monsitj/iStock by way of Getty Photographs

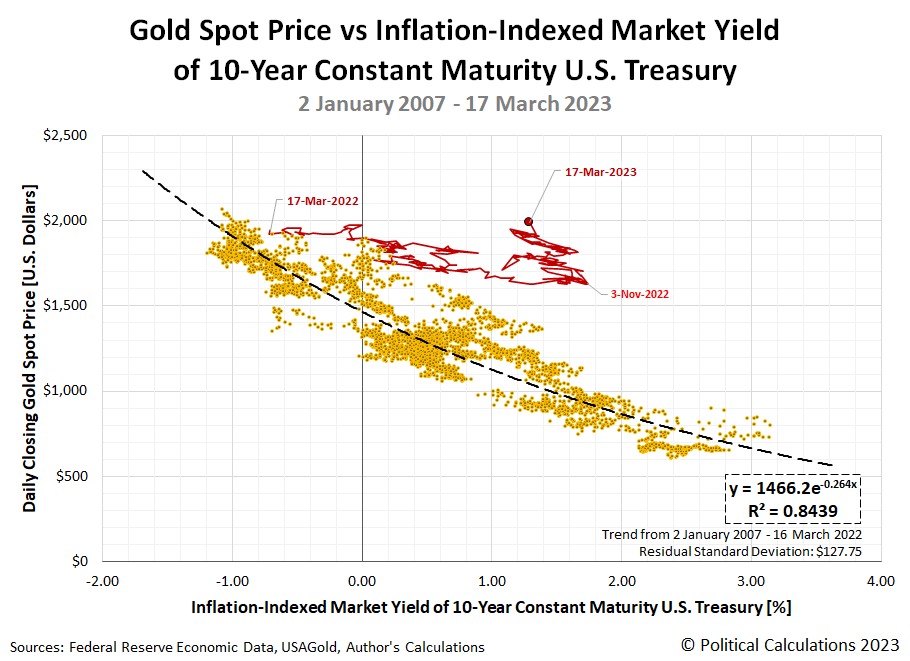

Simply over a yr in the past, we took a snapshot of the connection between gold costs and actual rates of interest, as indicated by the yield on inflation-adjusted 10-year fixed maturity U.S. treasuries.

That unique snapshot was taken on 17 March 2022, someday after the U.S. Federal Reserve began what grew to become a sequence of fee hikes that lifted the efficient Federal Funds Charge from 0.08% to 4.83% to fight inflationary forces unleashed by the Biden administration a yr earlier.

As a result of gold is utilized by buyers as a hedge towards inflation, rising in worth when inflation-adjusted rates of interest fall or flip unfavourable, the rising fee atmosphere the Fed has created over the previous yr ought to have diminished the value of gold by a considerable quantity. After we took our snapshot on 17 March 2022, the gold spot worth was $1,944.05 per ounce and the actual yield of the 10-year Treasury was -0.72%.

One yr later, on 17 March 2023, the spot worth of gold had risen to $1,988.11 per ounce, whereas the inflation-adjusted 10-year yield had swung to +1.29%. That enhance occurred regardless of the Fed’s fee hikes pushed actual rates of interest to swing from unfavourable to optimistic.

In between these dates, the value of gold fell for a time, however solely whereas actual rates of interest had been growing and never by anyplace close to as a lot because the 15-year-long relationship between the 2 would have predicted. However that anticipated pattern stopped after 3 November 2022, when the actual 10-year Treasury yield peaked at +1.74% and the value of gold hovered across the $1,629 stage, close to its lows in the course of the Fed’s fee hike cycle.

After that date, the actual yield of the 10-year Treasury fell again whereas the value of gold escalated. Our new snapshot of the connection between spot gold costs and inflation-adjusted 10-year Treasuries illustrates these modifications.

If the 15-year-long relationship from 2 January 2007 by means of 16 March 2022 between the value of gold and actual 10-year Treasury yields nonetheless held (proven by the dashed black curve within the chart), the value of gold would have fallen $850 per ounce greater than it has. If the value of gold dropped to the place it was trending between 17 March 2022 and three November 2022, which might be thought-about latest historical past, it will be about $350-$400 decrease per ounce than it’s for the same actual 10-year yield.

But it surely has risen increased, which raises new questions on what’s driving the value of gold. The workers at Goldmoney, who’ve a extra refined mannequin than we do, suppose there was a paradigm shift. Within the following excerpt from Half I of their evaluation, we have added the hyperlinks to the referenced displays, however not the boldface font, which seems in Goldmoney’s unique article:

Over the previous few months, the gold worth has as soon as once more indifferent from the mannequin’s predicted worth. And it has achieved so in a outstanding manner. First, the delta between the noticed gold worth and the model-predicted worth has reached an all-time excessive. Present gold costs are greater than $400/ozt over mannequin predicted costs (See Exhibit 2). The earlier all-time excessive was $200/ozt and it solely lasted for a brief time period.

Second, that is taking place in probably the most unlikely of all environments. The Fed has been aggressively mountain climbing charges for the previous 12 months to combat the very best inflation in over 40 years. The Fed raised the Fed Funds fee from 0% to 4.5% in simply 12 months. It is rather uncommon that we see such giant fee hikes from cycle bottoms. In reality, this has solely occurred 5 occasions since 1975 that the Fed raised charges greater than 4% from the underside (see Exhibit 3)….

But regardless of all this, gold costs haven’t simply held their floor; they’ve truly risen! Arguably, it could possibly be that the gold market as soon as once more has merely obtained forward of itself. Or we actually do see a paradigm shift this time.

Earlier than we proceed exploring this thought, we should add one caveat right here. In our fashions, we use publicly out there information for web central financial institution gross sales/purchases. The official information from the IMF is notoriously lagging and incomplete, and we’re sure that the reported web buy numbers are a lot too low. The World Gold Council (WGC), for instance, studies web additions of 1136 tonnes in 2022, greater than double the 450 tonnes purchased by central banks in 2021. It is no secret that central banks have been on a shopping for spree within the second half of final yr. However precisely how a lot gold they added stays a little bit of a thriller. That stated, even assuming that true central financial institution gold purchases exceeded the WGC estimates by an enormous 50% would deliver the model-predicted worth solely about $70/ozt nearer to the noticed worth. We consider that is partially a shortcoming of our mannequin, as it’s primarily based on historic information, and we’ve got not seen a number of volatility in CB gold purchases prior to now. Nevertheless, we’ve got had years with giant central financial institution purchases earlier than, and we had years with increased total gold demand from all sectors, and but this did not result in giant distortions in our mannequin. Therefore, we do not suppose central financial institution purchases can clarify the present big discrepancy between predicted and noticed costs.

Due to this fact, in our view, the one cause for gold costs to detach from the underlying variables in our mannequin by such a big quantity and for such a very long time is that the gold market lastly begins pricing in that there’s a threat central banks, significantly the Fed, are shedding management over inflation, which is outstanding given the prevailing narrative that the Fed is prepared and capable of do no matter it takes to deliver inflation below management.

Here is the underside line from Half II of their evaluation:

We consider that the almost definitely clarification for the latest rally in gold costs towards the underlying drivers of our mannequin is that the market is more and more pricing in that the Fed, as soon as it’s pressured to cease mountain climbing, will lose management over inflation. Confronted with the alternatives of years of excessive unemployment and a crumbling financial system or persistent excessive inflation, the gold market thinks the Fed will go for the latter. This is able to mark a real paradigm shift, and from that time on, gold costs might begin to worth in extended excessive inflation (and our mannequin might not be capable of seize this correctly).

If true, a number of fashions shall be as damaged as our easy mannequin already is! Then once more, within the immortal phrases of George Field, all fashions are unsuitable, some are helpful. The trick is to know once they work, as a result of counting on a failed mannequin after its expiration date can result in catastrophic penalties.

Authentic Publish

Editor’s Observe: The abstract bullets for this text had been chosen by Searching for Alpha editors.