GOLD (XAU/USD) KEY POINTS:

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to Publication

READ MORE: USD/JPY, EUR/JPY Value Forecast: Intervention Considerations Present Optimism for Yen Bulls

Gold costs continued its restoration within the European session because the Independence Day Vacation within the US has left the US Greenback on the again foot. Because the US session approaches costs may wrestle within the absence of liquidity with the FOMC minutes and NFP nonetheless to come back this week. A rise in chance of a 25bps hike from the Fed in July has finished little to quell the latest rally in Gold costs.

Markets are pricing in an 86.2% chance that the Federal Reserve will ship a 25bps on the July 26 assembly, up from 53.5% a month in the past and 76% per week in the past. Regardless of the rise in price hike possibilities, we’ve got additionally seen elevated concern round a possible recession as manufacturing information over the previous week has been significantly atrocious. This might in concept partly clarify the resurgence in gold costs following a quick stint beneath the $1900/oz psychological stage.

Supply: CME FedWatch Software

As talked about with the US vacation there isn’t lots anticipated within the US session with value prone to stay throughout the each day vary, between the $1918-$1930/oz handles. Market contributors will little doubt be trying towards the FOMC minutes launch on Wednesday for a possible catalyst that might provoke a breakout of the bigger vary in play between the $1890 and $1945 ranges respectively.

For all market-moving financial releases and occasions, see the DailyFX Calendar

Foundational Buying and selling Data

Commodities Buying and selling

Beneficial by Zain Vawda

TECHNICAL OUTLOOK AND FINAL THOUGHTS

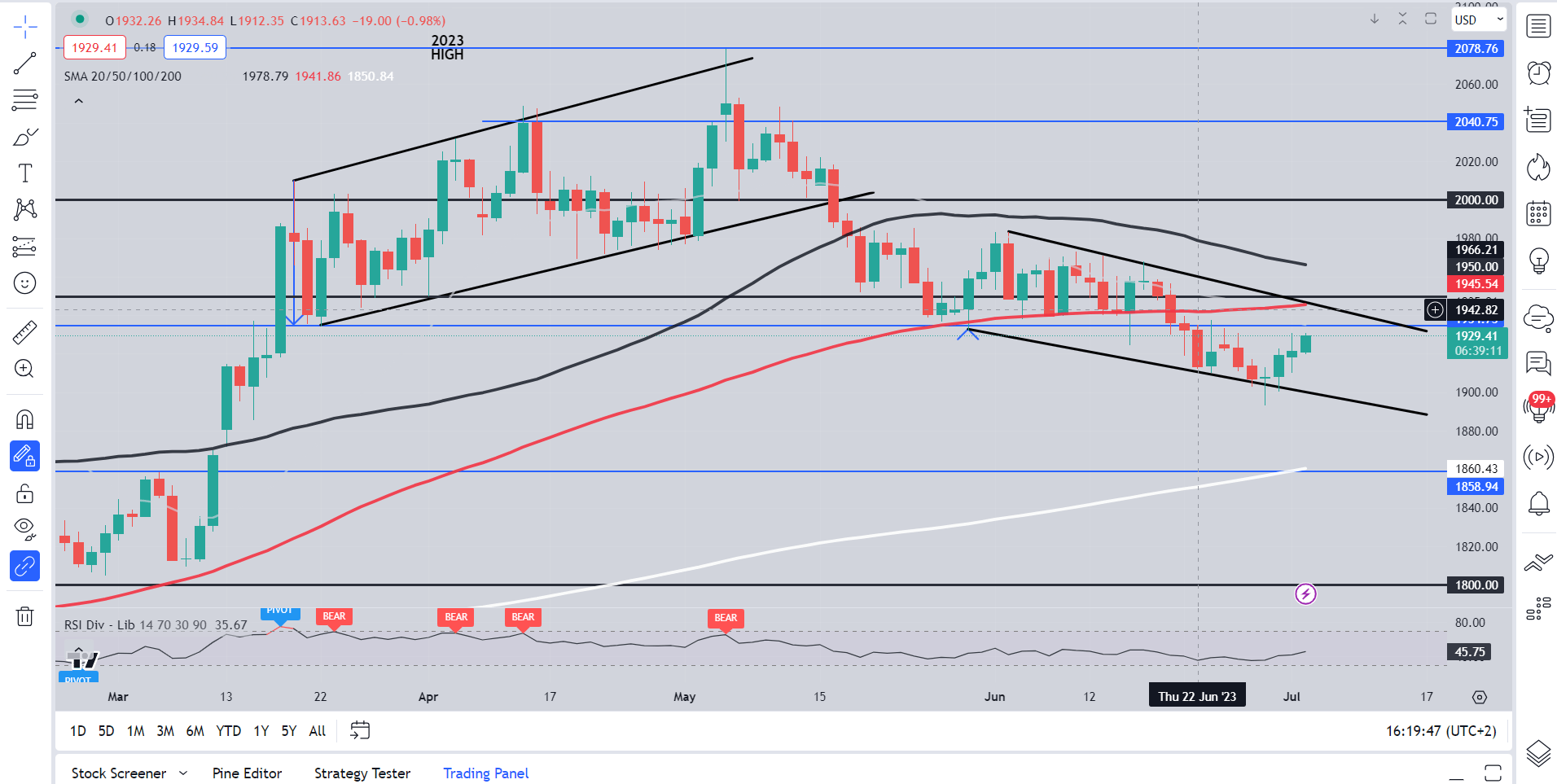

Kind a technical perspective, Gold value motion has been printing decrease highs and decrease lows with the 100-day MA remaining a key space of resistance prone to cap any tried transfer to the upside. Final week’s breach of the $1900 deal with failed to search out acceptance with the dear steel recovering slightly rapidly. So long as recessionary fears stay in play Gold may in concept stay supported as its protected haven enchantment grows. A each day candle shut beneath the $1900 stage is required if we’re to see additional draw back for gold costs whereas at this stage the 100-day MA across the $1945 deal with holds the important thing for bulls as they try one other run on the $2000 mark.

There’s a falling wedge sample in play on the each day chart beneath which might trace at a bullish breakout slightly than a bearish one. As talked about, the primary sticking level to any upside transfer would be the 100-day MA earlier than the $1975 and $2000 handles come into focus.

Gold (XAU/USD) Day by day Chart – July 4, 2023

Supply: TradingView, Chart Ready by Zain Vawda

IG CLIENT SENTIMENT DATA

Looking on the IG shopper sentiment information and we are able to see that retail merchants are presently internet LONG on Gold with 68% of merchants holding lengthy positions (as of this writing). At DailyFX we sometimes take a contrarian view to crowd sentiment which means we may see Gold costs proceed to say no following a brief upside rally.

Written by: Zain Vawda, Markets Author for DailyFX.com

Contact and observe Zain on Twitter: @zvawda