GOLD ANALYSIS & TALKING POINTS

- US CPI and FOMC minutes keenly anticipated tomorrow.

- Fed’s Harker and Kashkari scheduled to talk later in the present day.

- Bearish divergence vs bull pennant continuation?

Advisable by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL BACKDROP

Gold costs are hovering across the $2000 mark after a pullback from recent yearly highs final week. This comes after sturdy Non-Farm Payroll (NFP) knowledge bolstered hawkish Fed bets now pricing in a peak price above 5% and a 73.6% chance of a 25bps rate of interest hike within the Might assembly (see desk under).

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Supply: Refinitiv

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to Publication

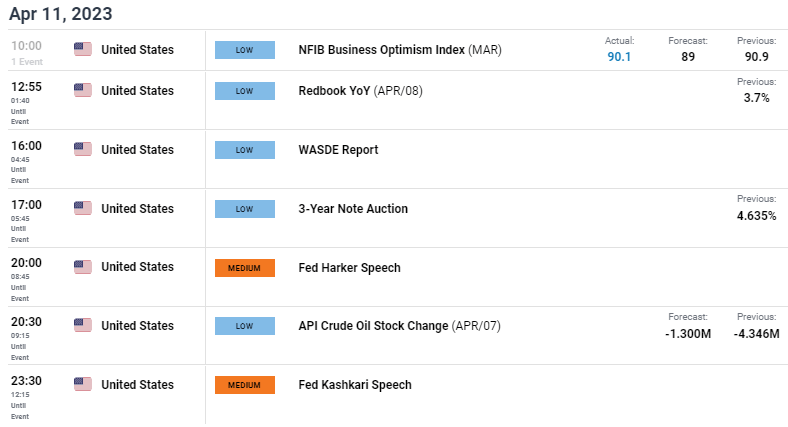

Whereas the main target for the week will stem from tomorrow’s US CPI print and FOMC minutes and their impression on the tight labor market figures. At this time brings lesser volatility by way of the NFIB enterprise optimism index in addition to Fed communicate (see financial calendar under). The NFIB report beat estimates giving the USD a lift forward of the US buying and selling session with bullion pulling again barely. Later in the present day, Fed audio system will dominate the calendar with consideration on their desire to aggressive or easing financial coverage.

ECONOMIC CALENDAR

Supply: DailyFX financial calendar

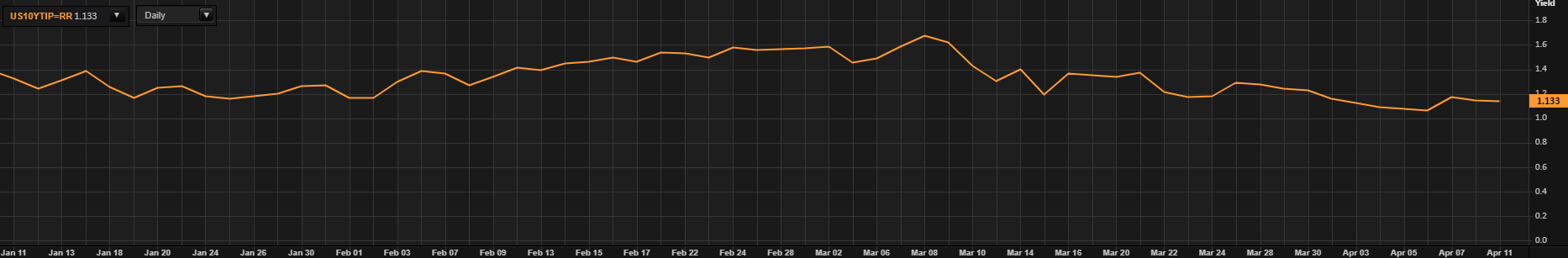

Actual yields have plateaued considerably since final week’s marginal restoration however could discover some directional bias after US CPI. Ought to CPI push increased and assist financial coverage tightening after sturdy NFP figures, actual yields could flip increased thus rising the chance price of holding gold, making the yellow metallic much less fascinating.

U.S. 10-YEAR TIPS – REAL INTEREST RATE

Supply: Refinitiv

TECHNICAL ANALYSIS

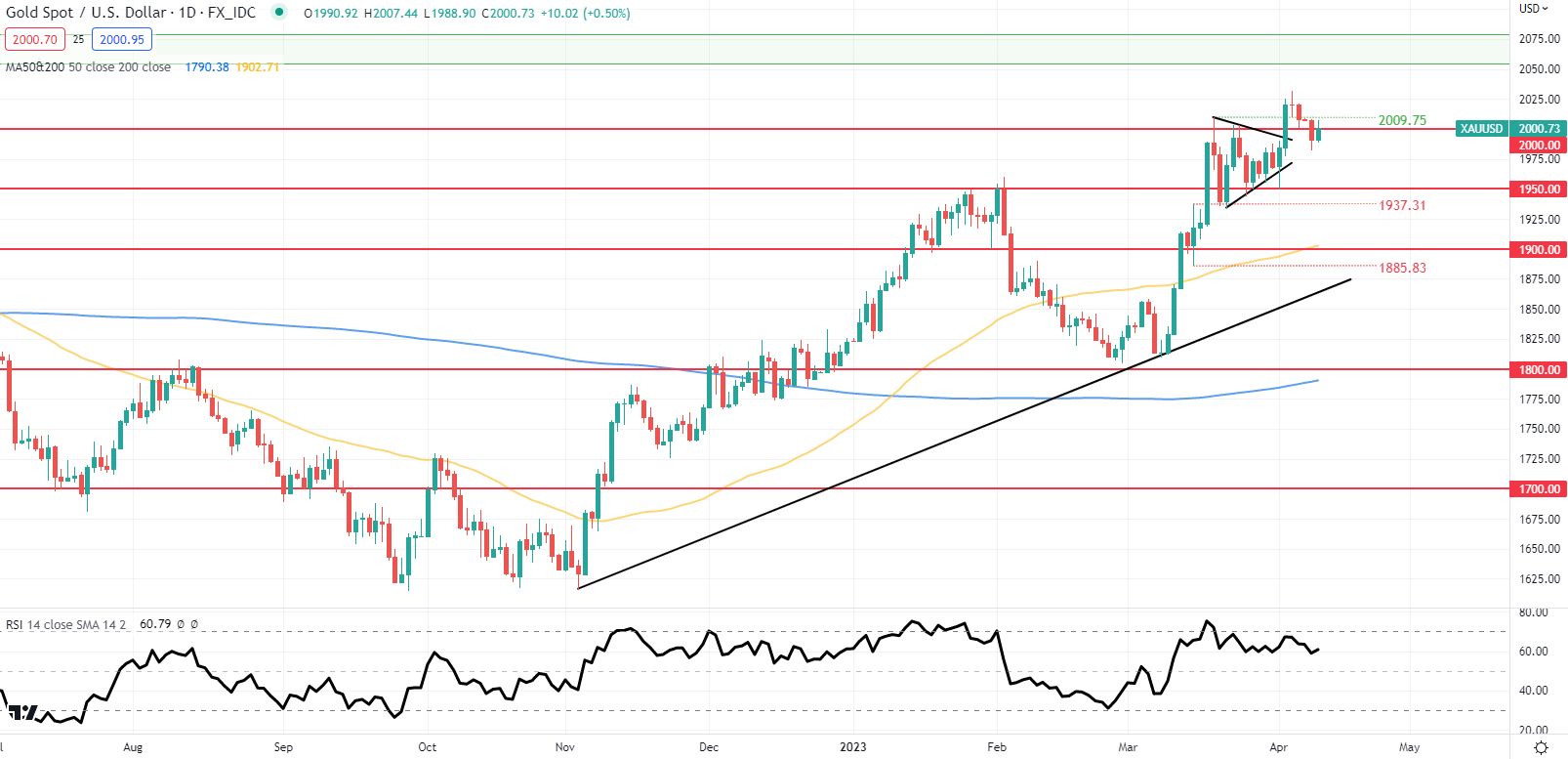

XAU/USD DAILY CHART

Chart ready by Warren Venketas, IG

As talked about in my evaluation final week, bearish divergence has since unfolded however could extra in retailer relying on the upcoming US inflation learn as talked about above. Present worth motion on the every day spot gold chart exhibits bulls unable to carry above the $2000.00 psychological deal with whereas imply reversion in the direction of the 200-day MA (blue) could possibly be a longer-term final result.

Any talked about relating to price cuts this 12 months from the forthcoming FOMC minutes may consequently lead to gold upside, extending the current bull pennant (black) breakout trajectory.

Resistance ranges:

- 2050.00 – 2080.00

- 2009.75

Help ranges:

IG CLIENT SENTIMENT: BEARISH

IGCS exhibits retail merchants are presently distinctly LONG on gold, with 58% of merchants presently holding lengthy positions (as of this writing). At DailyFX we usually take a contrarian view to crowd sentiment leading to a short-term draw back bias.

Contact and followWarrenon Twitter:@WVenketas