Gold Value Speaking Factors

The worth of gold checks the 50-Day SMA ($1674) because it retraces the decline following the Federal Reserve rate of interest choice, and the replace to the US Client Value Index (CPI) could prop up the valuable metallic because the report is anticipated to point out easing worth pressures.

Elementary Forecast for Gold Value: Impartial

The worth of gold trades to a recent weekly excessive ($1676) amid the kneejerk response to the US Non-Farm Payrolls (NFP) report, and bullion could try to retrace the decline from the October excessive ($1730) because it continues to defend the yearly low ($1615).

On the similar time, the US CPI could affect the worth of bullion as each the headline and core studying for inflation are anticipated to slender in October, and proof of slowing inflation could heighten the enchantment of gold because it places stress on the Federal Reserve to winddown the hiking-cycle.

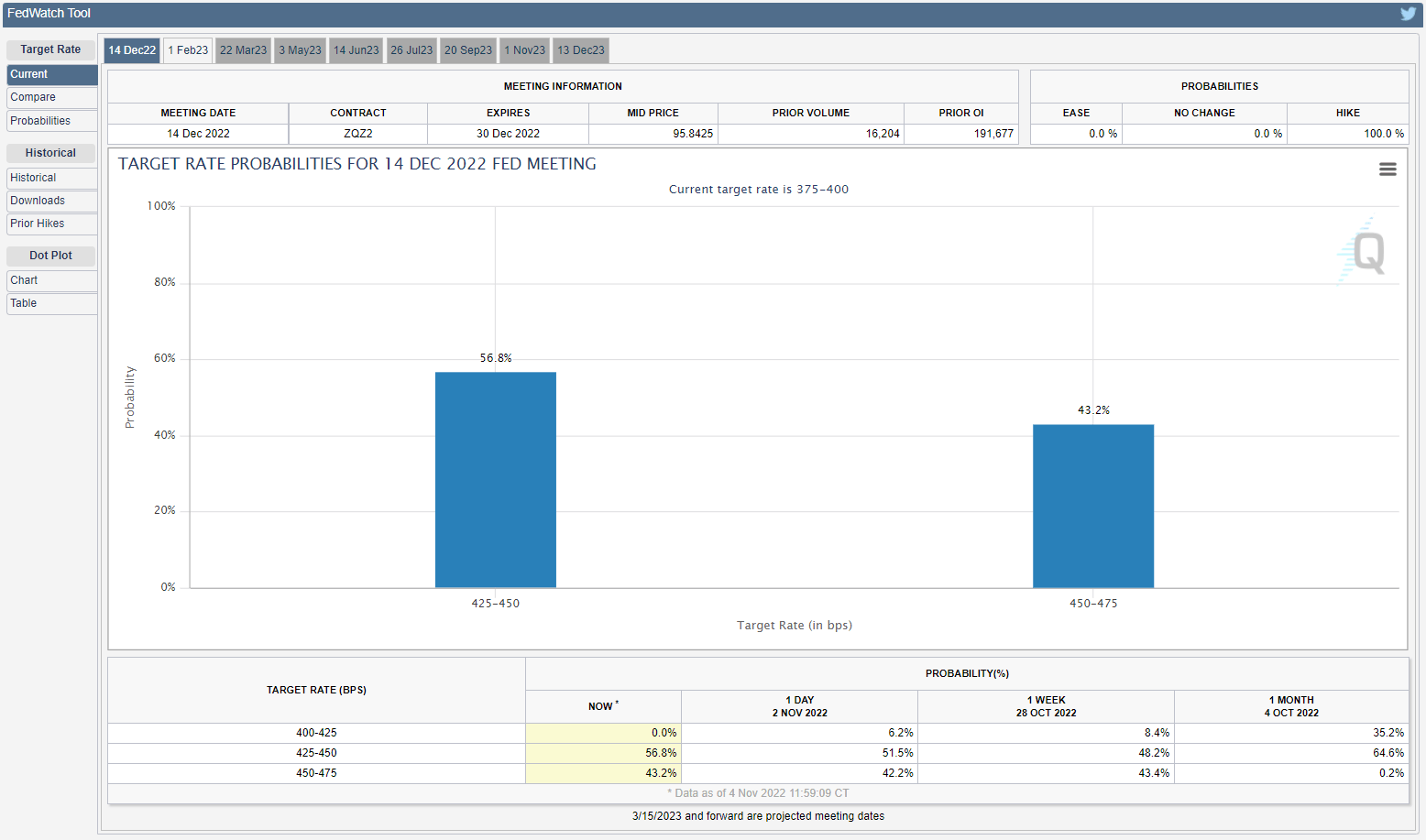

Supply: CME

Consequently, expectations for a shift in Fed coverage could drag on US yields because the CME FedWatch Instrument displays a better than 50% likelihood for a 50bp fee hike, however a higher-than-expected CPI print could present the Federal Open Market Committee (FOMC) with better scope to pursue a extremely restrictive coverage as Chairman Jerome Powell insists that “it is rather untimely” to pause the hiking-cycle.

In flip, indicators of sticky worth development could pressure the FOMC to take care of its current method in combating inflation as Chairman Powell emphasizes that “we have not seen inflation coming down,” and the worth of gold could proceed to face headwinds over the rest of the yr because the central financial institution retains a hawkish ahead steering for financial coverage.

With that stated, gold could mirror the worth motion from final month if it struggles to carry above the 50-Day SMA ($1674), however a downtick within the US CPI could prop up the worth of bullion because it dampens hypothesis for one more 75bp Fed fee hike.

— Written by David Music, Foreign money Strategist

Observe me on Twitter at @DavidJSong