Incoming US President Donald Trump has pledged tariffs of as a lot as 10% on world imports and 60% on Chinese language items, plus a 25% import surge on Canadian and Mexican Merchandise would upend commerce flows, increase prices and draw retaliation.

Nonetheless, President-elect Donald Trump says it “incorrectly states that my tariff coverage can be pared again”. Undoubtedly, the size and scope stay to be seen, however the highway forward is bumpy for the world markets.

However, main issues over larger yields are largely predicated upon a story of accelerating inflation dangers, together with US commerce protectionism, immigration coverage modifications, and ongoing excessive funds deficits that might hold the buoyant in 2025.

Primarily, the altering statements by President-elect Donald Trump what he dedicated earlier than the elections look evident sufficient to extend uncertainty on the rate of interest cuts in 2025 as a lot of the members say that also plenty of work is to be achieved on the rate of interest to regulate inflation in 2025.

Treasury yield jumped as knowledge for December confirmed indicators of inflationary strain and a leap in for November issues about inflation, casting doubt on sooner charge cuts.

Undoubtedly, this tempo of uncertainty resulted in a sudden surge in , resulted in a turbulent finish by the gold within the prior 12 months amid rising uncertainty over extra Federal Reserve rate of interest cuts, which contributed to an uptick in regular and actual bond yields.

Because of this most merchants count on extra charge cuts in 2025 however the incoming President will not be in favor of upper rates of interest as a way to hold the US greenback stronger in coming years.

costs fell this Tuesday, persevering with handy again the positive factors generated final week on optimism of extra coverage help to revive financial progress in China, the world’s largest crude importer.

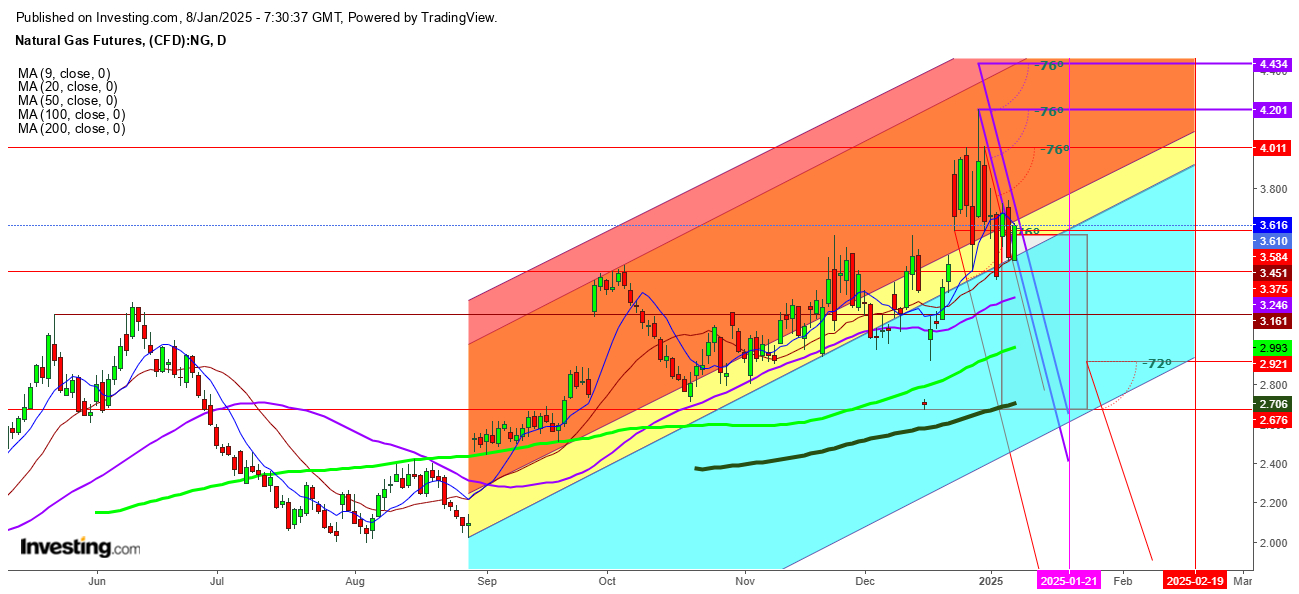

Pure gasoline futures are buying and selling within the bullish territory as a result of announcement of colder-than-normal climate for many components of america.

At this time, try to maintain within the bullish territory with a 4% achieve, however I discover that shortly a promoting spree is more likely to begin that might push the pure gasoline futures again into the bearish territory if they don’t seem to be capable of maintain above the rapid help at 50 DMA which is at $3.425.

Undoubtedly, the upcoming stock announcement this Thursday may result in a sudden reversal by the pure gasoline futures because the withdrawal could possibly be lesser than the anticipated ranges.

Lastly, I conclude that President-elect Donald Trump may repeat the coverage change roughly to his prior insurance policies throughout his final tenure from 2017 to 2021 and will hold the commodity and inventory markets underneath excessive uncertainty this 12 months.

Disclaimer: Readers are requested to take any place within the mentioned commodities on this article at their very own threat, as this evaluation is predicated purely on observations.