Revealed on November twelfth, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which are considerably greater than the market common. For instance, the S&P 500’s present yield is just ~1.2%.

Excessive-yield shares will be notably helpful in supplementing earnings after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Vitality Switch LP (ET) is a part of our ‘Excessive Dividend 50’ collection, which covers the 50 highest-yielding shares within the Positive Evaluation Analysis Database.

We’ve got created a spreadsheet of shares (and carefully associated REITs, MLPs, and many others.) with dividend yields of 5% or extra.

You possibly can obtain your free full checklist of all securities with 5%+ yields (together with necessary monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our checklist of high-dividend shares to overview is Vitality Switch LP (ET).

Enterprise Overview

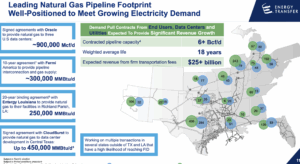

Vitality Switch LP is among the largest and most diversified power infrastructure corporations in the USA, working roughly 140,000 miles of pipelines and related power belongings throughout 44 states. Its operations span pure fuel midstream, intrastate and interstate transportation and storage, crude oil, refined product, and pure fuel liquids (NGL) transportation and terminaling, in addition to NGL fractionation.

The corporate additionally holds pursuits in Sunoco LP and USA Compression Companions, LP, enhancing its built-in power community and offering a broad base of fee-based income with restricted publicity to commodity worth fluctuations.

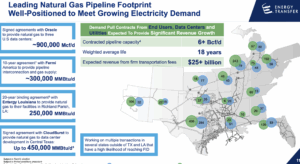

The partnership focuses on strategic progress by way of infrastructure enlargement, operational effectivity, and long-term provide agreements. Latest initiatives embody new processing vegetation, storage expansions, and energy era amenities, in addition to long-term pure fuel provide contracts with main company clients.

ET’s various portfolio and geographic attain enable it to generate balanced earnings throughout a number of segments, with a good portion of money circulate derived from pure gas-related belongings. This positions the corporate to maintain distributions to companions whereas investing in progress tasks throughout key U.S. power markets.

Supply: Investor Relations

The corporate reported Q3 2025 internet earnings of $1.02 billion, or $0.28 per frequent unit, with income of $6.03 billion, up 4.9% year-over-year. Adjusted EBITDA was $3.84 billion, and distributable money circulate totaled $1.90 billion, barely beneath final yr on account of one-time objects. Development and upkeep capital expenditures have been $1.14 billion and $293 million, respectively.

Operational volumes set new information throughout NGL terminals (+10%), NGL transportation (+11%), and exports (+13%), whereas pure fuel transportation and midstream volumes additionally elevated. Key tasks embody the Mustang Draw II processing plant, Worth River Terminal enlargement, and new West Texas energy amenities.

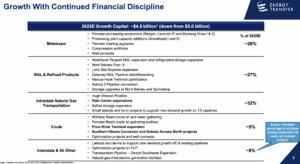

Strategically, the corporate signed long-term fuel provide agreements with Oracle and Entergy, and is increasing storage at Bethel to 12 Bcf by 2028. Quarterly distributions rose 3% to $0.3325 per frequent unit. With a diversified, fee-based portfolio, Vitality Switch plans $5 billion in 2026 progress capital, specializing in pure fuel infrastructure.

Supply: Investor Relations

Development Prospects

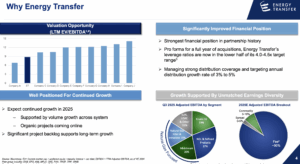

Vitality Switch LP’s progress prospects are anchored within the strategic enlargement of its midstream and pure fuel infrastructure throughout the USA. The corporate continues to put money into large-scale tasks, together with new processing vegetation, storage amenities, and pipeline expansions, that are designed to assist rising demand for pure fuel and NGL transportation.

Its ongoing tasks, such because the Mustang Draw II processing plant and Bethel storage enlargement, improve capability and operational effectivity, positioning ET to seize long-term progress alternatives in key power markets.

As well as, Vitality Switch is leveraging long-term provide agreements with main company clients, together with Oracle and Entergy, to safe steady, fee-based income streams. The corporate’s diversified portfolio, spanning a number of power segments and geographic areas, reduces commodity worth danger whereas offering constant money circulate for reinvestment.

With deliberate progress capital expenditures of roughly $5 billion in 2026, primarily in pure gas-related belongings, ET is well-positioned to develop its infrastructure management, enhance volumes, and maintain distributions to companions over the long run.

Supply: Investor Relations

Aggressive Benefits & Recession Efficiency

Vitality Switch LP’s aggressive edge comes from its scale, diversification, and largely fee-based operations. With 140,000 miles of pipelines and in depth terminals throughout 44 states, no single section drives greater than one-third of EBITDA, lowering commodity danger.

Partnerships with Sunoco LP and USA Compression strengthen its infrastructure and operational attain.

The corporate performs effectively throughout recessions on account of predictable, fee-driven money flows and important power infrastructure. Even in market downturns, ET maintains steady distributions whereas investing in progress tasks, leveraging its diversified portfolio to generate dependable income and maintain long-term monetary stability.

Dividend Evaluation

The corporate’s annual dividend is $1.33 per share. At its current share worth, the inventory has a excessive yield of seven.9%.

Given the corporate’s 2025 earnings outlook, CF/S is predicted to be $2.70 per share. In consequence, the corporate is predicted to pay out roughly 49% of its CF/S to shareholders in dividends.

Ultimate Ideas

Vitality Switch carries an elevated danger on account of a weak stability sheet and a modest rally over the previous 18 months. Over the subsequent 5 years, the inventory may ship a median annual return of seven.9%, pushed by its 7.9% distribution yield and 5% money circulate per share progress, partially offset by a -5.0% valuation drag.

The inventory retains a maintain score and is suitable just for buyers prepared to tolerate vital volatility.

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].