Market Wrap and Week Forward – w/c March eleventh

Latest commentary from ECB President Christine Lagarde and Federal Reserve Chairman Jerome Powell counsel that each central banks want to begin a collection of rate of interest cuts in June.

In his testimony to the Senate Banking Committee on Thursday, Fed Chair Jerome Powell indicated that rates of interest might quickly be on the best way down. ‘If the financial system does as anticipated, we predict rigorously eradicating the restrictive stance of coverage will start over the course of the 12 months’, Powell stated Thursday.

Friday’s newest US Jobs Report additionally confirmed the intently watched unemployment fee rise unexpectedly from 3.7% to three.9%, whereas common earnings slowed additional.

US Greenback Falls Additional After US NFP Beat However January Quantity Revised Decrease

Additionally Thursday, post-policy choice commentary from ECB’s Lagarde additionally pointed to the tip of H1 as an acceptable time to start out reducing borrowing prices.

‘We’re making good progress in the direction of our inflation goal and we’re extra assured in consequence…However we aren’t sufficiently assured. We’d like clearly extra proof and extra knowledge. We’ll know a bit of extra in April, however we are going to know much more in June.’

Earlier, ECB employees projections minimize inflation and development forecasts for the following three years.

Euro (EUR/USD) Drifts Marginally Decrease, ECB Leaves All Coverage Charges Unchanged

In Japan, latest commentary from Financial institution of Japan officers means that if the present spherical of wage negotiations produce the anticipated outcomes, then the BoJ could properly begin to hike rates of interest quickly, with the markets already pricing in a 60%+ probability of a hike this month.

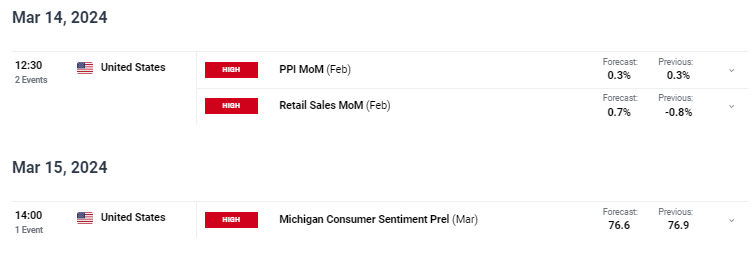

Excessive Significance Financial Releases and Occasions – w/c March eleventh.

There are just a few vital knowledge releases that may inject an extra shot of volatility into a variety of asset lessons. The standout subsequent week is the newest US inflation report, adopted by UK employment and development knowledge.

Discover ways to commerce financial knowledge releases and occasions with our complimentary information

Advisable by Nick Cawley

Introduction to Foreign exchange Information Buying and selling

For all market-moving financial knowledge and occasions, see the DailyFX Calendar

Gold, Nasdaq 100, Nvidia

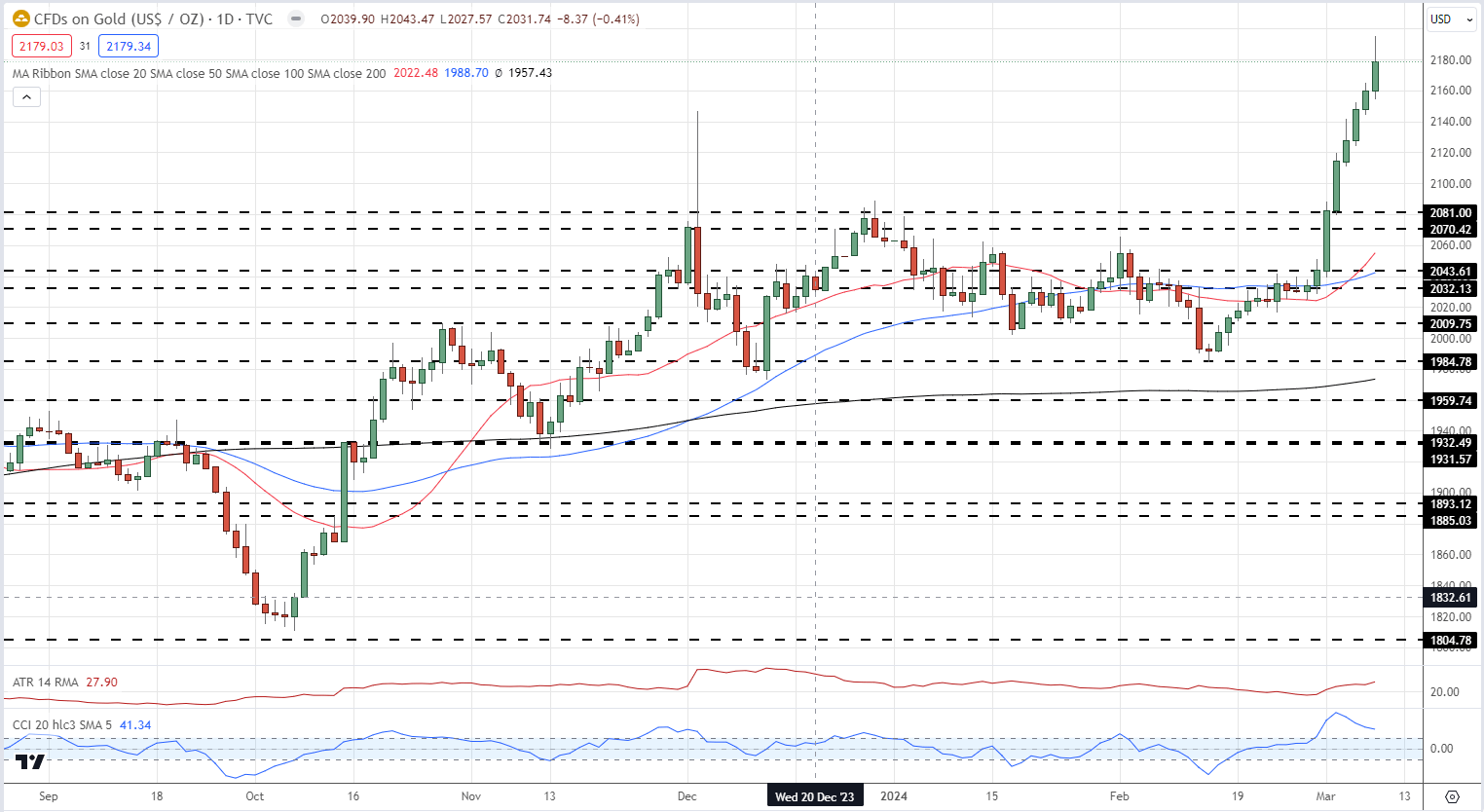

This week noticed gold proceed to push increased and make a few recent document highs. The valuable metallic is being pushed ever increased on a mixture of elevated fee minimize expectations, Chinese language demand, and secure haven shopping for.

Gold Each day Worth Chart

Obtain our free Q1 gold forecast

Advisable by Nick Cawley

Get Your Free Gold Forecast

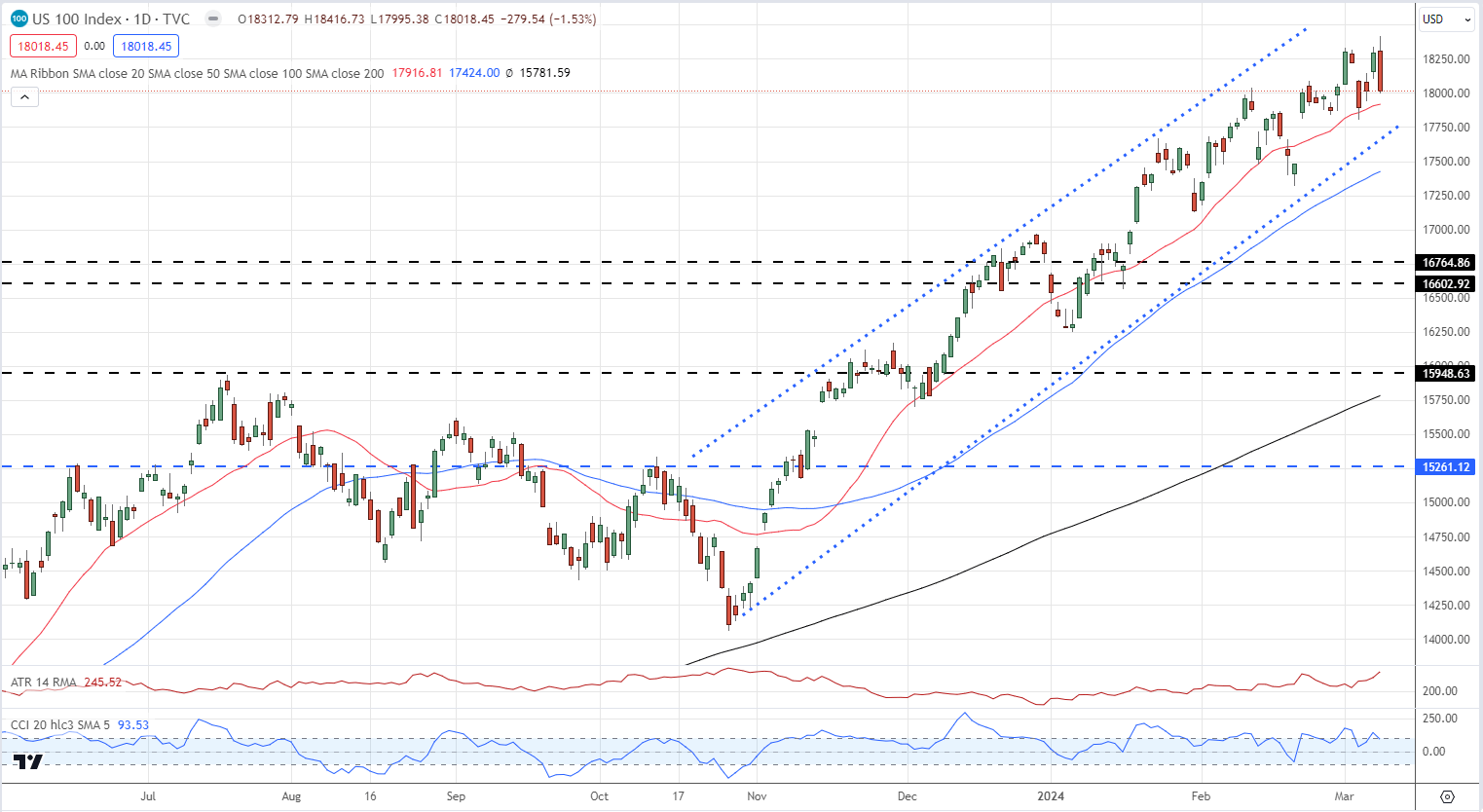

US indices pushed marginally increased over the week though Friday’s sell-off, noticeable within the Nasdaq, is value being attentive to. Friday’s sell-off, whereas damaging, nonetheless leaves Nasdaq in a bullish pattern with the indices making an unbroken collection of upper lows and better highs over the previous 5 months.

Nasdaq 100 Each day Chart

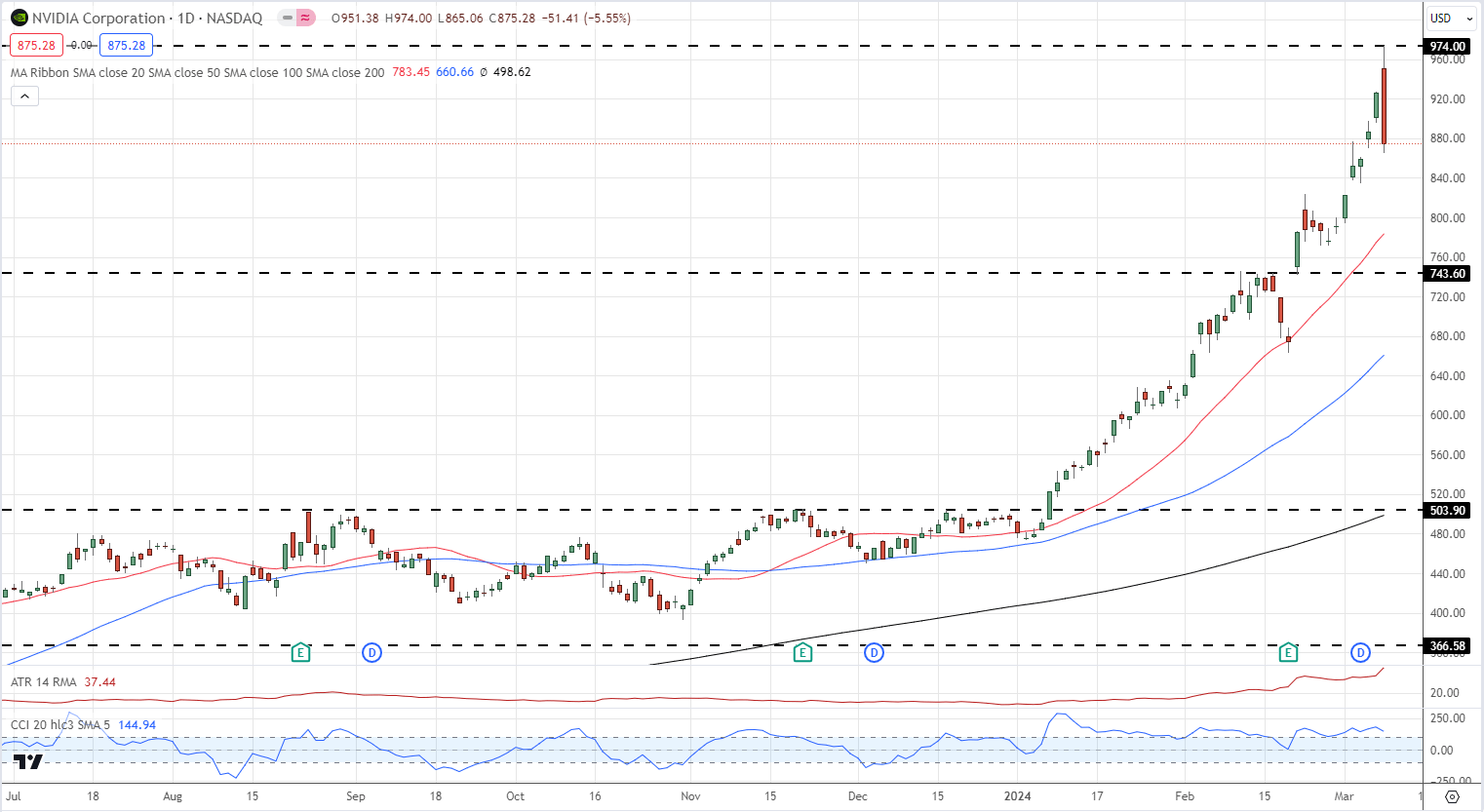

One firm that bucked its latest bullish pattern, Nvidia, turned sharply decrease on Friday. Chip large Nvidia is without doubt one of the largest quoted corporations and has an outsized influence on numerous US indices. It is going to be value following Nvidia subsequent week to see if Friday’s transfer was an aberration.

Nvidia Each day Chart

All Charts utilizing TradingView

Technical and Basic Forecasts – w/c March eleventh

British Pound Weekly Forecast: GBPUSD Appears Overextended at 7-Month Excessive

The Pound appears to be like set to start out a brand new buying and selling week at more-than seven-month highs in opposition to a United States Greenback broadly weakened by expectations that interest-rate cuts are absolutely coming.

Euro Weekly Forecast: Good points Look Weak within the Week Forward

This text explores the euro’s elementary and technical outlook, inspecting pivotal elements that will affect value actions within the upcoming week.

Gold Worth Outlook – Rally Appears Set to Proceed on Optimistic US Fee Lower Backdrop

The latest record-breaking gold rally appears prone to proceed as US rate of interest cuts are actually seen beginning on the finish of H1

US Greenback Forecast: US CPI to Spark Subsequent Huge Transfer – EUR/USD, USD/JPY, GBP/USD

February’s U.S. inflation knowledge is poised to ignite heightened market volatility within the upcoming week, enjoying a pivotal in shaping the near-term outlook for the U.S. greenback.

All Articles Written by DailyFX Analysts and Strategists