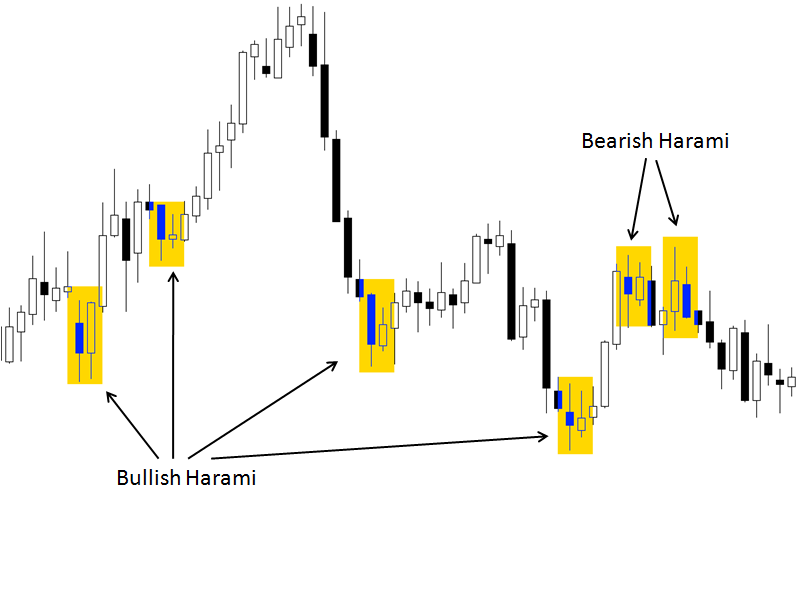

The harami value motion sample is a two candle sample which represents indecision available in the market and is used primarily for breakout buying and selling. It may also be referred to as an ‘inside candle formation’ as one candle varieties contained in the earlier candle’s vary, from excessive to low. Right here is an instance of what a bearish and bullish harami candle formation appears like:

A bearish harami varieties when a vendor candle’s excessive to low vary develops throughout the excessive and low vary of a earlier purchaser candle. As there was no continuation to kind a brand new excessive, the bearish harami represents indecision available in the market which may result in a breakout to the draw back.

A bullish harami varieties when a purchaser candle’s excessive to low vary develops throughout the excessive and low vary of a earlier vendor candle. As there was no continuation to kind a brand new low, the bullish harami represents indecision available in the market which may result in a breakout to the upside.

Listed here are some examples of bullish and bearish harami patterns that kind over a time frame:

So how may you commerce these patterns as a value motion buying and selling technique? There are lots of methods and nobody excellent approach. Nonetheless, many merchants use this as a standalone breakout sample. Listed here are some doable guidelines to construct upon:

Buying and selling The Bullish Harami Sample:

1. Establish bullish harami sample (a purchaser candle’s excessive and low vary that develops throughout the excessive and low vary of a earlier vendor candle).

2. Enter one pip above the excessive of the final candle.

3. Place a cease loss one pip under the low of the earlier candle (to provide the commerce some room to breathe).

4. Goal a one-to-one reward to threat which suggests focusing on the identical quantity of pips you’re risking from entry value to cease loss value.

5. If the commerce has not triggered by the open of a brand new candle, cancel the order. If the commerce has triggered depart it available in the market till cease loss or goal ranges have been reached.

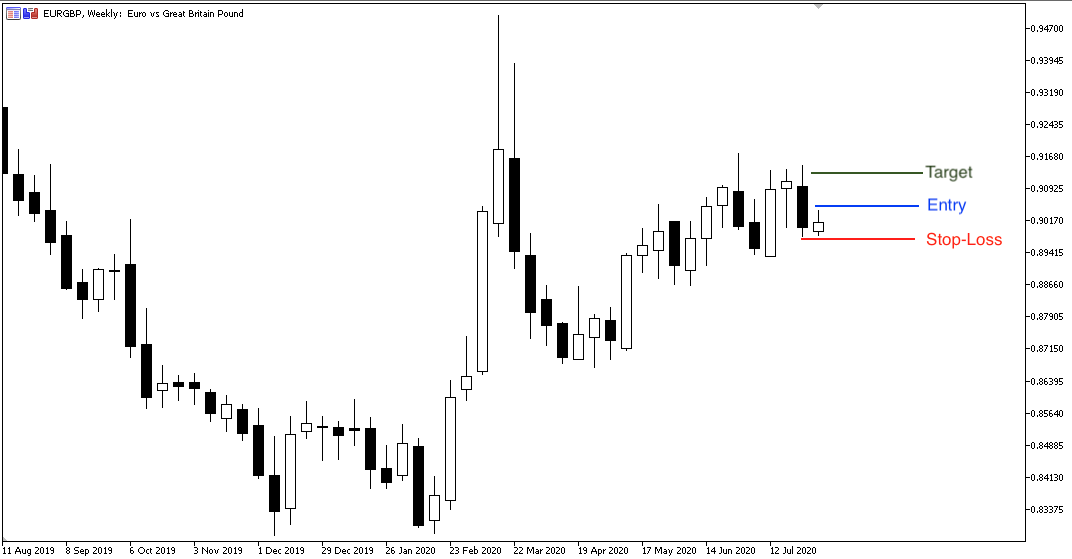

Based mostly on these guidelines above, right here is an instance of what it could appear to be on a chart:

Within the above chart of EUR/GBP, a bullish harami has shaped. Utilizing the rule above, one may have an entry value above the excessive of the final candle, with a cease loss on the low of the earlier candle. If the order doesn’t set off by the open of the following bar then one can merely cancel the order positioned and search for the following commerce. If it has triggered it, then your cease loss or goal ranges will exit you in a revenue or loss.

Buying and selling The Bearish Harami Value Motion Sample:

1. Establish bearish harami sample (a vendor candle’s excessive and low vary that develops throughout the excessive and low vary of a earlier purchaser candle).

2. Enter one pip under the low of the final candle.

3. Place a cease loss one pip above the excessive of the earlier candle (to provide the commerce some room to breathe).

4. Goal a one-to-one reward to threat which suggests focusing on the identical quantity of pips you’re risking from entry value to cease loss value.

5. If the commerce has not triggered by the open of a brand new candle, cancel the order. If the commerce has triggered depart it available in the market till cease loss or goal ranges have been reached.

Study extra about value motion buying and selling and different buying and selling associated subjects by subscribing to our channel.