- The inventory market is reaching new highs because the S&P 500 exceeds 5,700 factors.

- Whereas tech shares shine, healthcare is rising as a key sector this earnings season.

- Promising income development positions healthcare shares as distinctive alternatives for traders.

- Searching for actionable commerce concepts to navigate the present market volatility? Unlock entry to InvestingPro’s AI-selected inventory winners for underneath $9 a month!

As we strategy the Q3 earnings season, the inventory market is hovering to new all-time highs.

This yr alone, we have recorded greater than 40 new highs for the , representing 22.3% of whole buying and selling days, which implies we’ve set a brand new file greater than as soon as each 5 buying and selling days.

Not too shabby, particularly with the S&P 500 surging above 5,700 factors right this moment. By the top of the yr, we’ll see how nicely analysts and strategists from the large banks have fared in opposition to their January forecasts.

Buyers are as soon as once more focusing their consideration on the expertise sector (NYSE:), with the Magnificent Seven main the cost.

Whereas we count on optimistic outcomes total, one sector has me notably intrigued this earnings season: Healthcare (NYSE:).

Healthcare Shares Set to Outperform?

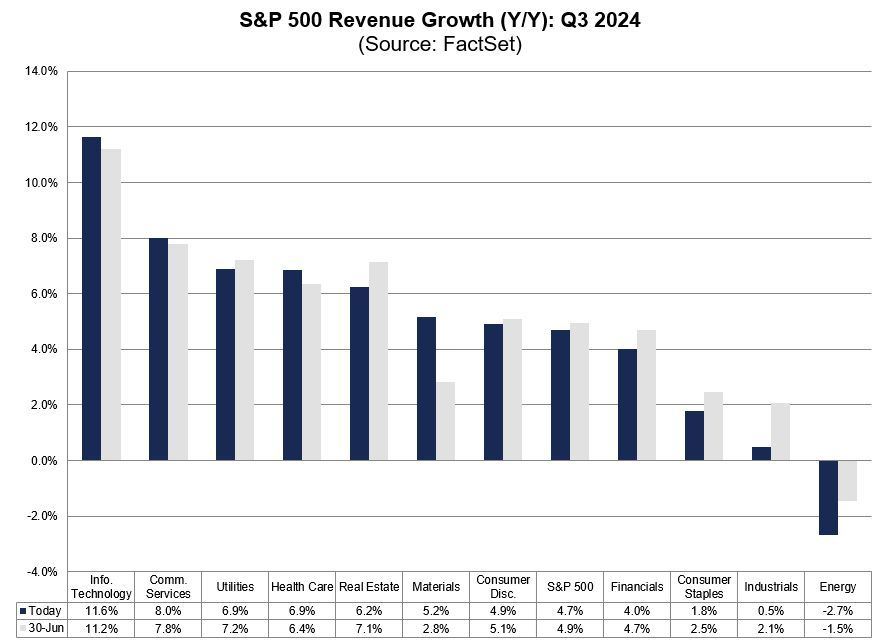

Present estimates not solely present promising income development, however Healthcare additionally boasts the best optimistic revisions since June 30, up by 0.5%—much more than tech.

Contemplate this: because the post-COVID interval, many pharmaceutical corporations have confronted important declines, creating a singular alternative:

- Valuations are in step with historic averages.

- Sentiment stays impartial to unfavorable.

These two situations open the door for attention-grabbing methods. Take into consideration what occurred with China and PayPal (NASDAQ:), two examples I’ve often mentioned. They have been as soon as neglected however now draw important curiosity.

In relation to technique, you could have choices. In case you favor broad publicity to the sector, think about using low-cost ETFs and numerous methods like fractional entries or dollar-cost averaging whereas monitoring the sector’s energy by rotational or relative energy methods.

Then again, if you wish to dive into inventory choosing, search for corporations with stronger turnaround potential. Give attention to these with recovering steadiness sheets, engaging valuations, and constructive chart patterns, particularly as you assess their newest quarterly outcomes.

***

Disclaimer: This text is written for informational functions solely. It’s not meant to encourage the acquisition of belongings in any manner, nor does it represent a solicitation, provide, advice or suggestion to take a position. I want to remind you that each one belongings are evaluated from a number of views and are extremely dangerous, so any funding choice and the related danger is on the investor’s personal danger. We additionally don’t present any funding advisory companies. We are going to by no means contact you to supply funding or advisory companies.