You recognize what’s regular? When a market takes a breather after a risky transfer – just like the proper now.

Miners Shrug Off Gold’s Rally

And are you aware what isn’t regular? When a market that’s pushed by another market just about ignores its sturdy indications.

Similar to what mining shares did relative to .

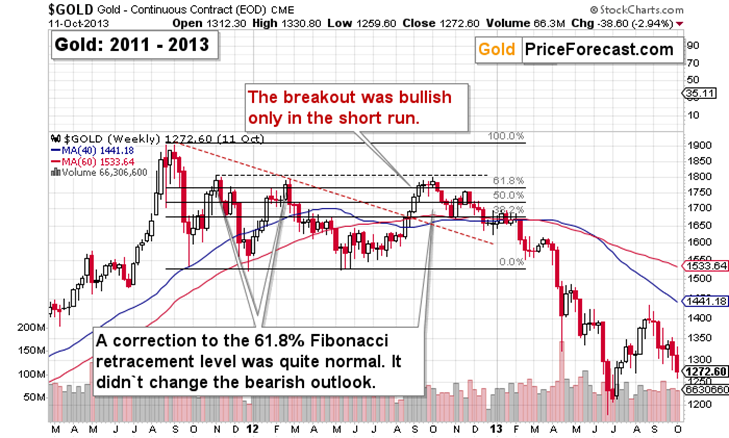

Gold rallied strongly on Friday, similar to the USD Index declined strongly on that day. Technically, it didn’t change a lot for gold – it stays under the rising resistance line, and it additionally stays in good tune with its worth sample from 2011-2013.

That November 2012 rally appears much like the newest fast upswing in gold.

However the motion in gold will not be as necessary as neither silver nor mining shares (not even platinum) moved visibly increased on Friday. Sure, they took their very own breathers, however nothing price writing house about.

Now, the best way miners ignored gold’s rally and didn’t capitalize on it’s one thing actually outstanding.

Not solely did the VanEck Junior Gold Miners ETF (NYSE:) fail to rally in a significant approach on Friday, however it truly closed the day under the April excessive (when it comes to closing costs) for the third consecutive buying and selling day – thus absolutely confirming this transfer.

In right now’s pre-market buying and selling, the GDXJ is at $66 for the time being of writing these phrases, which continues to be a negligible rally given the dimensions of the late-July decline. This can be a common breather, whose dimension absolutely confirms the bearish implications of the entire setup.

Gold shares are likely to outperform gold within the first elements of rallies within the treasured metals sector. We have now precisely the other proper now. The implication is that that is the very early a part of a much bigger decline.

In the meantime, the USD Index is on the point of rally way more.

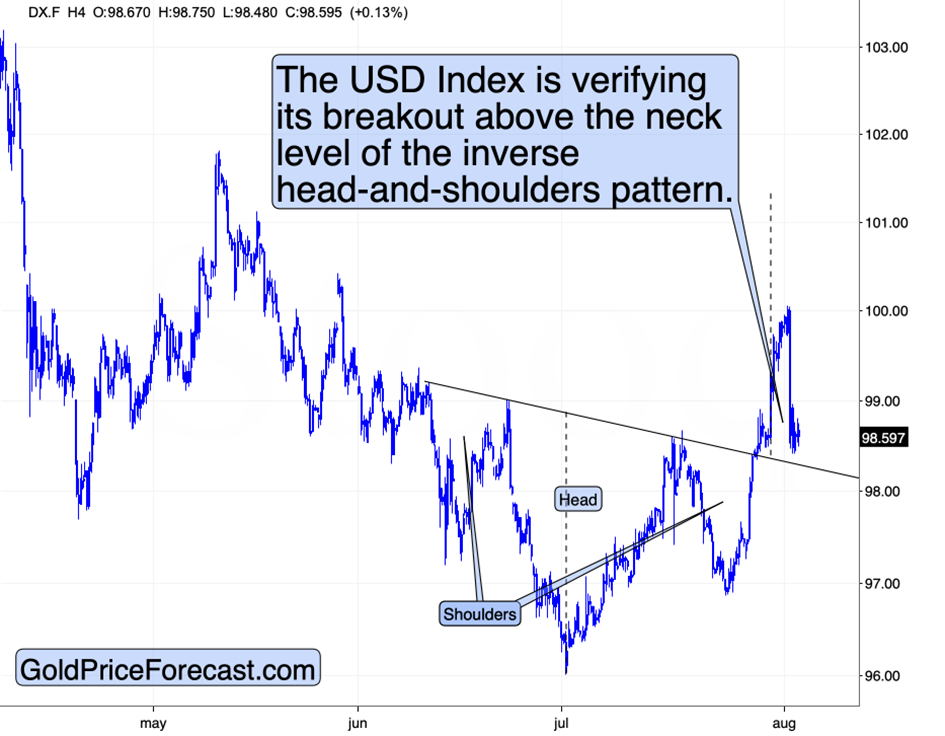

I beforehand described the inverse head-and-shoulders sample within the USD Index and its bullish implications (the USDX is prone to rally to not less than 101.3 above it). In the present day, I’d like so as to add that these patterns are usually verified by a transfer again to the neck degree. That is what we noticed just lately.

The USD Index moved again to its July excessive and to the neck degree (roughly) of the inverse H&S formation.

The breakouts are being verified – that is utterly regular.

In the meantime, shares are additionally taking a breather after taking a large beating on Thursday and Friday.

They consolidated above the 6,250 degree for just a few weeks, so it’s no surprise that this degree offered short-term help. Nonetheless, let’s remember that the is just one of many inventory market indices.

Wanting on the gives a clearly bearish image.

After failing to maneuver above the earlier highs, shares declined (simply because the Volatility Breakout System had forecasted) – additionally under their rising help line. This can be a mixture of two highly effective bearish indicators, and whereas we see a pause right now, it appears to be like like shares can decline considerably any day now.

All Indicators Level to 2008

Taking a step again from all this, doesn’t all of it remind you of one thing? I imply, gold is holding up comparatively nicely with vital volatility, the USD Index is beginning to rally, with shares that appear to be heading decrease, and weak efficiency of mining shares?

Sure – the present state of affairs has an enormous “2008” written throughout it.

And the perfect half? It’s early, and you’ll nonetheless revenue from it, particularly that the Peak Chaos principle stays intact.