Goldman Sachs is on observe to make round US$1bn in commodities buying and selling this quarter following dramatic swings in these markets, in accordance with sources accustomed to the matter, in what could be its finest three-month interval in commodities markets in over a decade.

The US financial institution had already generated roughly US$500m in commodities revenues earlier than Russia’s invasion of Ukraine in February amid a notable rise in shopper exercise, the sources mentioned, and its merchants have continued to carry out effectively since then.

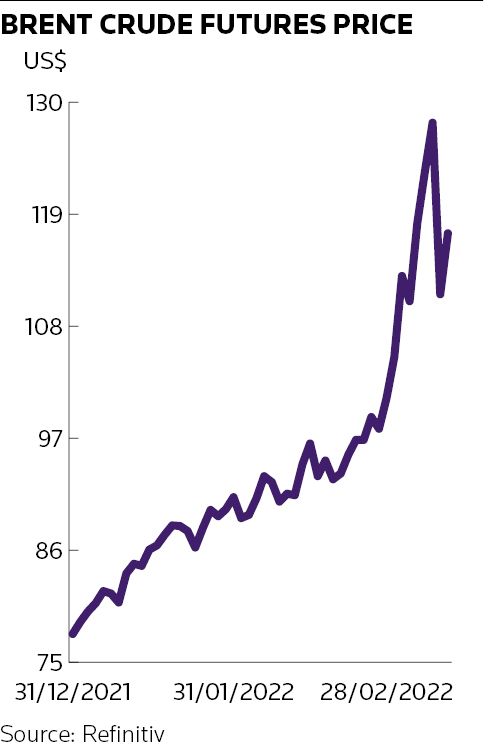

JP Morgan and Morgan Stanley are additionally set to report robust commodities outcomes, sources mentioned, as company treasurers and institutional traders have scrambled to place themselves for spiralling worth will increase. The warfare in Ukraine has solely served to convulse these markets even additional, prompting sharp strikes in uncooked supplies corresponding to crude oil, pure fuel, gold, nickel and wheat.

That top degree of volatility means there may be nonetheless some uncertainty across the quarter-end income numbers, the sources cautioned. Spokespeople for Goldman Sachs, JP Morgan and Morgan Stanley declined to remark.

The rise in commodities exercise ought to assist elevate banks’ general buying and selling revenues in what has been probably the most unstable interval for monetary markets because the begin of the coronavirus pandemic. Analytics agency Coalition Greenwich initiatives the highest 12 funding banks will report a 7% decline in world markets revenues within the first quarter from a yr in the past, although that will nonetheless symbolize a greater than a 35% improve from the primary quarter of 2019 (the equal pre-pandemic quarter).

“It is a considerably more healthy markets surroundings for banks than earlier than the pandemic,” mentioned Michael Turner, head of competitor analytics at Coalition Greenwich. “Though there is perhaps some losses, the elevated volatility means these will probably be offset by beneficial properties in different merchandise. The biggest banks with a broad providing ought to get pleasure from a portfolio impact.”

“We’re anticipating [an] uptick on the G-10 macro aspect, with banks doing very effectively in commodities, and downticks in equities and credit score,” he added.

US banks’ commodity buying and selling desks have grown in prominence because the begin of the pandemic amid heightened volatility in vitality and metals markets specifically. Goldman’s senior administration have highlighted robust efficiency in commodities buying and selling on seven of the final eight quarterly earnings calls because the financial institution has leveraged its sprawling presence throughout these markets.

Oil power

Commodities buying and selling head Ed Emerson has overseen a broad-based rise in revenues this yr throughout the commodities markets the place Goldman is lively, sources mentioned.

Oil buying and selling has continued to carry out effectively below Xiao Qin and Anthony Dewell, whose groups additionally registered massive beneficial properties in 2020 when oil futures costs plunged into detrimental territory. Brent crude oil futures contracts hit an intraday excessive of just about US$140 a barrel on March 7 – their most elevated degree since 2008.

Energy and fuel, which Nitin Jindal heads in North America, and metals buying and selling have additionally been robust for the financial institution, sources mentioned. Costs of varied valuable and base metals have whipsawed in latest months, with gold briefly rising above US$2,000 an oz.. Elsewhere, the London Steel Trade selected to halt nickel buying and selling and cancel transactions after costs greater than doubled on Tuesday to over US$100,000 a tonne.

Hedging curiosity

Bankers and consultants say a wider vary of corporations had been trying to insulate themselves towards commodity worth strikes even earlier than Russia’s invasion of Ukraine, given the sustained improve in prices to uncooked supplies that they have been already dealing with.

“I’ve by no means spoken to so many corporations about commodity hedging – even earlier than the battle in Ukraine began,” mentioned Amol Dhargalkar, world head of corporates at consultancy Chatham Monetary. “Curiosity in hedging tends to be extremely correlated with the commodity worth cycle. As costs transfer upwards – whether or not it’s in metals or vitality or agricultural merchandise – corporations have been scrambling to grasp exposures throughout their organisations and provide chains, and have been trying to have a playbook to place into place.”

Unsure occasions

Executives observe that regardless of the encouraging outlook for financial institution buying and selling revenues extra broadly, there stays appreciable uncertainty over the precise numbers. Troy Rohrbaugh, JP Morgan’s head of world markets, instructed an investor convention on Tuesday the financial institution was nonetheless on observe for a ten% decline in buying and selling revenues from a yr earlier than, however famous that loads of shoppers are below “excessive stress” and “that creates doubtlessly very vital counterparty threat publicity”.

Up till late February and the Ukraine battle, senior bankers had reported a powerful buying and selling surroundings for merchandise linked to rates of interest and international trade specifically, as traders reshuffled exposures in anticipation of the US Federal Reserve transferring to quell inflation.

That contrasts with what appears set to be a extra disappointing quarter for dealmaking. Turner at Coalition Greenwich mentioned funding banks’ dealmaking revenues may fall greater than 40% from a yr in the past within the first quarter, primarily because of a pointy drop in ECM exercise and SPAC listings specifically.

“What’s actually going to harm on the funding banking aspect is the shortage of SPACs,” mentioned Turner.