Gold (XAU/USD) – Repeated Makes an attempt at a Recent All-Time Excessive, US Retail Gross sales Weigh

Gold continues to check, and reject, its earlier all-time excessive at $2,485/oz. and a break greater is being pared by a powerful US retail gross sales report

- Gold unable to interrupt greater as resistance holds agency.

- Weekly net-short positions bounce.

Beneficial by Nick Cawley

Get Your Free Gold Forecast

Gold is coming underneath stress after the discharge of a stronger-than-expected US retail gross sales report. Expectations of a 50 bp charge lower have been pared again – from 38% to 25% – whereas expectations of a smaller 25 foundation level lower have been boosted from 62% to 75%.

For all high-importance information releases and occasions, see the DailyFX Financial Calendar

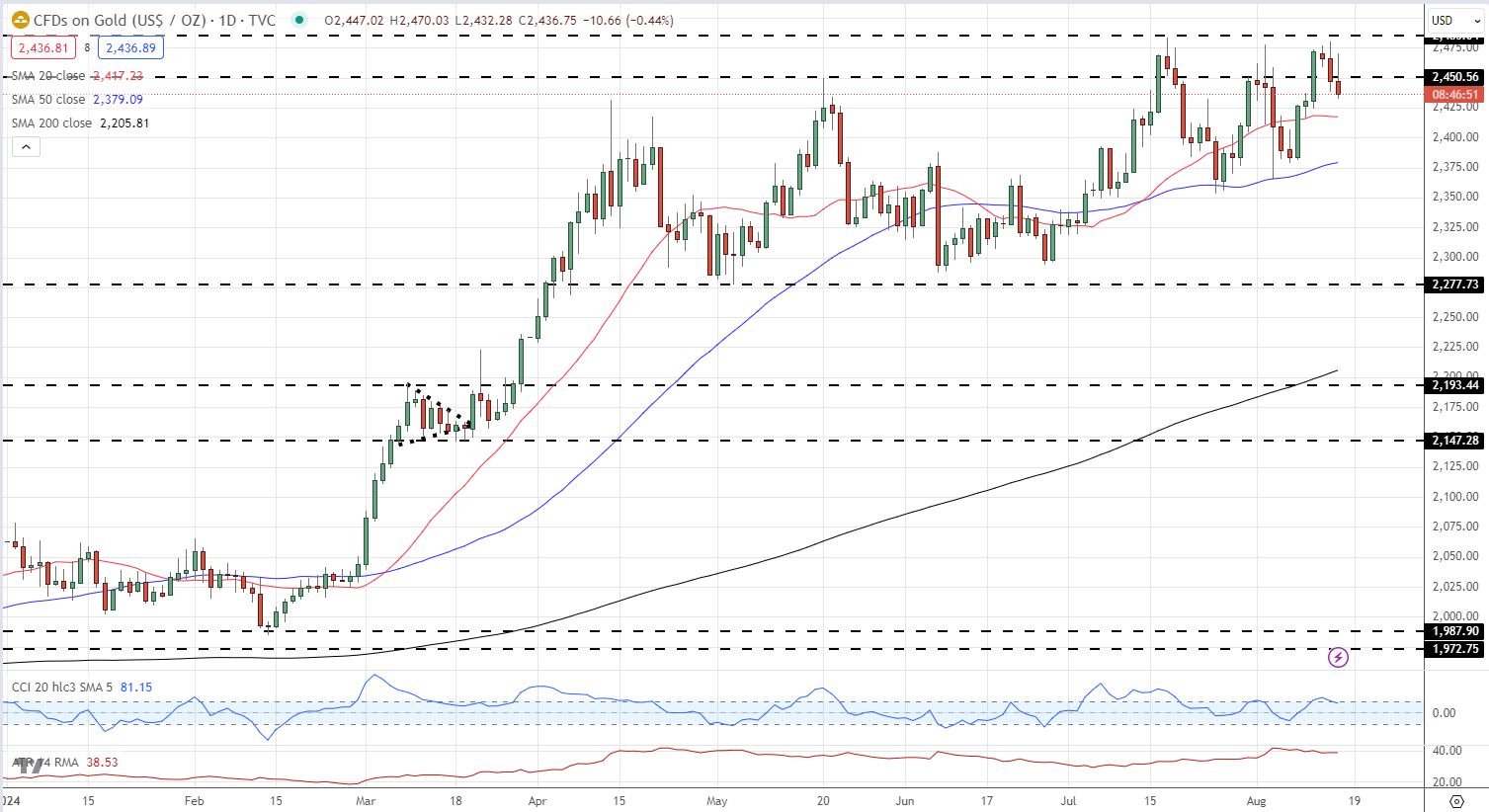

Gold continues to check the mid-July all-time excessive at $2,484/oz. and is probably going to take action once more however barely additional out. The day by day chart stays technically bullish – short-term greater lows and supportive easy shifting averages – with preliminary help off the 20-dsma at $2,417/oz. adopted by $2,400/oz. A break beneath $2,380/oz. would negate the short-term bullish outlook.

Gold Worth Every day Chart

Chart through TradingView

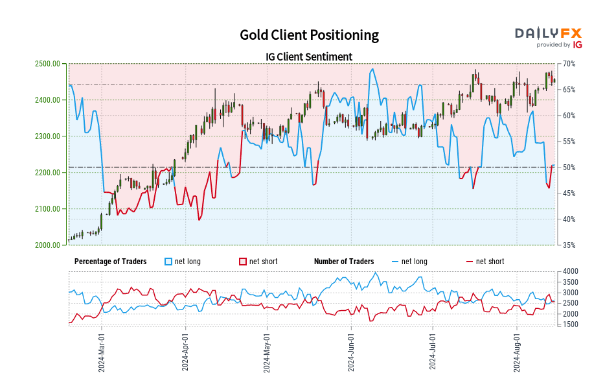

Retail dealer information reveals 50.72% of merchants are net-long with the ratio of merchants lengthy to quick at 1.03 to 1.The variety of merchants net-long is 8.89% greater than yesterday and 13.18% decrease than final week, whereas the variety of merchants net-short is 9.63% decrease than yesterday and 34.51% greater than final week.

We sometimes take a contrarian view to crowd sentiment, and the actual fact merchants are net-long suggests Gold costs could proceed to fall. Positioning is extra net-long than yesterday however much less net-long from final week. The mix of present sentiment and up to date modifications provides us an extra blended Gold buying and selling bias.

| Change in | Longs | Shorts | OI |

| Every day | 2% | -9% | -4% |

| Weekly | -13% | 16% | -1% |

What’s your view on Gold – bullish or bearish?? You may tell us through the shape on the finish of this piece or contact the creator through Twitter @nickcawley1.