By our reckoning, throughout the first half of 2022 the US financial system entered the bust section of the financial boom-bust cycle attributable to financial inflation (speedy financial inflation causes a growth that inevitably is adopted by a bust because the receding financial tide exposes the boom-time malinvestments). The bust section virtually at all times culminates in a recession, though it doesn’t must.

Thus far, the performances of commodity costs in each US$ phrases and phrases are in keeping with an financial system within the bust section, in that final week the GSCI Spot Commodity Index (GNX) examined its cycle low in US$ phrases and made a brand new 3-year low in gold phrases. The next each day chart reveals GNX in gold phrases, that’s, it reveals the commodity/gold ratio.

Booms and busts are outlined by the commodity/gold ratio, with booms being multi-year intervals throughout which the commodity/gold ratio tendencies upward and busts being multi-year intervals throughout which the commodity/gold ratio tendencies downward.

Notice that it isn’t uncommon for the inventory market, as represented by the (SPX), to pattern upward for a substantial time after the beginning of an financial bust. For instance, an financial bust began in October of 2018 however the SPX didn’t peak till February of 2020. Subsequently, the truth that the SPX made a brand new all-time excessive as just lately as final month just isn’t inconsistent with the US being within the bust section of the financial cycle.

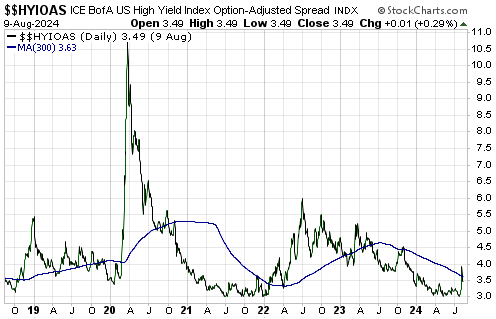

What’s inconsistent with the bust section are credit score spreads, which previous to the turmoil of the previous 1.5 weeks have been at their boom-time lows. Nonetheless, the comparatively low common stage of US credit score spreads doesn’t mesh with the comparatively giant variety of company bankruptcies, so it’s doubtless that credit score spreads are sending a deceptive sign.

The deceptive sign could possibly be the results of junk-rated companies delaying their re-financings for so long as doable within the hope that in the event that they wait lengthy sufficient, they are going to be capable of re-finance at decrease rates of interest throughout the subsequent Fed rate-cutting cycle. The issue that many of those firms will encounter is {that a} Fed rate-cutting cycle most likely will start close to the beginning of a recession and a multi-quarter interval throughout which rates of interest fall on high-quality debt whereas rising quickly on low-quality debt.

In a we wrote that the battle between the sign from the commodity/gold ratio and the sign from credit score spreads must be resolved both by credit score spreads widening considerably in response to proof of financial weak point or by the costs of business commodities rising considerably in response to proof {that a} new growth had been ignited.

Our view then and now could be that the previous is by far the extra doubtless consequence. Actually, there’s a great likelihood that final week’s rise within the credit-spreads indicator proven on the next each day chart marked an vital turning level.