Gold, Silver Evaluation

Advisable by Richard Snow

Get Your Free Gold Forecast

Gold Settles into Narrowing Sample as Yields, USD Edge Increased

Gold entered right into a narrowing sample on the finish of final yr (with hindsight), seeing gold worth rallies and selloffs comparatively extra contained. Costs rose on the finish of 2023 however since then, have entered into extra of a consolidatory section, with costs broadly being contained between $2050 and $2010.

Intra-day worth ranges reveal the market is lively however closing costs during the last two periods, and doubtlessly right this moment, witness flat closing costs. Yesterday’s check and rejection of trendline assist sees gold stabilizing round opening ranges, because the yellow metallic is on monitor to finish the week flat or little modified.

The secure haven demand for gold has waned as markets seem to have turn into desensitised to geopolitical tensions and conflicts presently ongoing. Gold has due to this fact, taken its cue from greenback and treasury markets. The blue line depicts the US 2-year Treasury yield which displays an inverse relationship with gold costs and the latest carry in yields might even see a slightly decrease shut this week.

Gold (XAU/USD) Each day Chart

Supply: TradingView, ready by Richard Snow

One thing to control at 13:30 GMT right this moment is the Bureau of Labor Statistics’ annual replace of seasonal adjustment elements for previous CPI prints. This impacts the month-on-month (MoM) rise/fall in inflation and leaves year-on-year (YoY) measures unchanged. Increased MoM CPI revisions might even see the greenback strengthen as price reduce bets proceed to be pared again, whereas decrease revisions might weigh on yields and the greenback because the disinflation pattern would seem like transferring in the suitable route.

Advisable by Richard Snow

How one can Commerce Gold

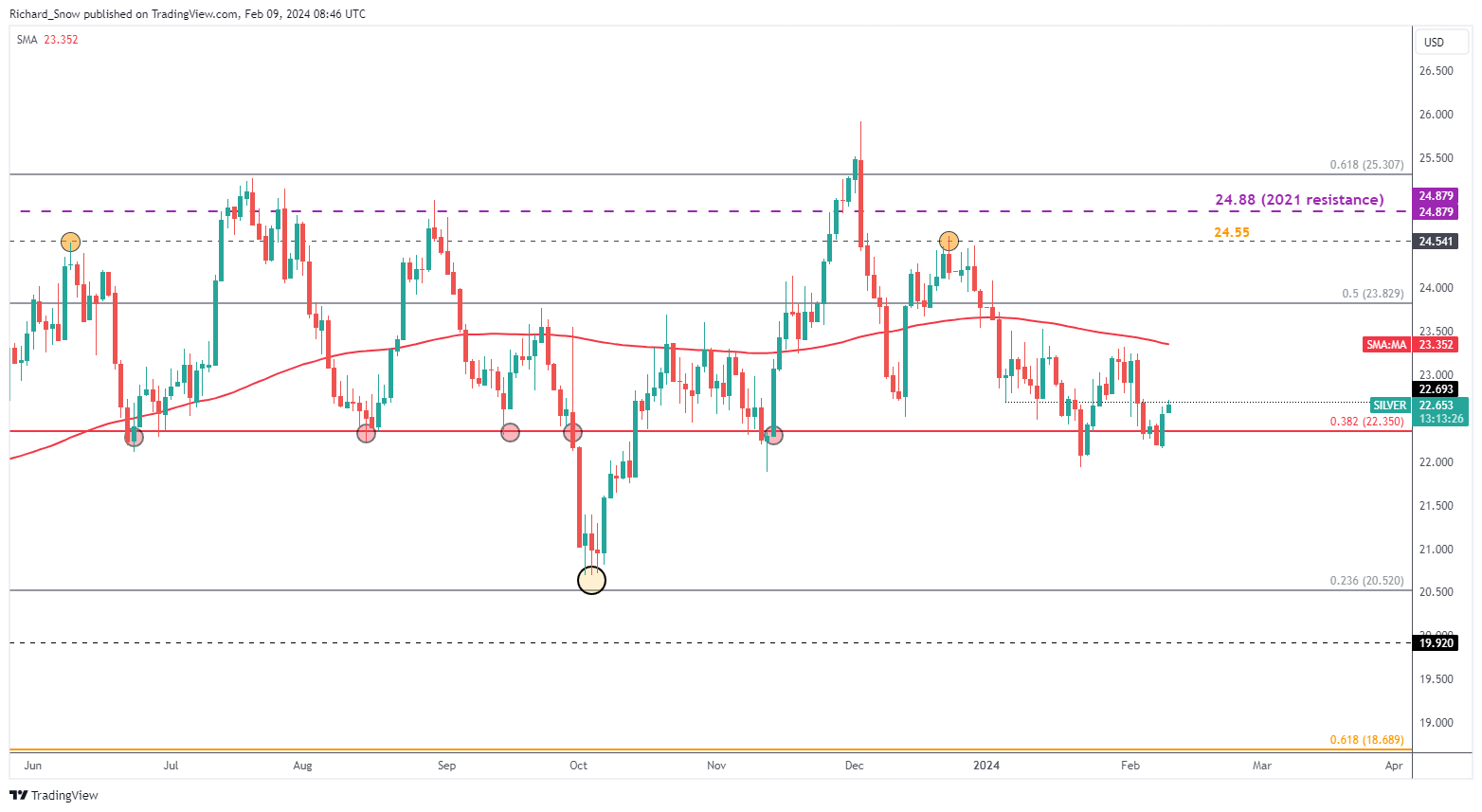

Silver Costs on Monitor for a Flat Week

Silver sees a transfer greater into the tip of the week, reclaiming misplaced floor off the again of final Friday’s NFP blowout. The transfer does seem unconvincing except we see a detailed above $22.70 – the prior low proper in the beginning of the yr.

As well as, silver costs have proven little regard for the numerous stage of $22.35 which beforehand stored bears at bay, supporting costs and offering a pivot level on a couple of event. The extent pertains to the 38.2% Fibonacci retracement of the most important 2021 to 2022 decline. The Fib stage does current us with a possible assist stage within the short-term, with the swing low at $21.33 thereafter.

Silver (XAG/USD) Each day Chart

Supply: TradingView, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX