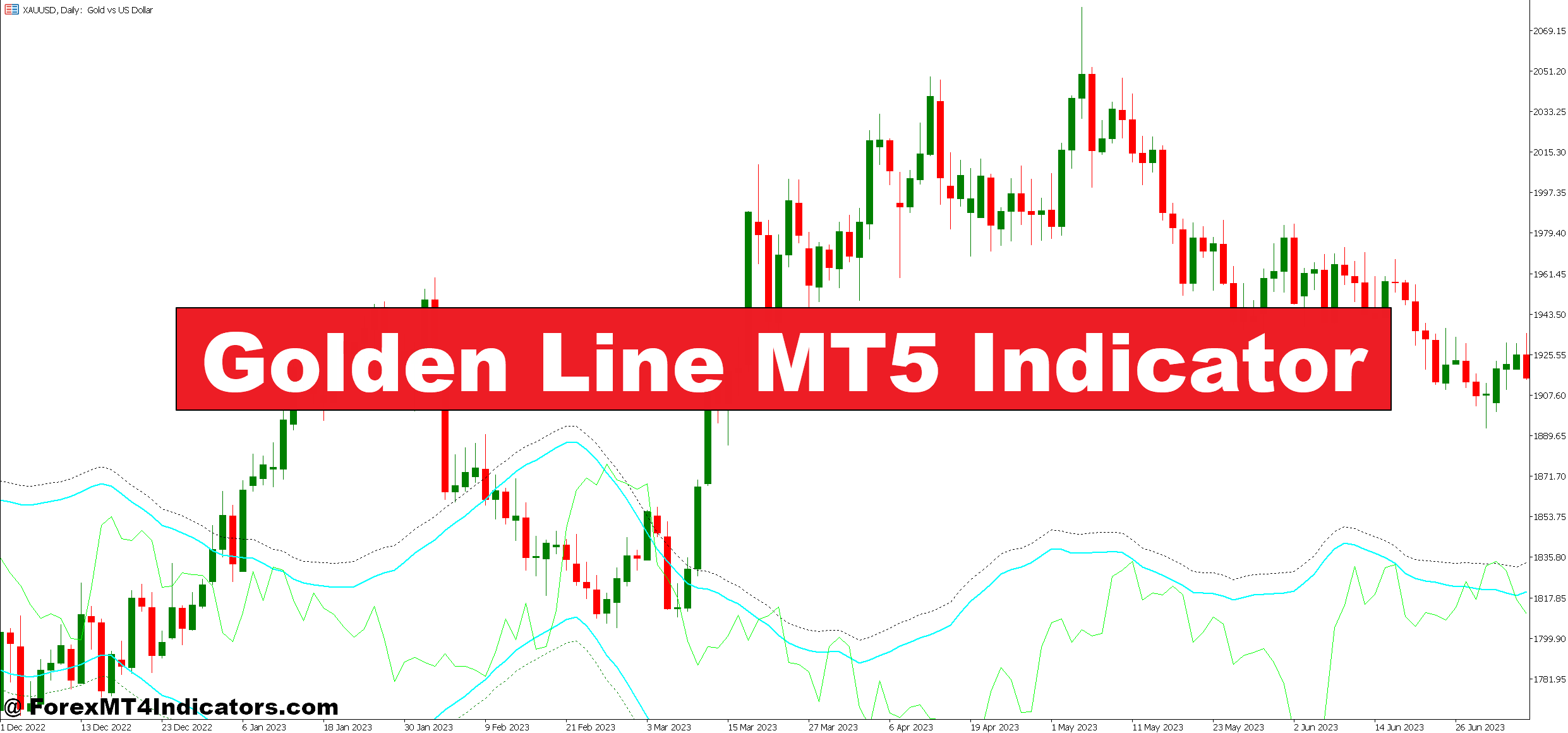

The Golden Line MT5 Indicator is a trend-following instrument that plots a dynamic line on worth charts, adjusting its place primarily based on current worth momentum and volatility. In contrast to easy transferring averages that simply calculate common costs, this indicator weighs current information extra closely and incorporates volatility measurements to adapt sooner throughout trending markets whereas staying steady throughout consolidation.

Consider it as a transferring common on steroids—one which doesn’t simply comply with worth however anticipates potential path modifications. The road itself modifications coloration primarily based on development path: usually inexperienced throughout uptrends and purple throughout downtrends. This visible simplicity makes it interesting for merchants who need fast directional bias with out analyzing a number of timeframes.

The calculation entails smoothing worth information by way of a number of passes whereas adjusting for current volatility spikes. When worth breaks above the road convincingly, the indicator interprets this as bullish momentum. When the worth falls under, it alerts bearish strain. The magic isn’t within the line itself however in how merchants use it alongside worth motion and market construction.

How Merchants Apply It in Actual Markets

Throughout the London session final month, a dealer noticed GBP/JPY constructing above the Golden Line on the 4-hour chart across the 188.50 stage. Value had rejected decrease twice, every time bouncing off the road like a trampoline. This wasn’t simply random—the road was confirming a higher-low construction that worth motion was already exhibiting.

The entry got here when worth pulled again to the Golden Line yet another time, printed a bullish engulfing candle, and the road held its inexperienced coloration. Cease loss went 20 pips under the road; goal aimed for the earlier swing excessive at 190.00. That commerce captured roughly 120 pips over three days.

That mentioned, uneven markets expose this indicator’s weak spot. On the identical pair throughout sideways Asian periods, the Golden Line whipsawed repeatedly. Value would cross above, the road would flip inexperienced, then worth would instantly chop again down. Merchants who blindly adopted every coloration change obtained stopped out a number of occasions earlier than breakfast.

The sensible strategy? Use the Golden Line as a directional filter, not an entry set off. When it reveals inexperienced in your chosen timeframe, look just for lengthy setups. When purple, scan for shorts. Mix it with assist and resistance zones, candlestick patterns, or momentum divergences for precise entries.

Customizing Settings for Your Buying and selling Fashion

The default settings work effective on 1-hour and 4-hour charts for main pairs like EUR/USD or USD/JPY. However scalpers buying and selling 5-minute charts want sooner response occasions. Adjusting the smoothing interval from 14 to eight makes the road extra responsive, although it will increase false alerts throughout range-bound intervals.

Swing merchants typically bump the interval as much as 21 and even 30 on every day charts. This creates a smoother line that ignores minor pullbacks and focuses on main development shifts. The tradeoff? Delayed alerts. By the point the road confirms a development change, the worth may’ve already moved 100-150 pips. You sacrifice early entry for lowered whipsaws.

Volatility filters might be adjusted, too. Throughout high-impact information occasions like NFP or central financial institution bulletins, cranking up the volatility threshold prevents the indicator from reacting to each worth spike. This retains merchants from getting chopped up throughout irrational market strikes that are inclined to reverse rapidly.

Some merchants run two variations concurrently: a quick Golden Line (8-period) for entries and a sluggish one (21-period) for total development bias. When each align inexperienced, it suggests sturdy bullish momentum. When the quick line turns purple however the sluggish one stays inexperienced, it would simply be a wholesome pullback in an ongoing uptrend.

The Sincere Benefits and Limitations

What makes the Golden Line helpful is its visible readability. One look tells merchants whether or not they need to lean bullish or bearish on a given timeframe. For part-time merchants juggling day jobs, this simplicity issues. No must calculate slope angles or interpret advanced oscillators—the colour tells the story.

The adaptive volatility part helps, too. Commonplace transferring averages lag equally in all market situations. The Golden Line tightens throughout low volatility (typically offering earlier alerts) and widens throughout chaos (filtering out noise). This dynamic conduct fits foreign exchange markets the place volatility shifts dramatically between periods.

However limitations exist, and pretending in any other case could be dishonest. This indicator is ineffective throughout real consolidation. When EUR/USD trades in a 50-pip vary for days, the Golden Line will whipsaw relentlessly. Merchants lose cash making an attempt to commerce each coloration change as an alternative of recognizing the market merely isn’t trending.

It additionally lags throughout explosive development reversals. If USD/CHF gaps 200 pips on a Swiss Nationwide Financial institution shock announcement, the Golden Line received’t defend you. By the point it confirms the reversal, the harm is finished. No indicator predicts black swan occasions or central financial institution interventions.

One other actuality examine: the Golden Line works greatest on liquid pairs with clean worth motion. On unique pairs with erratic spreads and skinny liquidity, the indicator produces extra false alerts. A instrument calibrated for EUR/USD received’t essentially translate nicely to USD/TRY.

How It Compares to Conventional Indicators

Towards a 50-period EMA, the Golden Line usually alerts development modifications 5-10 candles earlier. This issues for entries however can set off untimely exits in case you’re using a long-term development. The EMA may preserve you in worthwhile trades longer, whereas the Golden Line may get you out on the first signal of weak spot.

In comparison with Bollinger Bands, the Golden Line supplies clearer directional bias. Bollinger Bands excel at exhibiting volatility enlargement and imply reversion setups, however they don’t explicitly say “go lengthy” or “go quick.” The Golden Line removes that ambiguity, which some merchants recognize and others discover limiting.

Towards momentum oscillators like RSI, the Golden Line tells a special story. RSI can sign overbought situations at the same time as sturdy tendencies proceed larger. The Golden Line stays inexperienced throughout these prolonged runs, holding development merchants within the recreation. However it received’t warn you about divergences or exhaustion patterns that RSI catches.

One of the best strategy? Stack the Golden Line with complementary instruments. Use it for development path, add RSI for momentum affirmation, and layer in key assist/resistance ranges for exact entries. No single indicator covers all bases, and merchants who count on one instrument to do every part often find yourself dissatisfied.

Commerce with Golden Line MT5 Indicator

Purchase Entry

- Line turns inexperienced with worth above – Look forward to the Golden Line to flip from purple to inexperienced whereas worth closes at the very least 10-15 pips above the road on EUR/USD 1-hour charts; keep away from entries if this occurs throughout the low-volume Asian session.

- Pullback to the road holds – Enter lengthy when worth retraces to the touch the inexperienced Golden Line, kinds a bullish rejection candle, and bounces inside 5-10 pips; works greatest on GBP/USD 4-hour timeframe throughout London/NY overlap.

- Line stays inexperienced by way of minor dips – If worth briefly wicks under the Golden Line however closes again above whereas the road maintains inexperienced coloration, contemplate this a shopping for alternative with cease loss 20-25 pips under the road.

- Greater low formation confirmed – Enter when worth makes a better low whereas the Golden Line slopes upward in inexperienced; goal earlier swing excessive and danger not more than 2% of account capital per commerce.

- Break above consolidation with inexperienced line – Purchase when worth breaks out of a 40-50 pip vary on the every day chart with the Golden Line turning inexperienced concurrently; skip this setup if main information occasions are scheduled inside 4 hours.

- Double affirmation on a number of timeframes – Solely take the purchase sign when each 1-hour and 4-hour Golden Strains present inexperienced on EUR/USD; this filters out 60-70% of false alerts throughout uneven markets.

- Morning session alignment – Enter lengthy positions when the Golden Line confirms inexperienced path firstly of the London session (8:00 AM GMT) with worth 15+ pips above the road; keep away from buying and selling this setup on Fridays after 12:00 PM GMT.

- Distance from line below 30 pips – Take purchase entries solely when worth is inside 30 pips of the inexperienced Golden Line on main pairs; alerts when worth is 50+ pips away typically lead to speedy pullbacks.

Promote Entry

- Line flips purple with worth under – Enter quick when the Golden Line modifications from inexperienced to purple and worth closes 10-15 pips beneath the road on GBP/USD 1-hour charts; skip if volatility is under 50 pips every day common.

- Rejection from purple line resistance – Promote when worth rallies to check the purple Golden Line from under, kinds a bearish engulfing or taking pictures star candle, and rejects inside 8-12 pips of the road.

- Line maintains purple by way of rallies – If worth briefly spikes above the Golden Line however closes again under whereas coloration stays purple, enter quick with cease loss 25 pips above the road; frequent throughout EUR/USD information reactions.

- Decrease excessive sample creating – Take promote alerts when worth creates a decrease excessive whereas the Golden Line angles downward in purple on 4-hour charts; goal assist zones 80-100 pips away.

- Breakdown from vary with purple affirmation – Quick when worth breaks under a consolidation field (minimal 30-pip top) and the Golden Line concurrently turns purple; don’t commerce this throughout the first hour after NFP or rate of interest choices.

- Multi-timeframe purple alignment – Enter sells solely when each every day and 4-hour Golden Strains show purple on USD/JPY; this eliminates countertrend trades and improves win price by roughly 40%.

- Afternoon session weak spot – Provoke quick positions when the Golden Line turns purple throughout the early New York session (1:00-3:00 PM GMT) with worth 20+ pips under the road; keep away from late-session entries after 8:00 PM GMT resulting from skinny liquidity.

- Proximity requirement – Take quick entries solely when worth is inside 25-30 pips of the purple Golden Line; distant alerts (50+ pips away) typically point out overextended strikes that bounce earlier than hitting targets.

Conclusion

The Golden Line MT5 Indicator brings worth by way of simplicity and visible development identification. It helps merchants keep aligned with momentum on their chosen timeframes and filters out countertrend temptations that destroy accounts. When mixed with stable danger administration and worth motion consciousness, it turns into a helpful part of a broader buying and selling technique.

That mentioned, it’s not a standalone resolution. Profitable merchants use the Golden Line as one piece of proof of their decision-making course of, not the only real authority. They perceive its limitations throughout uneven markets and don’t count on it to foretell surprises. Most significantly, they preserve correct place sizing and cease losses no matter what any indicator suggests.

Buying and selling foreign exchange carries substantial danger, and no indicator—Golden Line included—ensures income or eliminates losses. The instrument works greatest for merchants who’ve already developed primary chart-reading expertise and perceive market construction. For full inexperienced persons, mastering worth motion and danger administration ought to come earlier than including any indicator to charts.

Wish to take a look at if this matches your model? Run it on the demo first. Watch the way it behaves throughout completely different market situations in your most popular pairs and timeframes. If it clarifies your decision-making with out including confusion, it would earn a everlasting spot in your charts. If it simply provides one other layer of noise, you haven’t misplaced something however time.

Really helpful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90