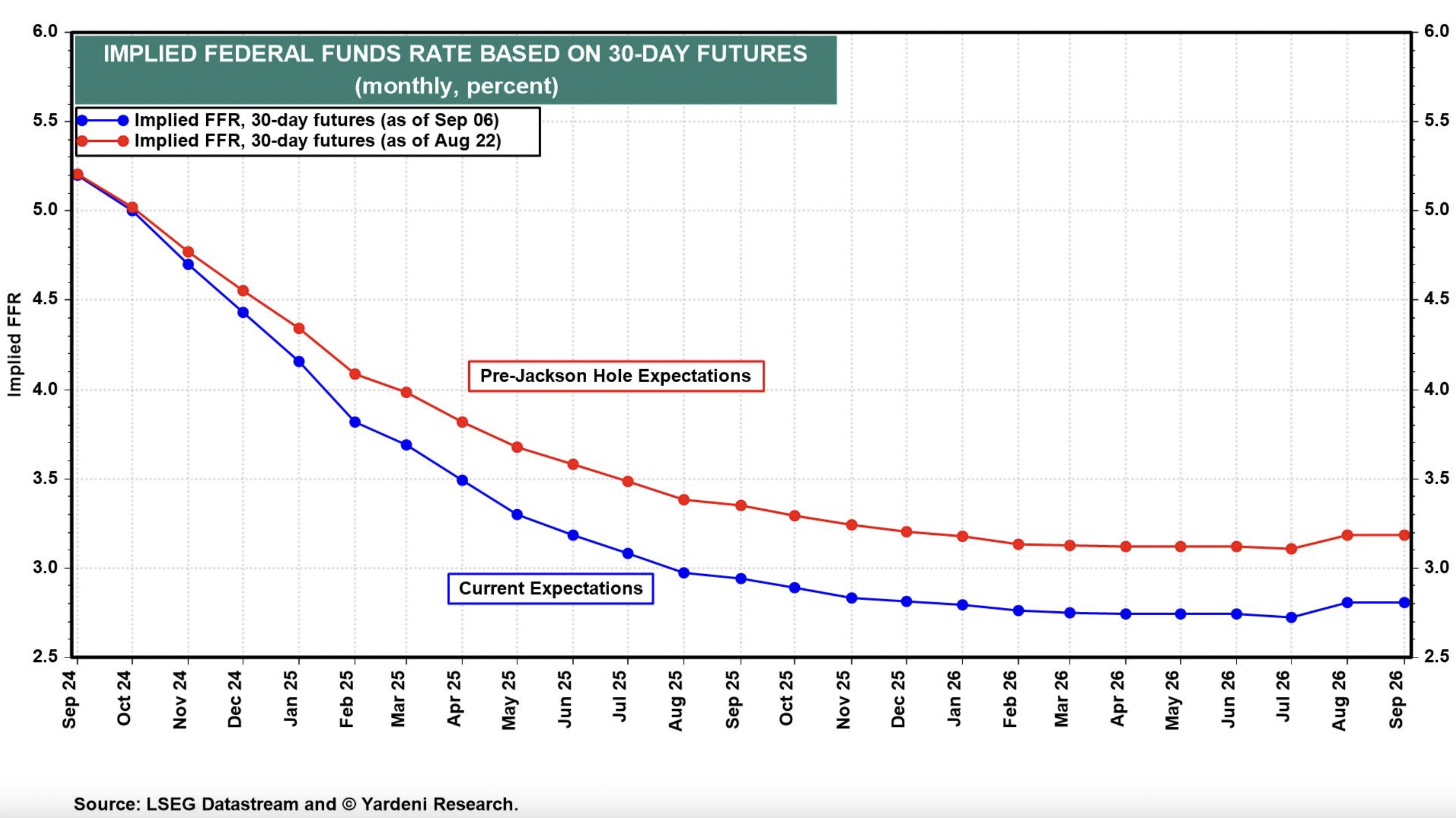

The monetary markets have been anticipating extra cuts within the federal funds price (FFR) than Eric and I’ve all 12 months thus far. At first of this 12 months, the markets anticipated six to seven price cuts in 2024.

We anticipated two to a few at most.

The markets are extra dovish on the speed outlook than we had been due to buyers’ widespread perception that the Fed must decrease rates of interest a number of occasions to avert a recession, following the historic script. At such occasions up to now after a spherical of tightening, the financial system fell right into a recession despite the fact that the Fed eased in response to its weakening. This time, we’ve had extra confidence within the resilience of the financial system. For the reason that summer time, we’ve been predicting one price lower in September for the remainder of this 12 months and pondering possibly two to 4 cuts in 2025. We’ve been extra on the mark than the market thus far in 2024: There hasn’t been even a single price lower but this 12 months.

Now our one-and-done outlook for the rest of 2024 appears to be like much less seemingly after Friday’s weak employment report. Contemplate the next:

1 – September odds at 100%

The market’s odds of a 25bps lower on September 18, when the newest FOMC Assertion can be launched, are actually at 70%. The percentages that the lower may be 50bps are 30% at present. That’s in line with the CME Group’s FedWatch. 5 of the final six price reducing cycles started with 50bps price cuts. (Hat tip to John Mauldin.) Fee cuts now are additionally broadly anticipated following the November and December FOMC conferences.

2 – Markets anticipating a number of cuts.

The federal funds price (FFR) futures market is at present anticipating 25bps price cuts in November and December.

Six and 9 25bps cuts within the FFR are anticipated over the subsequent six and 12 months. These expectations recommend that the FFR will fall 150bps to three.75% in six months and 225bps to three.00% in 12 months. In fact, these expectations had been heightened by Fed Chair Jerome Powell’s Jackson Gap speech on August 23, when he stated: “The time has come for coverage to regulate. The path of journey is evident, and the timing and tempo of price cuts will depend upon incoming knowledge, the evolving outlook, and the stability of dangers.”

3 – The Fed’s projections

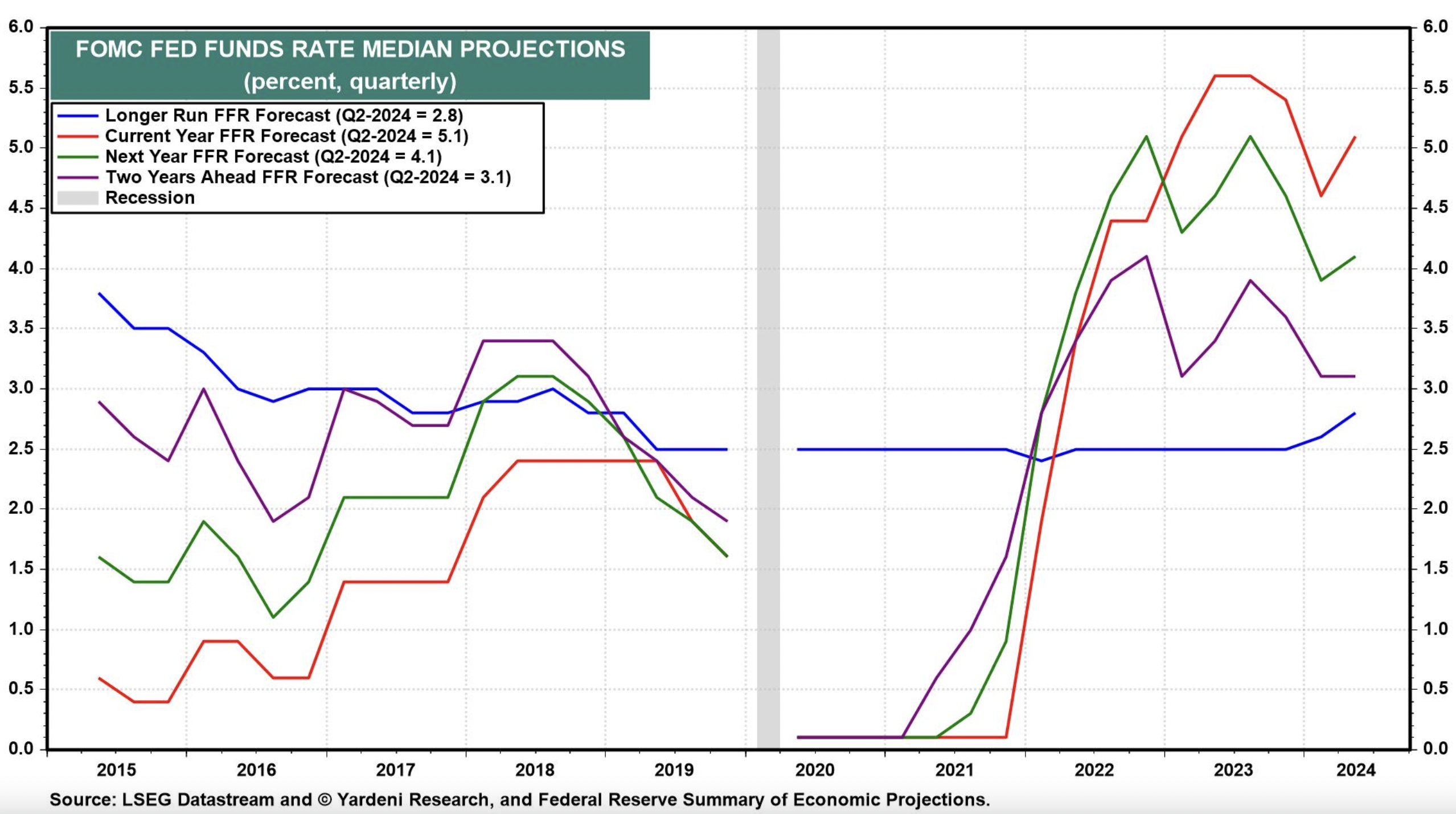

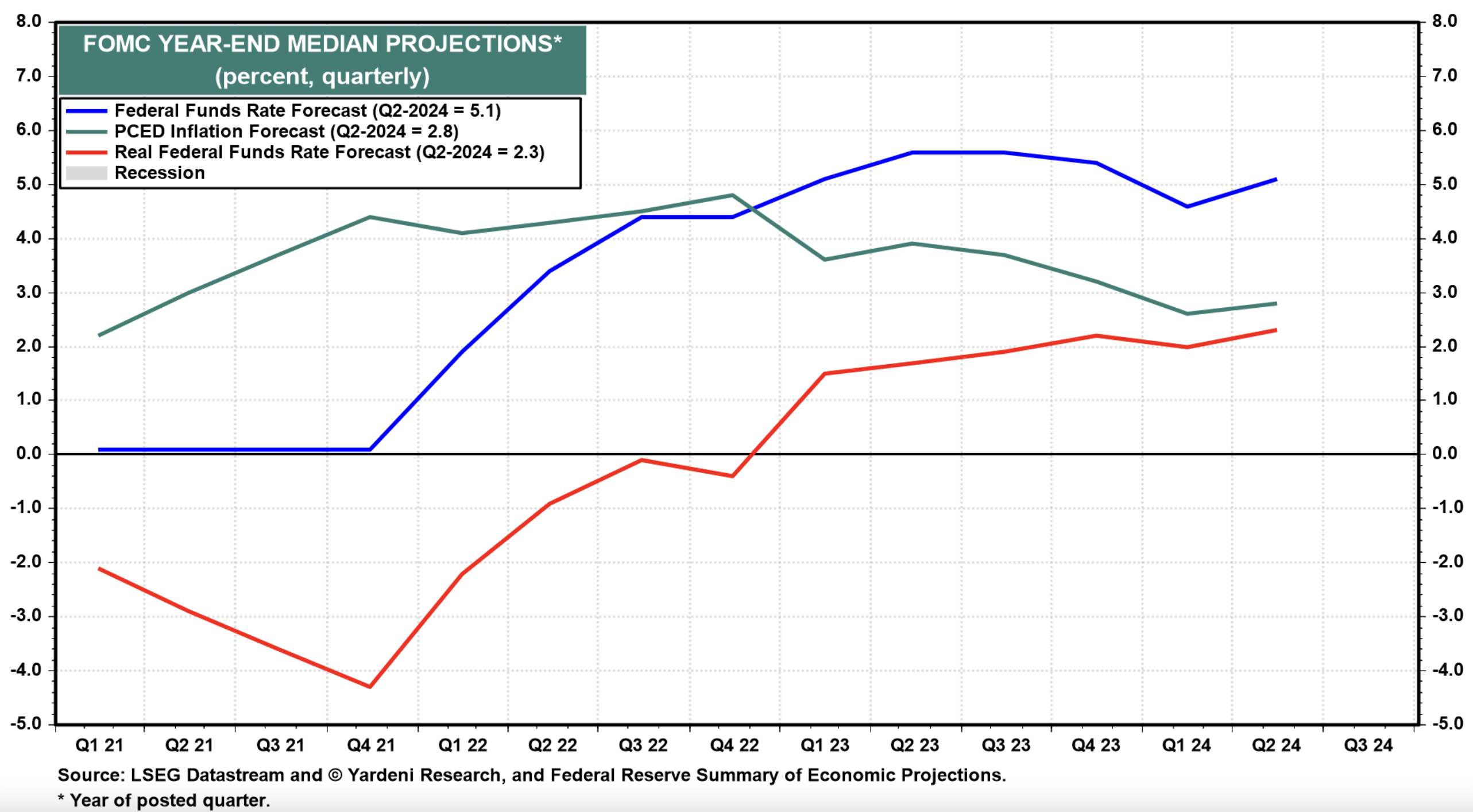

Each quarter, the FOMC releases the committee’s Abstract of Financial Projections (SEP). The final one is dated June 12, and it confirmed the FFR at 5.1%, 4.1%, and three.1% at year-ends 2024, 2025, and 2026.

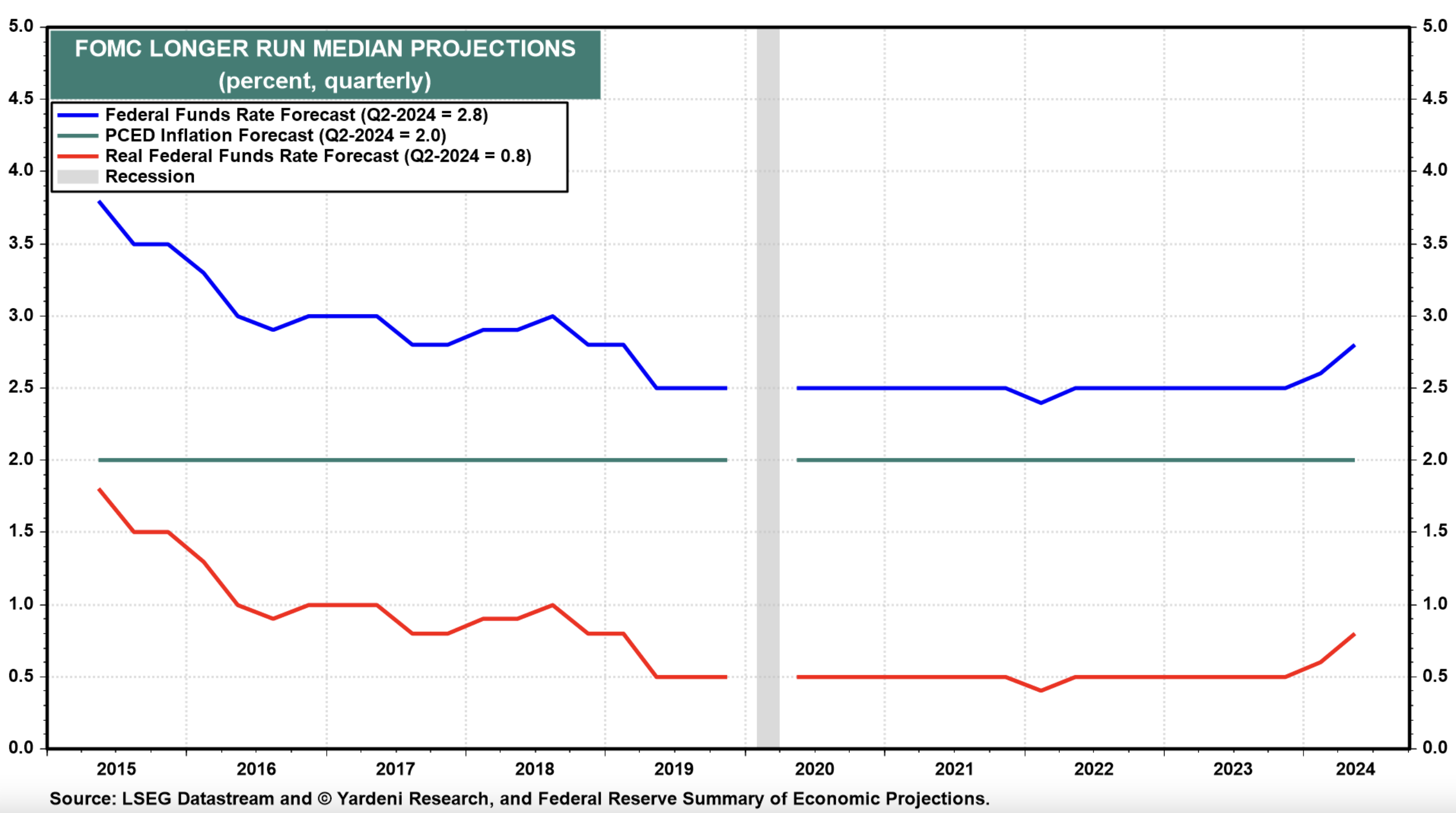

The so-called “longer-run” FFR was estimated to be 2.8%, up from 2.6% in March’s SEP.

Presumably, the longer-run FFR is the committee’s projection of the so-called impartial FFR.

So the FFR futures market is predicting that September’s SEP will present that the committee’s projections have been lowered. We agree, although maybe not as a lot as at present prompt by the futures market. June’s SEP anticipated only one price lower by the top of this 12 months.

September’s SEP would possibly present two or three price cuts. It is going to be fascinating to see whether or not and by how a lot FOMC individuals decrease their FFR projections for 2025 and 2026. Once more, we doubt they are going to be as dovish because the market’s present projections. As well as, we received’t be shocked in the event that they barely elevate their evaluation of the long-run FFR given the resilience of the financial system.

4 – Our evaluation

What about our projections for the FFR? Our opposite intuition is that what’s taking place now could be not more than one other development scare that may cross. As soon as once more, we anticipate that the financial system will shock to the upside. Our evaluation of Friday’s employment report is that it wasn’t as unhealthy as broadly believed. Moreover, a number of the obvious weak spot in employment means that productiveness development might proceed to shock to the upside.

5 – Don’t combat the Fed (!)

In any occasion, we discovered early in our careers to respect the next adage: “Don’t combat the Fed.” Powell & Co. have clearly signaled that they’re intent on decreasing the FFR to avert a recession now that they’ve in impact declared “Mission Achieved” on inflation—i.e., they’ve introduced it down shut sufficient to their 2.0% goal that they’re assured it’ll get there shortly by itself even when they begin easing financial coverage to maintain the jobless price from rising.

Once more, we aren’t satisfied that the financial system wants a lot assist from the Fed to continue to grow. Nevertheless, we do agree that inflation will find yourself this 12 months even nearer to 2.0%, as we’ve been predicting for the reason that summer time of 2022. So an easier-than-necessary financial coverage might very properly enhance actual financial development. We anticipate that may come from quicker productiveness development, quite than employment development.

As for inflation, we are going to fear about it rather more if both the Democrats or the Republicans sweep the November 5 elections.