bymuratdeniz

Simplify Enhanced Revenue ETF (NYSEARCA:HIGH) is an actively managed fund that makes choices performs with a purpose to generate earnings. It’s run by the identical firm that runs some extremely fashionable funds comparable to Simplify Volatility Premium ETF (SVOL) and Simplify Managed Futures Technique ETF (CTA).

This fund is a bit completely different in comparison with different fashionable high-yielding funds that make the most of choices performs comparable to JPMorgan Fairness Premium Revenue ETF (JEPI) and International X NASDAQ 100 Lined Name ETF (QYLD). The distinction is that this fund sells choice credit score spreads as an alternative of lined calls. In a lined name play, one would purchase 100 shares of a inventory and write 1 name choice towards these 100 shares to generate earnings. As a substitute of that, this fund sells numerous put and name choices and buys the identical choice a number of {dollars} away from the strike worth of the choices it bought. For instance, the fund might promote a SPY (SPY) $425-420 put unfold which might imply that it’s promoting $425 places and shopping for $420 places, limiting its draw back potential.

Sometimes the fund makes month-to-month or weekly performs and will get out and in of positions in a short time as quickly as its aim has been met within the play. The fund would not specify that standards it makes use of with a purpose to choose strike worth or width of choices spreads it sells however after a number of of the fund’s latest performs it appears just like the fund principally targets a delta vary of 25-30 for its choices performs. What this implies is that the fund picks a worth level the place likelihood of dropping cash is about 25-30%.

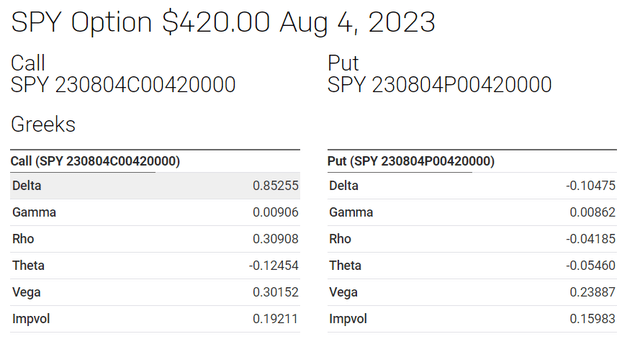

How does any of this work? Let me present you an instance. Let’s take a selected SPY choice, places and calls expiring on August 4th 2023 at a strike worth of $420. Every particular choice carries a number of inherent set of metrics known as “Greeks” as a result of they’re related to sure letters of the Greek alphabet. For instance, Theta refers back to the time decay and time worth of the choice and the way a lot time decay may very well be anticipated from an choice per day. Vega refers to volatility of the choice and the way it reacts to every level enhance or lower in volatility. Delta is a quantity that tells us how a lot worth an choice will achieve or lose when the underlying inventory strikes by $1. Within the under instance, $420 calls have a Delta worth of 0.85 which suggests this selection will achieve 85 cents for every greenback SPY rises and lose 85 cents for every greenback SPY drops. Put choice has the identical relationship in the other way.

Instance of Greeks of an choice (Nasdaq)

Delta values of choices will also be used to calculate chances of an choice expiring nugatory although. For instance, if a put choice has a delta worth of 0.15 it means there’s solely 15% probability that it is going to be worthwhile for the client and 85% probability that it is going to be worthwhile for the vendor. These chances are primarily based on previous actions, volatility and timing of the choice they usually are typically extremely correct.

This fund principally sells choices with delta values round 0.25-0.30 which point out low likelihood of failure but it surely comes with a caveat which is the truth that choices with low deltas additionally are typically cheaper which suggests payout can be small for the choice vendor. If the choice vendor needs to generate extra earnings, they’ve to choose a better delta however this additionally means taking over extra threat. In spite of everything there isn’t any free lunch in choices buying and selling whether or not you might be on the shopping for or promoting facet.

The fund distributes 20 cents per share monthly and it is on monitor to have an annual dividend of $2.40 which might translate right into a yield of near 10% towards the share worth of $25.

Really the fund at present has majority of its belongings briefly time period treasuries that yield about 5.25% and the fund passes this onto traders as a part of its dividend. The fund additionally makes use of this as collateral for its choices performs. Because the fund has dedicated to pay about 10%, it solely has to generate about one other 5% to cowl its dividend plus bills. Which means the fund would not need to go overly aggressive to generate its yield however this might change if brief time period rates of interest drop. For instance if brief time period treasury charges have been to drop to 2%, the fund must generate one other 3.25% from its choices performs with a purpose to cowl its dividend and it may need to make extra aggressive performs general.

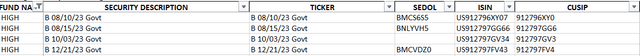

Once I take a look at the fund’s present holdings I’m not seeing any choices in the meanwhile which suggests the fund completed its performs and now seeking to provoke new positions. HIGH is not invested in choices performs 100% of the time and it usually strikes out and in of positions which leaves a while gaps the place it has no energetic performs apart from the bonds it holds for collateral. The fund takes an opportunistic method in its performs and it’ll solely provoke a place if it has conviction in it. This nature of the fund’s performs additionally makes it tough for me to look at and provide my tackle their particular positions.

HIGH’s present holdings (Simplify)

Buyers who really feel uncomfortable with the thought of a extremely energetic fund that rapidly strikes out and in of choices positions ought to in all probability both keep away from this fund or make it a really small place inside their portfolio. I have already got a really small place of this fund as a result of I personally really feel snug with the thought of promoting choice spreads for earnings and I even promote spreads myself every so often. Having stated that, this fund is definitely not for everybody. Conservative and risk-aversive traders might in all probability discover extra worth in additional conventional choices funds comparable to JEPI and International X S&P 500 Lined Name ETF (XYLD) and sleep higher at evening in comparison with this fund.

Editor’s Observe: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.