In final week’s meandering market missive, I opined that, “the subsequent main pattern – in both route – is prone to be pushed by the outlook/expectation for the state of the economic system”.

Whereas I’ll admit that this is not precisely groundbreaking evaluation, I proceed to consider that is the important thing to understanding the present big-picture market setting.

To this point a minimum of, the inventory market seems to be waiting for higher days. To a time when the Fed is not the enemy. To when the inflation bogeyman has slunk again into the shadows. And to a time when recession shouldn’t be the extensively anticipated end result for the U.S. economic system.

How else do you clarify the spectacular good points seen within the main indices in 2023? Doing a little fast math, I discover that the (utilizing as a proxy) is up +6.1% year-to-date, () have superior +8.7%, Mid caps are up +7.8%, and the a lot maligned () sports activities an eye-popping return of +11.3% thus far within the new 12 months.

Not too shabby, eh?

Our furry pals within the bear camp are fast to pooh-pooh the notion that shares are wanting forward and recommend that the present market rally is merely one other in what’s already an extended string of oversold reactions – aka a bear market bounce.

These seeing the market’s glass as a minimum of half empty inform us that virtually each indicator on the planet is SCREAMING that the great ‘ol USofA is both in, or about to enter, a recession. And lest we overlook, these donning their bear costumes remind us the inventory market returns throughout bear markets that are accompanied by a recession have been a lot worse that those who weren’t. As such, the bears contend the key indices are destined to maneuver decrease because the 12 months progresses.

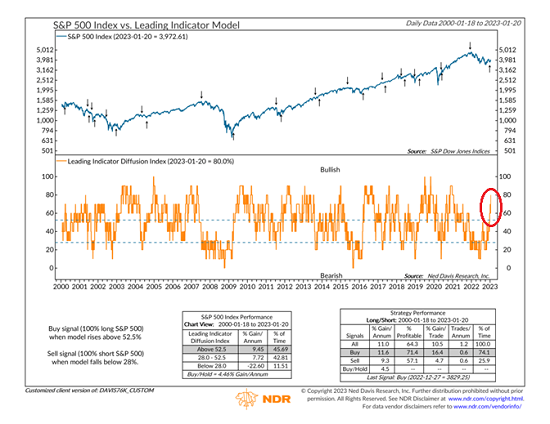

One of many VERY sturdy arguments for the Destructive Nancys’ recession case making the rounds this week was the newest replace to the Convention Board’s Index of Main Financial Indicators (LEI).

Sadly, the newest studying of the LEI fell -1% for the month. This was nicely beneath the consensus expectations for a drop of -0.7%, marked the third straight month-to-month decline of a minimum of -1%, and is off -7.4% year-over-year. And for these of you preserving rating at house, the December studying marked the tenth consecutive month the venerable indicator had declined. None of which sounds good.

In a word to shoppers, Deutsche Financial institution’s Jim Reid knowledgeable us that since 1959, each time the LEI has dropped greater than 1% year-over-year, a recession has hit within the subsequent months. And as Jim factors out, “There are not any false positives.”

The chart beneath makes Mr. Reid’s level fairly clear. I’ve drawn in a horizontal crimson line to spotlight the truth that each time the LEI has fallen to the diploma it has at present, a recession has certainly occurred.

Convention Board’s Index of Main Financial Indicators

LEI/US YoY GDP

Picture Supply: Deutsche Financial institution, Convention Board

Are We Already In Recession?

This chart together with the historical past of inverted and a few others are giving credence to the cry that the U.S. is already in recession. Truthful level.

MKM Companions’ Michael Darda summed up the present state of the economic system properly by saying, “It might now seem that three of 4 NBER enterprise cycle indicators have peaked for this cycle, with employment because the lone survivor.”

The considering is that the roles market is preserving the economic system afloat/out of recession proper now as each the manufacturing and providers sectors are in decline to various levels. And because the shopper represents one thing on the order of 70% of all financial exercise, the argument is you’ll be able to’t have a recession when all people has a job and money within the financial institution.

So, even essentially the most ardent bulls are pressured to confess that IF the economic system begins to shed jobs throughout the board (thus far a minimum of, the majority of the job losses have been occurred within the expertise sector), then a recession is at hand.

And that is the rationale, expensive readers, that Friday’s jobs report carries the same old quantity of significance. Reducing to the chase, an excellent report pushes the thought of recession to the again burner whereas a report sporting job losses will give the bear camp some severe ammunition.

On the Different Hand

On the opposite sideline, our heroes in horns have a special tackle what is going on right here. The bull camp has a variety of speaking factors they wish to promote lately together with:

- (a) charges, the , and costs (and in flip, ) are all falling

- (b) China is reopening rapidly and financial stimulus is probably going on the way in which

- (c) labor markets stay sturdy

- (d) the Fed can be transferring towards the sidelines quickly

- (e) provide chain pressures are normalizing

- (f) Europe’s economic system is hanging in there

- (g) lots of money in each shopper and company steadiness sheets

- (h) the technical image is bettering.

That final level is price increasing on a bit. Not like the prior bear market bounces we have seen, the present transfer seems to have some oomph behind it. Whereas the bulls are most positively not out of the woods and technical confirmations (comparable to a “increased excessive” on the charts) are wanted, it’s price noting that our main market fashions are bettering properly.

Oh, and do not look now followers, however the dips are being purchased on an intraday foundation proper now. To make certain, this case may activate a dime. However as we have been saying, the “tenor” of the market has positively improved.

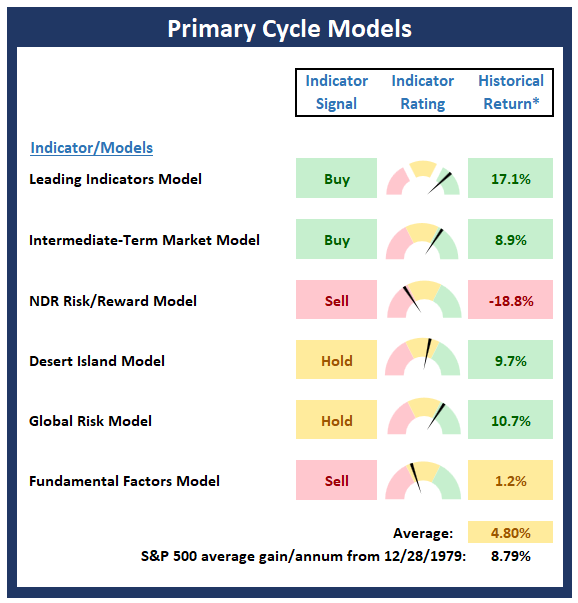

As well as, a few of my favourite longer-term fashions have flashed purchase indicators of late. One among which is Ned Davis Analysis’s Main Indicators mannequin. To not be confused with the Convention Board’s LEI, it is a mannequin containing 10 indicators which have traditionally “led” the inventory market. (For the indicator geeks on the market, the elements of the mannequin embody evaluation of: Utilities, Financials, Quantity Demand, A/D Line, Every day Momentum Mannequin, Co Lag, Weekly % New Highs, Massive Mo Multicap, Moody’s BAA Yield, Bulls-Bears Sentiment.)

I’ve labored with this mannequin for a few years and whereas nothing is ideal on this enterprise, the mannequin has performed a VERY good job at occasions of calling the subsequent large transfer available in the market – forward of time, after all. Check out the chart beneath (courtesy of Ned Davis Analysis).

NDR Main Indicators Mannequin

S&P 500 vs. Main Indicator Fashions

Picture Supply: Ned Davis Analysis Group

Notice the well timed promote indicators that occurred in December of 2021, 2015, 2011, and the large one in 2007. Additionally word the string of stable purchase indicators which have been given within the final 23 years.

It’s going to suffice to say that when this mannequin “talks,” I are likely to hear. And whereas the route of the market will doubtless be dictated by the state of the economic system within the coming months, this mannequin tells me to provide the bulls the advantage of the doubt right here and/or to get longer in my exposures.

So, is that this the beginning of a brand new bull market or merely one other irritating bounce? From my seat, the chances favor the previous. However the latter positively can’t be dominated out. As such, the plan has been to extend publicity as the burden of proof improves – and stay alert to any sudden adjustments within the “tenor” of the motion.

Now let’s evaluate the “state of the market” by the lens of our market fashions…

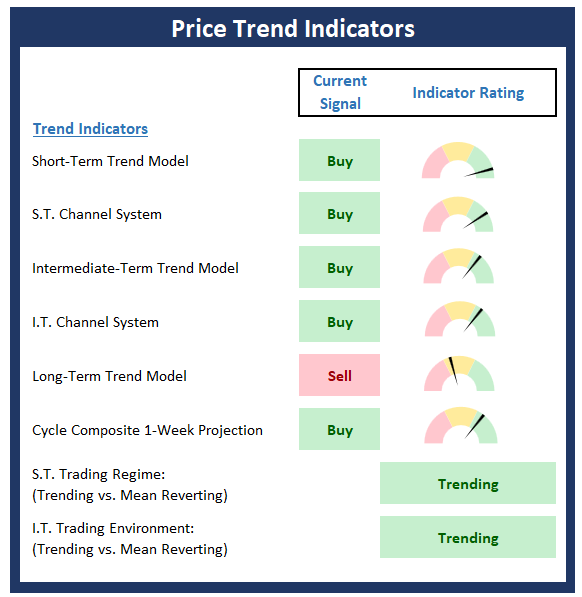

Main Cycle Fashions

Beneath is a gaggle of big-picture market fashions, every of which is designed to determine the first pattern of the general “state of the inventory market.”

Main Cycle Fashions

* Supply: Ned Davis Analysis (NDR) as of the date of publication. Historic returns are hypothetical common annual performances calculated by NDR.

Development Evaluation

Beneath are the scores of key value pattern indicators. This board of indicators is designed to inform us in regards to the total technical well being of the market’s pattern.

Worth Development Indicators

Key Worth Ranges

- S&P 500 Close to-Time period Help Zone: 4020

- S&P 500 Close to-Time period Resistance Zone: 4102

- S&P 500 50-day Easy MA: 3943

- MA Course: Rising

- S&P 500 200-day Easy MA: 3958

- MA Course: Declining

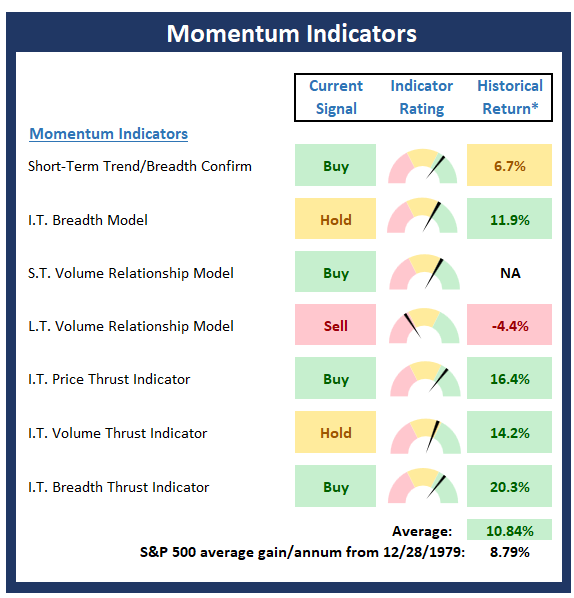

Market Momentum Indicators

Beneath is a abstract of key inside momentum indicators, which assist decide if there may be any “oomph” behind a transfer available in the market.

Momentum Indicators

* Supply: Ned Davis Analysis (NDR) as of the date of publication. Historic returns are hypothetical common annual performances calculated by NDR.

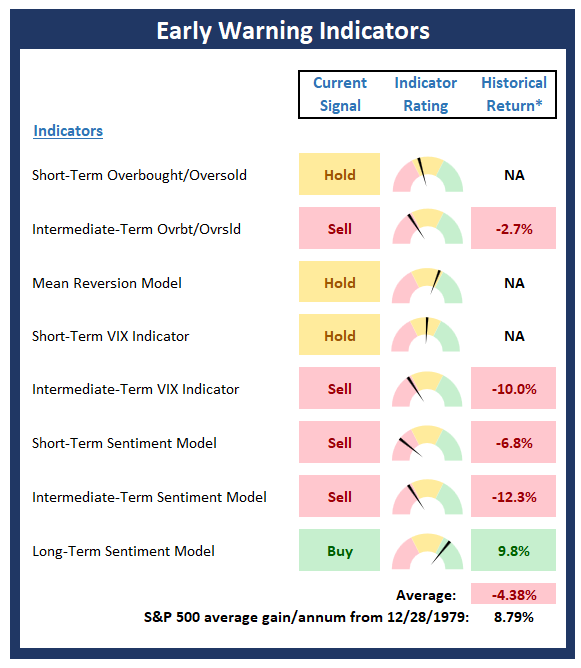

Early Warning Indicators

Beneath is a abstract of key early warning indicators, that are designed to recommend when the market could also be ripe for a reversal on a short-term foundation.

Early Warning Indicators

* Supply: Ned Davis Analysis (NDR) as of the date of publication. Historic returns are hypothetical common annual performances calculated by NDR.

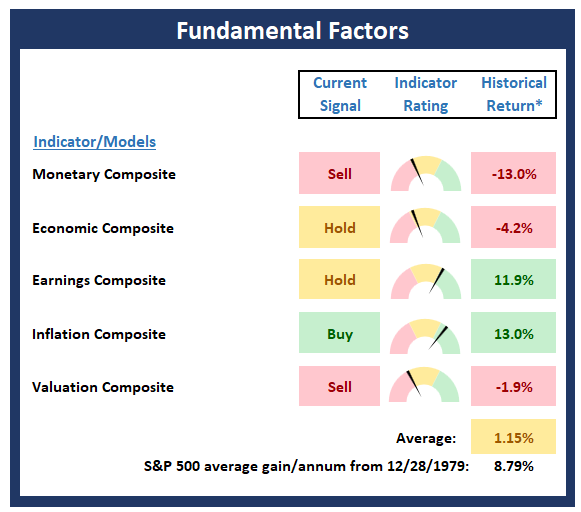

Basic Issue Indicators

Beneath is a abstract of key exterior elements which have been identified to drive inventory costs on a long-term foundation.

Basic Elements

* Supply: Ned Davis Analysis (NDR) as of the date of publication. Historic returns are hypothetical common annual performances calculated by NDR.

Thought for the Day:

“There’s nothing incorrect with change, whether it is in the correct route” -Winston Churchill

Wishing you inexperienced screens and all the perfect for an excellent day,

***

Disclosures:

On the time of publication, Mr. Moenning held lengthy positions within the following securities talked about: SPY, QQQ, MDY, IWM – Notice that positions might change at any time.