Gold, XAU/USD, Fed’s Bostic Speaks, IGCS – Briefing:

- Gold costs aimed larger on Tuesday because the US Greenback fell

- Bearish Engulfing follow-through stays a threat for gold

- IGCS reveals merchants decreased upside bets, a bullish signal?

Really useful by Daniel Dubrovsky

Get Your Free Gold Forecast

Gold costs gained barely over the previous 24 hours after the worst 2-day loss since early February. The anti-fiat yellow metallic benefited from a cautiously weaker US Greenback as merchants continued to fine-tune their expectations of the place the Federal Reserve may take rates of interest later this yr.

Throughout Tuesday’s Wall Avenue buying and selling session, Atlanta Fed President Raphael Bostic spoke and famous that he favors one fee hike earlier than “occurring maintain”. He added {that a} recession just isn’t in his baseline outlook and that the central financial institution “will do what it takes” to deliver down inflation to 2%.

This commentary might need stored the US Greenback restrained and thus supplied XAU/USD some elevate. Specializing in Wednesday’s Asia-Pacific buying and selling session, the financial docket is missing notable financial occasion threat. Which will preserve merchants targeted on basic threat urge for food, which is pretty quiet in the interim.

XAU/USD Each day Chart

On the each day chart, gold continues to face the draw back threat of the aftermath of a Bearish Engulfing. Draw back follow-through has been missing, with costs being supported by the 20-day Easy Shifting Common. Optimistic RSI divergence was current earlier than the Bearish Engulfing shaped, hinting that upside momentum was fading. In the meanwhile, watch the shifting common for key assist. Within the occasion of a flip larger, the 2022 excessive at 2070.42 stays a key degree to observe.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to E-newsletter

Chart Created Utilizing TradingView

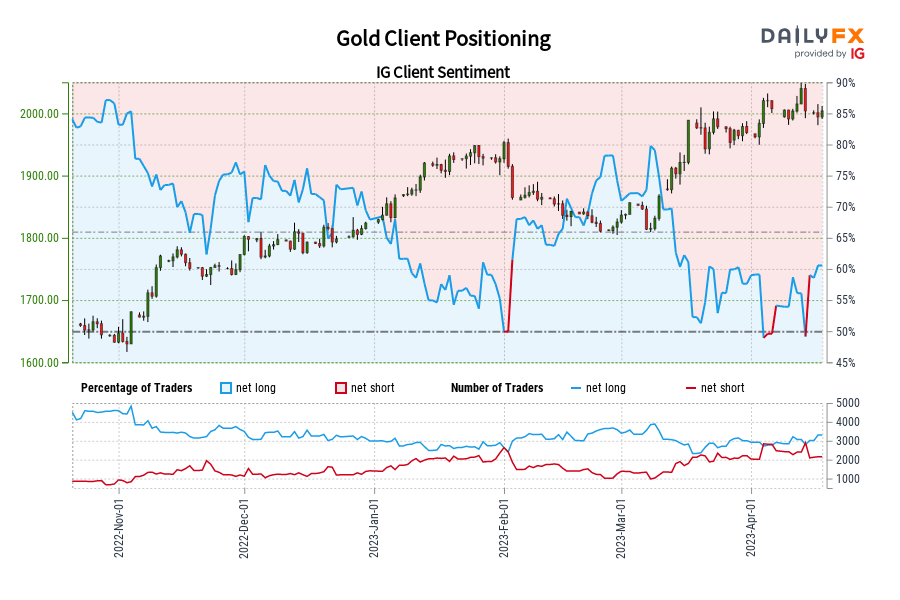

Gold Sentiment Evaluation – Bullish

In response to IG Consumer Sentiment (IGCS), about 58% of retail merchants are net-long gold. IGCS tends to operate as a contrarian indicator. Since most merchants are net-long, this hints costs might fall. However, upside publicity has decreased by 5.14% and 5.45% in comparison with yesterday and final week, respectively. With that in thoughts, current modifications in publicity warn that costs might quickly reverse larger as soon as extra.

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, comply with him on Twitter:@ddubrovskyFX