Revealed on January tenth, 2023 by Nikolaos Sismanis

Shares of Enviva have declined considerably over the previous yr over fears of a possible dividend minimize.

Nonetheless, Enviva has continued to develop its dividend even supposing it’s basically funded by additional debt and fairness proceeds.

With shares declining and the dividend rising within the meantime, the inventory’s yield has now been pushed to a hefty 6.8%.

Therefore, Enviva is among the many high-yield shares in our database.

We now have created a spreadsheet of shares (intently associated REITs and MLPs, and many others.) with 5% or extra dividend yields.

You’ll be able to obtain your free full listing of all securities with 5%+ yields (together with vital monetary metrics similar to dividend yield and payout ratio) by clicking on the hyperlink under:

This text will analyze Enviva (EVA).

Enterprise Overview

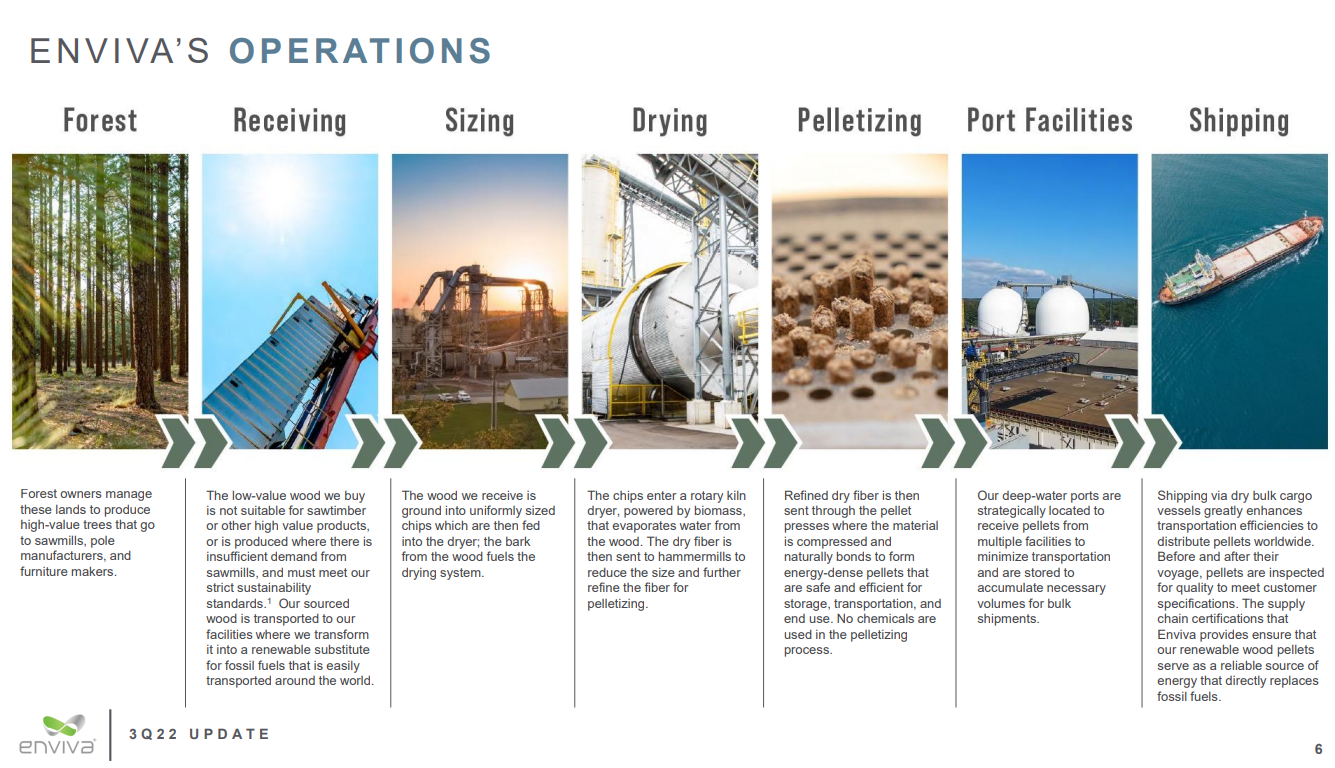

Enviva focuses on sourcing wooden fiber and turning it into transportable wooden pellets. It’s, the truth is, the biggest producer of wooden pellets for utilities on the earth, with the vast majority of their wooden pellets being offered by means of long-term contracts with purchasers all around the world.

Their ten U.S.-based amenities have a complete capability of roughly 6.2 million metric tons per yr, whereas the corporate exports its wooden pellets by means of its personal marine terminals and third-party marine terminals in numerous different states.

Supply: Investor Presentation

In October 2021, EVA acquired 100% of the possession curiosity in Enviva Holdings, simplifying the corporate’s construction by changing from an MLP into a conventional company starting in 2022.

Enviva’s latest efficiency has been considerably delicate, with adjusted EBITDA coming in at $60.6 million in its Q3 outcomes, down from $62.9 million final yr non-recast (i.e., previous to the enterprise simplification)

Distributable money move got here in at $36.3 million, an additionally underwhelming consequence from final yr’s $49.5 million, previous to the transformation of the corporate.

The corporate estimates a distributable money move of roughly $180 million for fiscal 2022, which hardly covers the dividend regardless of administration’s dedication to elevating it.

Development Prospects

Enviva plans to extend its distributable money move by increasing manufacturing capability and finishing accretive acquisitions. They just lately acquired the Lucedale plant, as an example, which started operations within the final quarter of 2021, and will have reached full capability by the tip of 2022 (This autumn outcomes but to be out).

The corporate has additionally introduced plans to speed up its growth by means of natural progress. Particularly, the corporate expects to double its manufacturing capability over the subsequent 5 years from 6.2 million metric tons per yr to round 13 million metric tons per yr.

This progress might be achieved by setting up and beginning operations on two crops concurrently.

That stated, inflationary pressures (larger commodity, transportation, and wage prices) are more likely to strain the corporate’s profitability in the course of the present surroundings.

Aggressive Benefits

Being the biggest participant within the transportable wooden pellets house, Enviva has the sting over its smaller opponents, who can not scale as effectively.

Due to its various provider base and facility places, the corporate is ready to get pleasure from extra constant and cheaper deliveries than different firms within the area or business.

Its Chesapeake terminal, as an example, gives a aggressive benefit of 3-4 days shorter transport time to Europe in comparison with different ports positioned within the south or alongside the Gulf Coast.

Dividend Evaluation

Even previous to changing into a c-corp, Enviva had been appreciated by dividend progress buyers as a result of its hefty payouts and constant will increase. Payouts have now grown for six consecutive years, whereas the inventory trades with a yield shut to six.8%.

That stated, Mr. Market has been coming near the conclusion that Enviva’s dividend progress technique will not be sustainable. Payouts have barely been lined since Enviva initiated the dividend in 2016, whereas the corporate has currently resorted to elevating extra capital to search out sufficient money to cowl it.

Within the first half of 2022, Enviva recorded a detrimental working money move of $68.9 million. In Q3, issues received a little bit higher, however general the corporate nonetheless recorded a detrimental working money move of $51.6 million for the primary 9 months of the yr.

Regardless of the detrimental working money flows, Enviva continued to pay and even enhance its dividend, whose funds totaled $158.3 million throughout the identical interval.

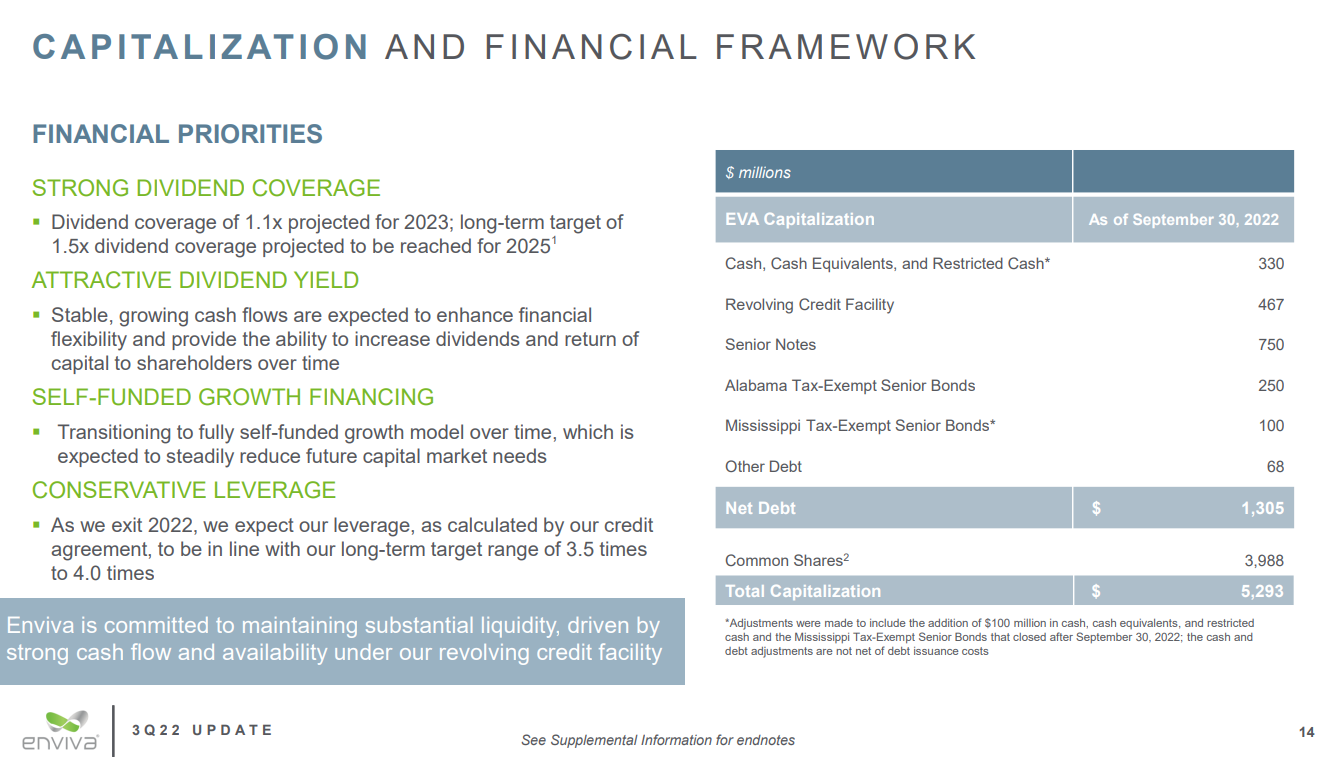

Damaging working money move can not presumably fund their dividend funds, not to mention the $162.4 million in CAPEX the corporate additionally recorded. So how did they fund this gap? By issuing $250.4 million of debt, web, and $333 million of fairness.

Shifting ahead, this transfer to short-term maintain payouts might be costly for shareholders, because the debt will demand extra curiosity bills and the fairness extra dividend payouts.

The corporate expects dividend protection to develop to 1.5X by 2025, however whether or not such an bold goal is feasible stays to be seen.

Supply: Investor Presentation

Until the corporate resumes dividend protection inside 2023, the likelihood of a dividend minimize ought to solely enhance over time.

Ultimate Ideas

Enviva has managed to reward shareholders with rising dividends since its debut within the public markets.

Its transformation to a c-corp ought to simplify operations and unlock some extra versatile progress avenues.

Nonetheless, the viability of Enviva’s dividend is at the moment being contested.

Subsequently, we urge that buyers shouldn’t rely closely on Enviva’s payouts.

If you’re occupied with discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases might be helpful:

The main home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them usually:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].