The week forward presents many ‘excessive significance’ threat occasions starting from US CPI information to central financial institution choices in Canada, New Zealand and the European Union. The FOMC minutes of the March assembly may also present extra perception on Fed pondering, though, the pattern of hotter US information might diminish the influence of what was mentioned through the March assembly.

On the lookout for actionable buying and selling concepts? Obtain our high buying and selling alternatives information full of insightful ideas for the second quarter!

Advisable by Richard Snow

Get Your Free Prime Buying and selling Alternatives Forecast

US Greenback (DXY) in Focus Forward of CPI Information, NFP Increase Proved Quick-Lived

Friday’s hotter-than-expected jobs information for March initially despatched the greenback increased however the catalyst failed to carry into the shut. US CPI information will certainly draw an enormous focus from the market because of the cussed PCE figures and usually strong US information which will delay charge cuts even additional.

US Greenback Basket (DXY) Each day Chart

Supply: TradingView, ready by Richard Snow

Elevate your buying and selling expertise and achieve a aggressive edge. Get your arms on the U.S. greenback Q2 outlook in the present day for unique insights into key market catalysts that must be on each dealer’s radar:

Advisable by Richard Snow

Get Your Free USD Forecast

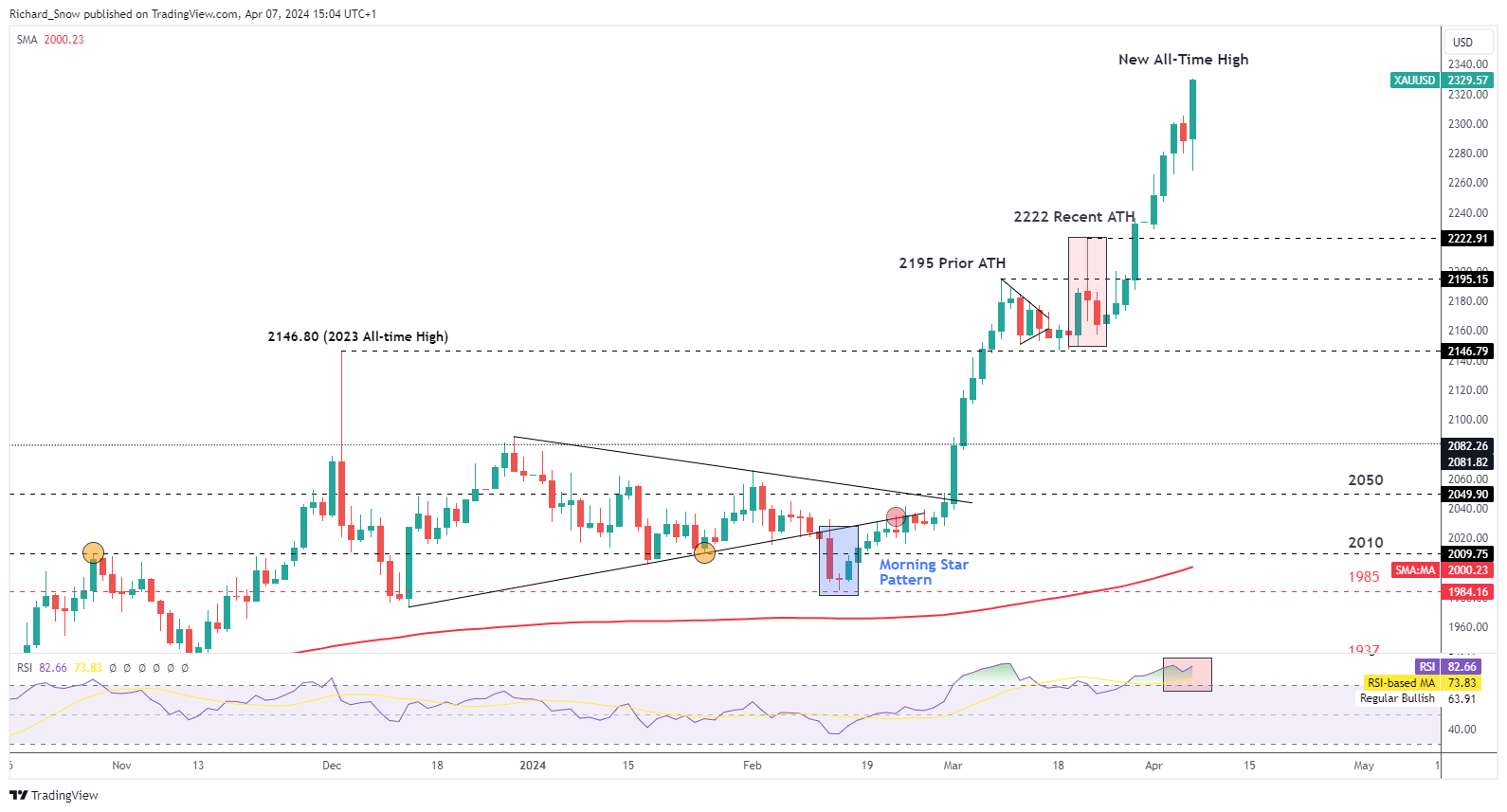

The Danger of a Broader Battle within the Center East Triggered Gold’s Secure Haven Push

Gold has gone from power to power regardless of rising US yields. The buck (DXY) registered a minor decline final week however US 2-year and 10-year treasury yields rose for the week.

The prospect of charges remaining on maintain for longer, has the potential to see extra hawkish repricing for treasuries that will increase the chance price of holding the non-interest bearing commodity.

Current escalations in japanese Europe and the Center East increase the attract of gold on account of its protected haven properties however the market has returned to massively overbought territory, hinting at a possible cooling off interval at the beginning of the week within the absence of additional escalation.

Gold (XAU/USD) Each day Chart

Supply: TradingView, ready by Richard Snow

TECHNICAL AND FUNDAMENTAL FORECASTS – W/C April 8

US Greenback’s Outlook Rides on US Inflation Information – EUR/USD, USD/JPY, GBP/USD

The U.S. greenback misplaced floor this previous week, however the tide might flip again in its favor within the coming days, particularly if Wednesday’s U.S. inflation report surprises to the upside and triggers a hawkish repricing of rate of interest expectations.

Gold Value Weekly Forecast – Recent Document Highs on Heightened Israel/Iran Fears

Gold is urgent additional into document excessive territory as escalating tensions between Israel and Iran proceed to gas the dear metallic’s safe-haven bid.

Euro Forecast: April ECB Assembly Prone to be a Prelude for a June Minimize

The euro recovers forward of the ECB assembly which is more likely to level to June for that first charge minimize. Encouraging sentiment information and comfortable inflation present conflicting dynamics

British Pound Weekly Forecast: Lack of Information Will Go away USD in Cost

The British Pound heads into a brand new buying and selling week underneath stress in opposition to the US Greenback as once-reliable monetary-policy assist continues to ebb.

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX