– Gold was larger in all currencies in 2022 and outperformed shares, bonds, crypto and bitcoin in a big means as buyers fled threat belongings and once more sought shelter in gold and silver bullion.

– Gold was marginally larger in US {dollars} with a 0.8% achieve however noticed stronger beneficial properties in euros (+5.6%), British sterling (+10.5%), Japanese yen (+11.5%), Swiss franc (+1%) and different fiat currencies.

Asset Efficiency – Full Yr 2022 – Supply: Finviz

– Gold and silver once more acted like protected haven belongings in one other very turbulent 12 months. Shares fell very sharply with the S&P 500 down 19% and the NASDAQ 100 down 32.8% (see desk above).

– “Threat free” and benchmark US authorities debt noticed very sharp falls and the US 30 12 months and 10 12 months fell very sharply – shedding 22.2% and 14% in worth respectively (see desk above). Considerations concerning the susceptible US economic system, very poor governance and big US authorities debt are set to extend within the coming months which can seemingly see additional losses for bonds.

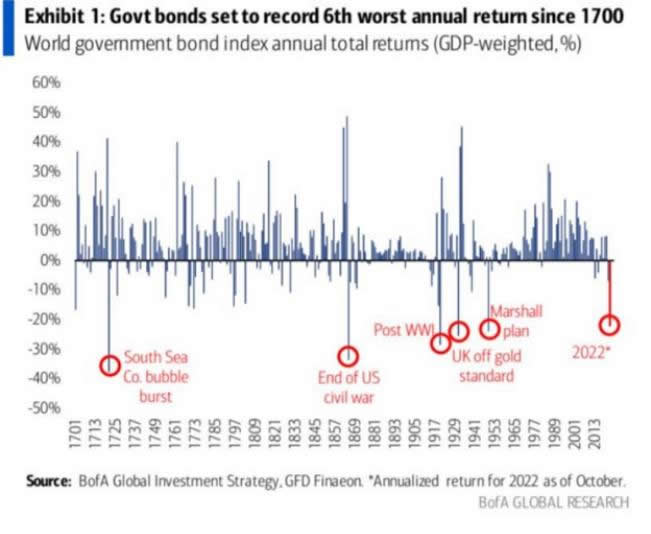

– U.S. authorities bonds had an “annus horribilis” and it was the worst 12 months for bonds in additional than 50 years & sixth worst returns since 1700 (see desk beneath). Governments together with the U.S. authorities are primarily bankrupt and central banks together with the Federal Reserve are devaluing & debasing all main currencies.

– Central banks at the moment are nervous to purchase and maintain US and different authorities debt and or as an alternative more and more diversifying into gold bullion to guard and hedge their overseas trade reserves. Central banks globally have collected gold reserves this 12 months at a tempo by no means seen since 1967, when the US greenback was nonetheless backed by gold and earlier than the tip of the London Gold Pool.

From the FT:

“The final time this stage of shopping for was seen marked a historic turning level for the worldwide financial system. In 1967, European central banks purchased huge volumes of gold from the US, resulting in a run on the worth and the collapse of the London Gold Pool of reserves. That hastened the eventual demise of the Bretton Woods System that tied the worth of the US greenback to the dear steel.”

– Commodities which have been undervalued surged in 2022 and the conflict in Ukraine and international tensions have contributed to the surging costs in power and meals commodities. Pure gasoline was 24% larger whereas oil (NYMEX WTI) was solely 5% larger. This has contributed to inflation and this inflation seems intractable particularly as we’re due a interval of greenback weak spot.

– “Digital gold” bitcoin collapsed 64% in 2022, clearly exhibiting that it’s not a protected haven asset or certainly a foreign money. Different cryptos have been down by extra with some going to zero because the crypto sector skilled mass liquidations by nervous speculators realising they owned “idiot’s gold”.

– Each asset class aside from gold, silver, platinum and sure commodities completed deep within the purple as a “excellent storm” of surging inflation, slowing international development, an power disaster, a meals disaster, deepening supply-chain challenges, conflict and the danger of a World Struggle badly impacted threat belongings.

– Gold and silver bullion as soon as once more demonstrated their long run protected haven advantages to buyers precisely after they wanted a hedge and protected haven asset.

– Since 2000, gold has often fallen briefly initially of bear markets in shares and when there have been international disaster similar to these seen after the ‘911’ assaults, the collapse of Lehman Brothers and the EU debt disaster. Gold tends to be considerably correlated with threat belongings within the very quick time period however quickly after decouples and makes sturdy beneficial properties whereas threat belongings fall additional or enter bear markets.

– We anticipate gold’s latest outperformance to proceed in 2023 and within the subsequent few years because it resumes its secular bull market and shares and bonds enter secular bear markets.

– The greenback energy seen in 2022 is unlikely to proceed into 2023 and 2024 and greenback weak spot ought to contribute to additional beneficial properties for treasured metals.

– Markets are prone to have a curler coaster journey of uncertainty and volatility in 2023, making the case for proudly owning bullion cash and bars much more compelling.

– There have been forecasts that gold might rise as excessive as $4,000/ozin 2023. Gold costs might surge to $4,000 an oz in 2023 as recession fears persist and as many economies might face recessions within the first quarter, which might result in many central banks slowing their tempo of rate of interest hikes and make gold immediately extra engaging, revered analyst Juerg Kiener, MD of Swiss Asia Capital advised CNBC.

Had been gold to greater than double in worth within the coming months, I might anticipate silver to see even larger beneficial properties and to surge to ranges between $50/ozand $100/oz.

– Silver bullion stays probably the most undervalued asset on the earth regardless of its slight beneficial properties in 2022. Silver stays undervalued relative to shares, bonds, property and different belongings. It additionally stays undervalued relative to gold. That is seen within the gold to silver ratio which stays very excessive at over 76 (€1700 / €22.35 or $1,823 / $23.96 per ounce) . Silver is the one asset that is still half of its nominal value in 1980 and once more in 2011.

– Conclusion: Individuals ought to be benefiting from this beneficial time to arrange

We’re within the ‘calm earlier than the storm’ with a nonetheless comparatively low gold and silver value. This uncertainty and instability is just not going to go away any time quickly. Certainly, the plans for central financial institution digital currencies (CBDCs) are highlighting the advantages of proudly owning gold and silver cash each as shops of worth but in addition as decentralised types of cash within the occasion of stagflation, hyperinflation or the pressured introduction of “Orwellian” fiat, digital, management currencies.

– As ever, it’s best to hope for the very best however be financially, materially and psychologically ready for much less benign eventualities by turning into much less depending on authorities, banks and our digital techniques by proudly owning gold and silver bullion within the most secure methods attainable.