Key Takeaways

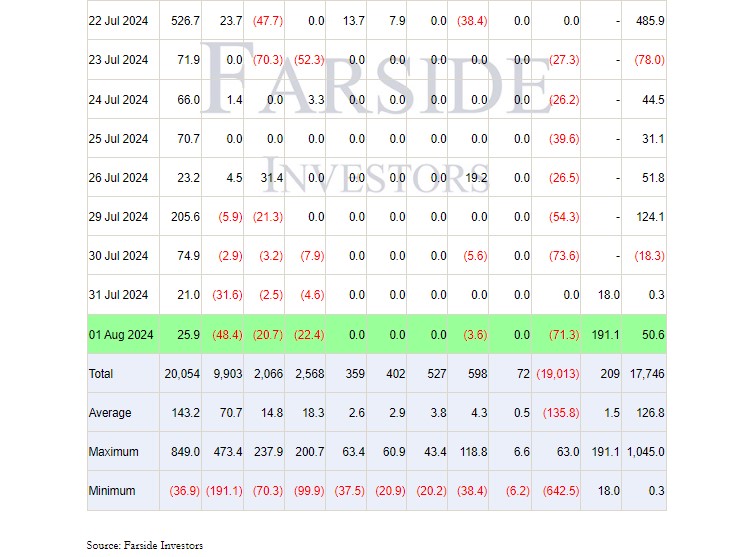

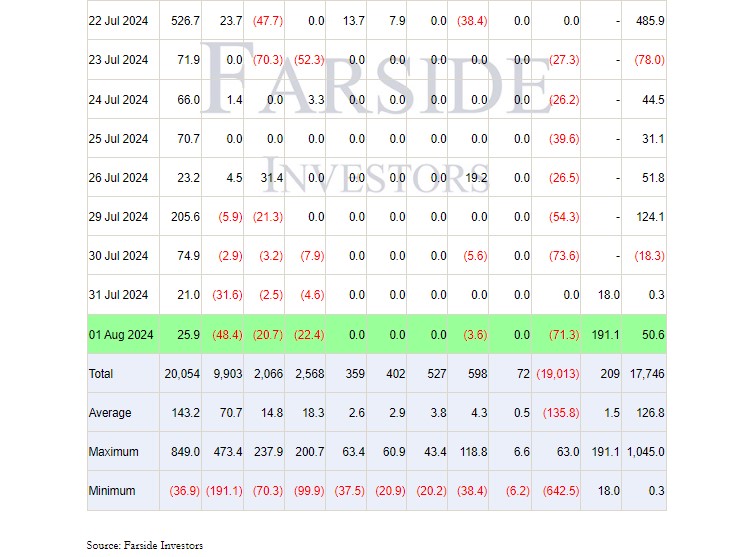

- Grayscale’s Bitcoin Mini Belief continued its sturdy efficiency on Thursday, attracting an extra $191 million in inflows.

- The Grayscale Bitcoin ETF has suffered over $19 billion in losses post-ETF conversion.

Share this text

![]()

Grayscale’s Bitcoin Mini Belief obtained off to a powerful begin after pulling in $191 million on Thursday, its second day of buying and selling, knowledge from Farside Traders reveals. The surge marks a 960% uptick from its preliminary day’s $18 million.

The fund, working below the BTC ticker, comes as a part of Grayscale Investments’ ongoing efforts to draw traders with a low-cost possibility for gaining publicity to Bitcoin. With a 0.15% sponsor charge, Grayscale’s BTC is the most cost effective spot Bitcoin exchange-traded fund (ETF) in the marketplace.

The mini fund can also be anticipated to alleviate promoting strain on the Grayscale Bitcoin Belief (GBTC) and seize a portion of GBTC’s capital outflows.

Thursday’s acquire brings the overall internet inflows of the BTC to $209 million. In accordance with up to date knowledge from Grayscale, its market worth stands at round $1.7 billion.

In distinction, GBTC reported roughly $71 million in internet outflows on Thursday. The fund’s whole loss after its ETF conversion exceeded $19 billion.

Different competing ETFs, together with Constancy’s FBTC, Bitwise’s BITB, ARK Make investments/21Shares’ ARKB, and VanEck’s HODL, additionally witnessed capital withdrawals.

BlackRock’s Bitcoin ETF (IBIT) ended the day with virtually $26 million in internet inflows. General, US spot Bitcoin ETFs collectively took in over $50 million.

Share this text

![]()

![]()