One thing vital is about to occur subsequent week…

The U.S. statistics have been simply launched. They have been higher than anticipated, however total, effectively throughout the earlier vary of values – nothing to put in writing residence about.

Markets’ response was comparatively small and in good tune with the technical patterns that I had already described beforehand.

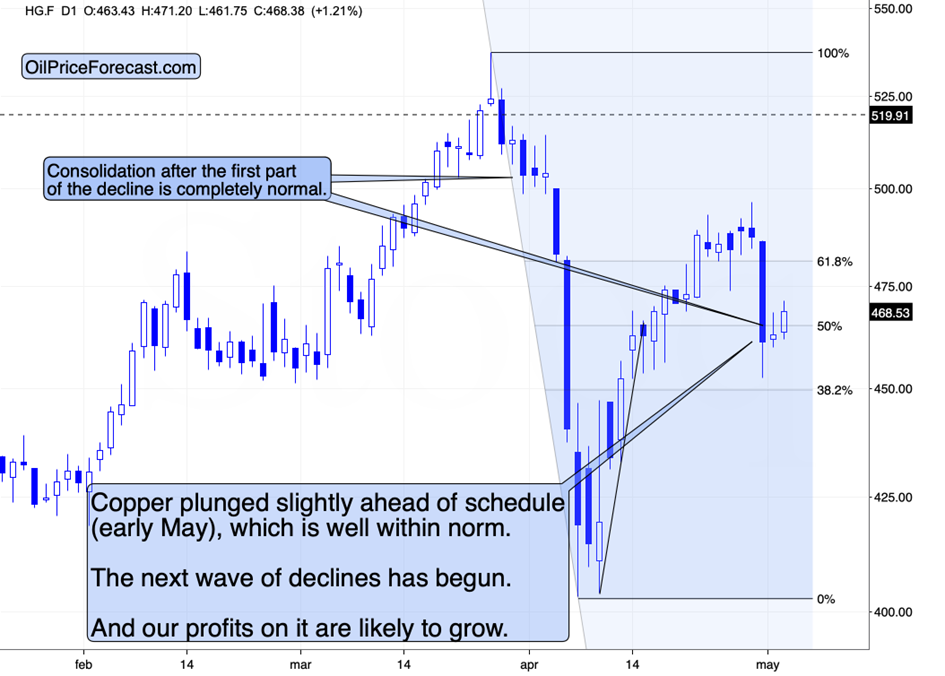

corrected a bit after breaking under the earlier intraday lows. This consolidation is regular, and it’s unlikely to lead to any significant rebound as no main assist degree was reached (apart from the early April excessive, which was nearly reached). The whole lot that I wrote about gold worth forecast for Might 2025 stays up-to-date. Extra importantly, nonetheless, the (to the rally of which gold reacted by sliding) didn’t encounter any specific resistance degree.

In truth, plainly after the present pullback, its worth will rally as soon as once more.

USD Index Completes Bullish Sample

This pullback is totally pure, because the USDX simply accomplished its inverse head-and-shoulders sample. Corrections after these are frequent. And for the reason that USDX simply bottomed very near the triangle-vertex-based reversal, plainly the underside right here is in or about to be in.

This, in flip means that the corrective upswing in gold and silver is about to be over.

The identical is probably going for the inventory market, which is probably going additionally linked to the reversal within the USD Index, however in shares’ case, there’s extra to that.

As I defined yesterday, the inventory market has its personal triangle-vertex-based reversal level, which is due early subsequent week. Consequently, the present pause after a rally is kind of pure. We’re nonetheless prone to get a (probably large) transfer decrease subsequent week.

Apart from, the decline in already indicated what’s probably subsequent for shares – it strikes fairly intently with the S&P 500, and it already declined considerably this week.

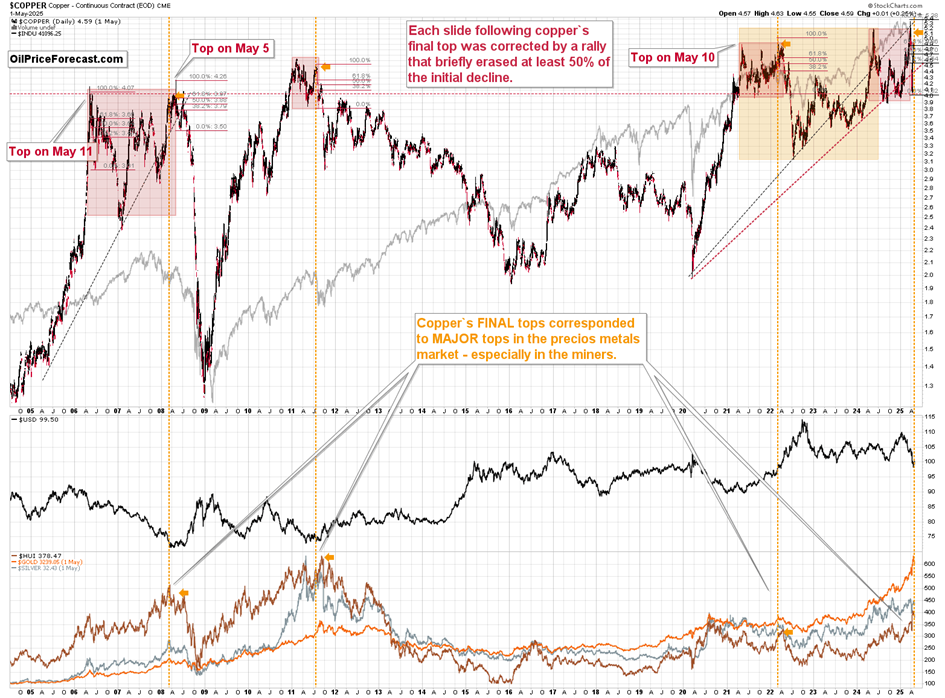

The invalidation of the transfer above the 61.8% and 50% Fibonacci retracement ranges together with copper’s sturdy tendency to type main tops in early Might strongly favors large declines within the following weeks.

Those that don’t learn about this tendency would possibly consider copper’s rebound and even FCX’s (or different copper shares’ energy) right here. However that it’s all faux. It’s a gimmick. A last shakeout of these making emotional buy selections.

Within the earlier weeks, I wrote loads in regards to the hyperlinks between now and 2008. Whereas the historical past rhymes as a substitute of being repeated to the letter, however generally the market does repeat its efficiency on vital anniversaries. And please observe that the ultimate prime in copper in 2008 was shaped on Might 5. If this was to be repeated, we’d be in search of the ultimate prime to happen on the subsequent buying and selling session – on Monday.

This could be in good tune with the inventory market’s triangle-vertex-based reversal and with the truth that the USD Index is prone to rally shortly.

Mining Shares Flash Main Warning Signal

In the meantime, mining shares offered us with an enormous “issues are altering” sign of their very own.

Particularly, the VanEck Junior Gold Miners ETF (NYSE:) simply closed under the very best shut of 2020! It is a main invalidation and a transparent promote sign. Quoting my yesterday’s feedback:

“That is vital, as a result of the very best each day shut of 2020 was $59.58. This implies, that GDXJ might invalidate the breakout above this excessive when it comes to each day closing costs as early as at this time.

The bottom weekly shut of 2020 was $56.69, so if we have been to get this week’s shut under that, the invalidation could be good. And that’s precisely what we’re prone to get – if not this week, then within the subsequent of the next weeks.

Given gold’s momentum, and – most significantly – USD Index’s probably last backside, plainly we received’t have to attend lengthy for this invalidation. And the invalidation itself would function a gateway to a lot decrease costs within the following weeks.

My greatest guess proper now’s that we’ll get the above-mentioned invalidation when it comes to the weekly closing costs subsequent week. The reason being the scenario on the inventory market.”