Gold, XAU/USD, US Greenback, DXY Index, Fitch, AA+, Treasury Yields, GVZ – Speaking Factors

- The gold worth seems directionless regardless of strikes in different markets

- The Fitch announcement may see stress on threat belongings and haven asset tailwinds

- If volatility emerges within the gold worth, will it assist or hinder the valuable steel?

Beneficial by Daniel McCarthy

How you can Commerce Gold

The gold worth steadied into the Asian session on Wednesday after a selloff into the New York shut in a single day.

The value motion comes after Fitch, a big credit standing company, downgraded the US sovereign debt credit standing to AA+ from AAA.

The company “anticipated fiscal deterioration over the subsequent three years, a excessive and rising basic authorities debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated friends during the last 20 years,”

Sarcastically in early commerce, Treasuries rallied in worth and yields dipped as threat aversion appeared to outweigh the implication for US Authorities borrowing prices.

Nonetheless, yields had made notable positive factors within the US session with the benchmark 10-year word buying and selling close to 4.06% earlier than dipping beneath 4% immediately.

The announcement from Fitch got here after the shut of the Wall Avenue money session, however futures are shifting decrease within the aftermath. APAC equities are equally priced in a tender day forward.

If the theme of threat aversion continues all through the day, then gold may see an uptick in volatility.

The GVZ index is a measure of implied volatility for gold that’s calculated in an analogous option to the VIX index’s interpretation of volatility for the S&P 500. Gold volatility has been languishing and may point out an absence of conviction for path in worth.

US Greenback gyrations can also impression the gold worth.

Beneficial by Daniel McCarthy

The Fundamentals of Vary Buying and selling

SPOT GOLD AGAINST US 10-YEAR TREASURY YIELD, DXY (USD) INDEX AND GVZ INDEX

Chart created in TradingView

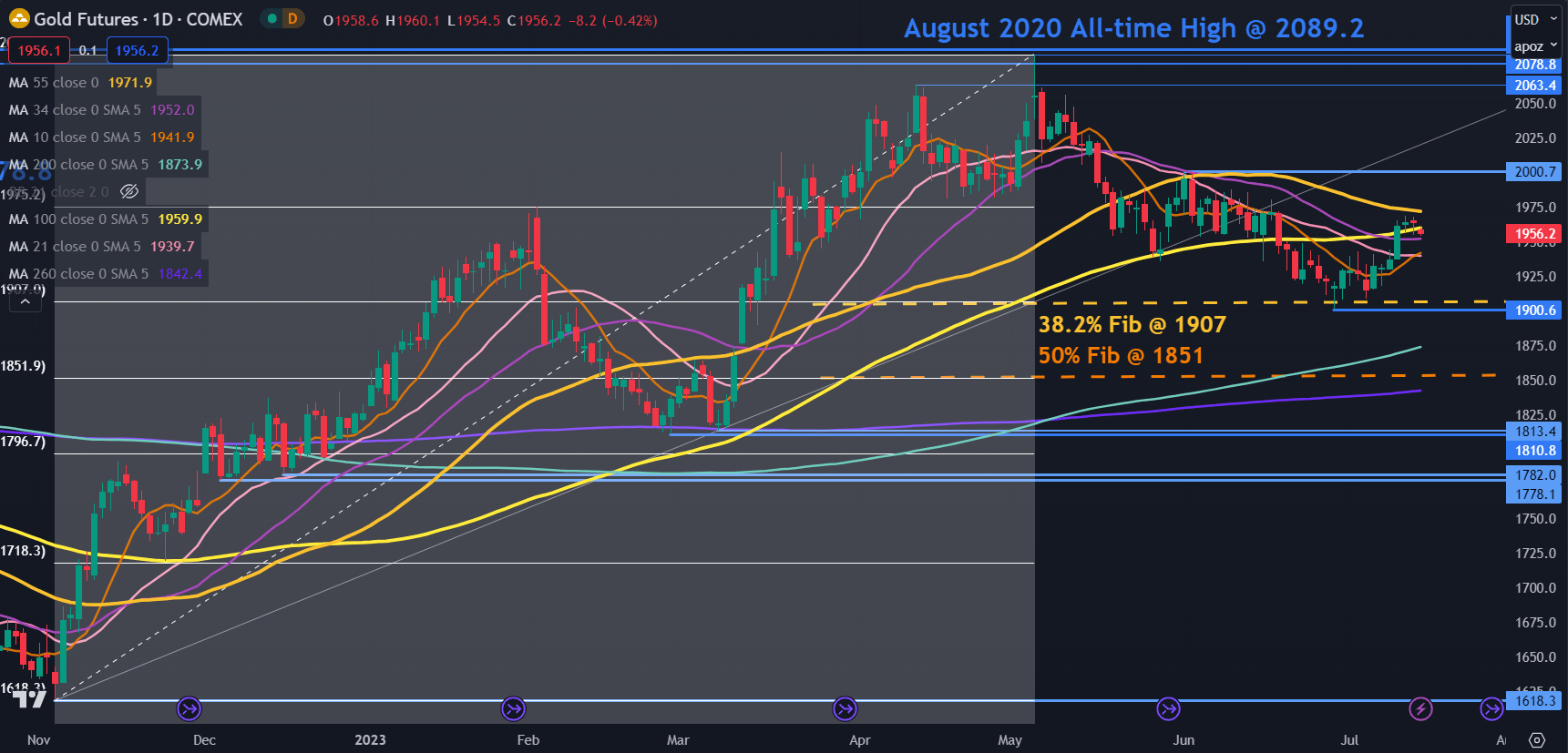

GOLD TECHNICAL ANALYSIS

The gold worth stays close to the center of its nearly 5-month vary between 1885 and 2062. It additionally lies near the 10-, 21-, 34-, 100-day easy shifting averages (SMA) which can indicate an absence of directional confidence within the gold market.

The decrease sure of the vary may see notable assist lie within the 1885 – 1895 space.

In that zone, there are a few prior lows, a breakpoint, the 200-day SMA and the 38.2% Fibonacci Retracement degree of the transfer from 1614 as much as 2062.

Additional down the 50% Fibonacci Retracement at 1838 may lend assist.

On the topside, resistance could be on the current peak of 1897 or the breakpoint close to 2000.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel through @DanMcCathyFX on Twitter