfolio firm and sustaining a yield unfold between funding returns and borrowing prices, Fidus generates steady web funding revenue whereas mitigating draw back threat.

Its diversified portfolio throughout industries and its mixture of variable- and fixed-rate debt additional improve resilience and supply flexibility in capital deployment.

Throughout financial downturns, Fidus has traditionally maintained portfolio stability and revenue era. Its emphasis on cash-flow-positive companies with resilient enterprise fashions permits it to navigate recessions with out vital impairment losses.

Even when dividends often exceeded realized beneficial properties, leading to non permanent NAV stress, the corporate’s long-term observe report reveals constant NAV progress, demonstrating its skill to maintain returns and protect shareholder worth in difficult market environments.

Supply: Investor Relations

Dividend Evaluation

The corporate’s annual dividend is $1.72 per share. At its latest share value, the inventory has a excessive yield of 8.5%.

Given the corporate’s 2025 earnings outlook, EPS is anticipated to be $2.00 per share. In consequence, the corporate is anticipated to pay out roughly 86% its EPS to shareholders in dividends.

Ultimate Ideas

Since its IPO, Fidus Funding Company has delivered stable efficiency, constantly paying substantial dividends whereas rising its web asset worth per share.

We undertaking annualized returns of roughly 4.6% by means of 2030, largely pushed by common dividends, although potential valuation headwinds might restrict progress.

This estimate excludes particular dividends, which Fidus has traditionally paid with consistency, suggesting whole returns might be considerably larger. Primarily based on this outlook, we preserve a maintain ranking on FDUS.

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].