SOPA Photographs/LightRocket by way of Getty Photographs

Funding thesis

GigaCloud Expertise (NASDAQ:GCT) inventory has surged within the inventory market and at the moment demonstrates an “A+” momentum grade. My evaluation signifies that the corporate justifies its vital rally, and the discounted money movement simulation underscores the substantial potential for additional development. My optimism stems from the momentum of enterprise growth, which is obvious in sturdy income dynamics and notable enhancements throughout key efficiency metrics. Moreover, the corporate’s fortified stability sheet gives ample sources to maintain investments in innovation. All in all, I assign GCT a “Sturdy Purchase” ranking.

Firm data

GigaCloud Expertise, via its subsidiaries, gives a B2B market to giant parcel and e-commerce gamers throughout the globe. GCT itself is a holding firm integrated within the Cayman Islands, in accordance with the newest annual SEC submitting. The corporate’s fiscal yr ends on December 31 with a sole working phase. GCT generates income via three main income streams:

- GigaCloud 3P generates service revenues by facilitating transactions between sellers and consumers within the market;

- GigaCloud 1P generates product revenues via the sale of the corporate’s stock within the market;

- Off-platform e-commerce generates product revenues via the sale of the corporate’s stock to and thru third-party e-commerce web sites.

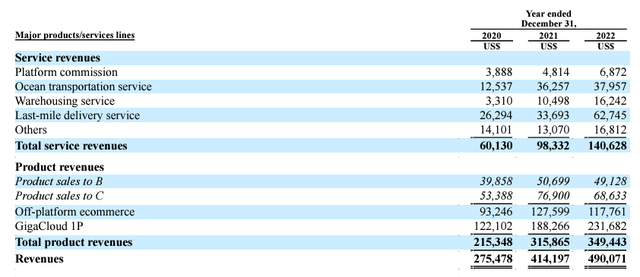

GCT’s newest annual SEC submitting

Financials

I choose to start out my monetary evaluation by zooming out and developments in an organization’s monetary efficiency over the past decade, however GCT went public lower than two years in the past. Subsequently, the monetary monitor report is comparatively brief, and I’ll solely spotlight it briefly.

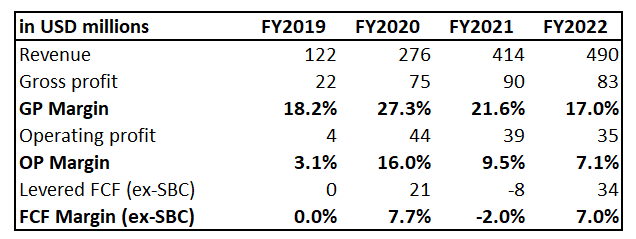

Writer’s calculations

Income compounded with virtually 60% CAGR between FY 2019 and 2022, which means the highest line about quadrupled inside 4 years. Profitability metrics have been extremely unstable, however I’m okay with this since GCT is a younger firm, and typically, the tempo of reinvestments in enterprise may not be even. However what’s a stable constructive signal and important is that, regardless of being a younger enterprise, GCT generates a constructive working margin and free money movement [FCF] even with the stock-based compensation [SBC] deducted. Based on the corporate’s money movement, it raised round $36 million through the IPO, which seems stable however not very vital in comparison with the $214 million money stability as of the newest reporting date. The corporate is financially versatile since it’s in a internet money place and has sturdy liquidity metrics.

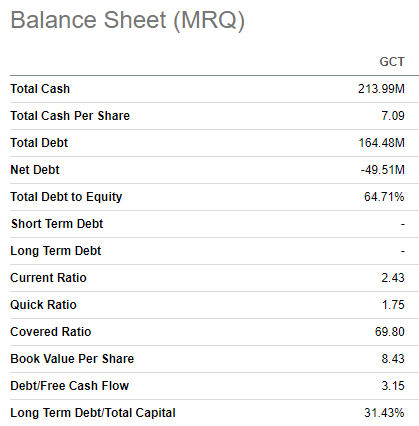

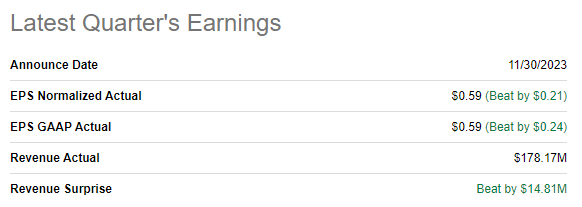

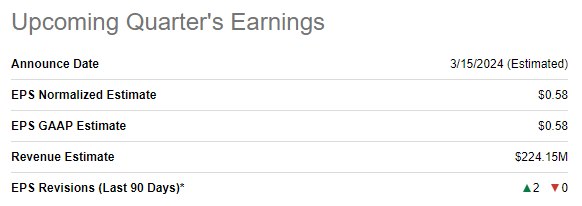

Looking for Alpha

The newest quarterly earnings have been launched on November 30, when GCT confidently topped consensus estimates. Income demonstrated a staggering 39% YoY development, and the adjusted EPS elevated from $0.01 to $0.59. The EPS growth was achieved with the assistance of the agency working leverage. The gross margin expanded by virtually ten proportion factors, and the working margin grew YoY from 3.3% to 17.8%.

Looking for Alpha

The income development momentum is predicted to speed up, notably in This autumn of 2023. Consensus estimates venture $224 million in This autumn income, which means a 79% YoY development. Profitability is predicted to observe the highest line, and the adjusted EPS is predicted to virtually double, from $0.31 to $0.59. The This autumn earnings launch is predicted to be scheduled for March 15. It is usually vital to underline that GCT reported its quarterly earnings as a public firm solely 5 instances and by no means missed consensus estimates.

Looking for Alpha

Based on Statista, the worldwide B2B e-commerce market is large and is 5 instances larger than the B2C e-commerce market. Whereas this may present good development alternatives for GCT, it additionally signifies that the competitors is intense. Based on the corporate’s newest annual SEC submitting, aside from e-commerce platforms and marketplaces, rivals additionally embody third-party logistics service suppliers, furnishings shops, and big-box retailers. It is usually value mentioning that GCT’s scale is considerably decrease in comparison with giants like Amazon (AMZN), Alibaba (BABA), or Japanese Rakuten (OTCPK:RKUNF). However on the similar time, having a smaller scale gives the corporate with the benefit of being much less bureaucratic and having the ability to implement innovation quicker.

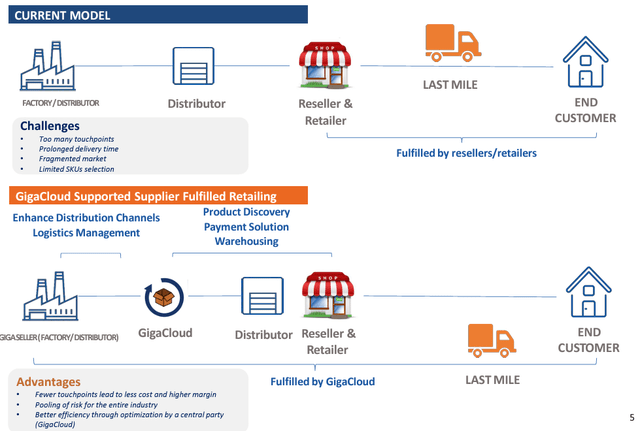

GCT’s newest earnings presentation

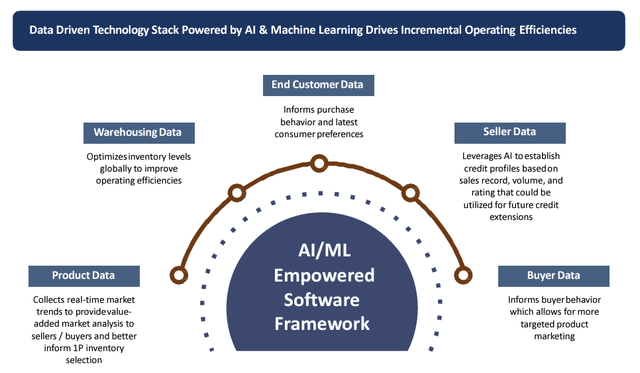

GigaCloud units itself aside with an modern method to your complete supply cycle. Reasonably than coming into the sport solely on the final mile, GCT establishes direct relationships with “gigasellers” [factories, official distributors], aiming to reduce touchpoints and cut back middleman earnings, thereby decreasing prices for the tip buyer. It is value noting that consolidating all touchpoints underneath GCT’s operations calls for distinctive operational execution, a objective the corporate pursues via cutting-edge software program applied sciences. The corporate’s software program framework seems complete, addressing important B2B e-commerce course of matrix parts.

GCT’s newest earnings presentation

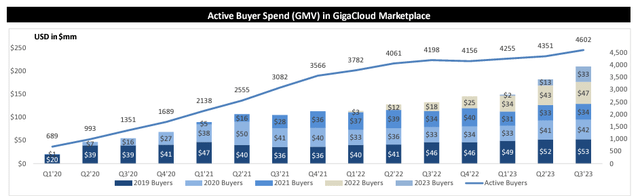

I wish to assess a enterprise’s mannequin effectivity via the prism of important metrics. For an e-commerce enterprise, arguably probably the most essential metric is the gross merchandise worth [GMV], and from this angle, GCT demonstrates sturdy dynamics. The constant growth of the variety of lively consumers can be a robust issue that can doubtless gas additional development as a result of a market is sort of a snowball – the extra consumers it attracts, the extra sellers are keen on becoming a member of {the marketplace} and vice versa. The stellar “A-” profitability grade from Looking for Alpha Quant for a younger firm with annual income far under $1 billion can be a major indication of the enterprise mannequin’s brilliant prospects, in my opinion.

GCT’s newest earnings presentation

Past enterprise excellence and innovation, assessing the trade’s future prospects is essential to gauge GCT’s sustainability. Fortuitously, the corporate’s outlook seems promising, as the worldwide B2B e-commerce market is projected to develop at a sturdy annual fee of 19.2%, offering substantial tailwinds for GCT’s continued success.

General, I view GCT as an organization holding a number of key benefits. Its administration’s dedication to innovation and distinctive enterprise methods has resulted in outstanding efficiency, evidenced by vital income development and increasing profitability. With a sturdy monetary place, GCT has huge room to additional spend money on innovation and differentiation. Furthermore, these inner strengths are extremely doubtless poised to be supported by secular tailwinds for years to return.

Valuation

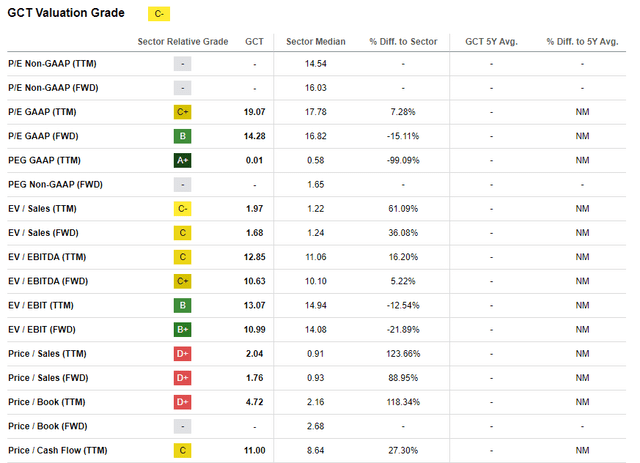

GCT is on fireplace with a 456% rally over the past twelve months and a 60% inventory worth appreciation YTD. I consider I need not emphasize how the inventory carried out in comparison with the broader market. From the angle of valuation ratios, the inventory doesn’t look overpriced, in accordance with the typical “C-” grade from Looking for Alpha Quant.

Looking for Alpha

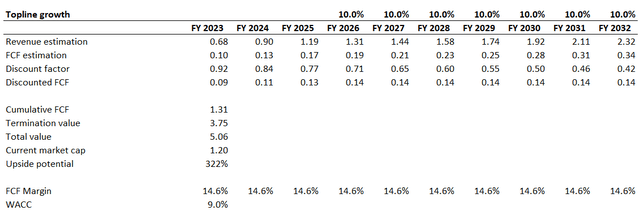

GCT is much from paying dividends, so I believe simulating the discounted money movement mannequin [DCF] is the one sound choice to proceed with. I’ll low cost GCT’s money flows with a 9% WACC advisable by GuruFocus. Consensus income estimates forecast above 30% income CAGR for the upcoming two fiscal years. For the years past, I take advantage of a ten% income CAGR. I take advantage of a flat 14.6% TTM FCF ex-SBC margin for the entire decade.

Writer’s calculations

Based mostly on the DCF simulation, the enterprise’s truthful worth is $5 billion, which is 4 instances larger than the present market cap. That mentioned, I consider there’s a staggering upside potential, even regardless of the large rally over the past 12 months.

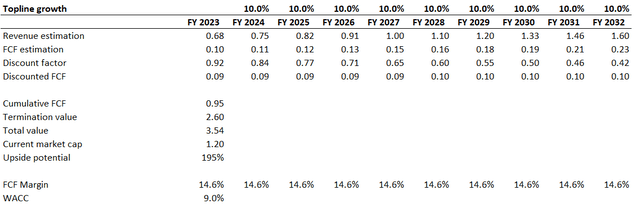

For cautious traders, I wish to emphasize that even when a ten% income CAGR is integrated for the entire decade, GCT remains to be a number of instances undervalued. After altering the income trajectory to a extra conservative one with different assumptions untouched, the DCF template signifies that the corporate’s potential truthful worth is $3.54 billion, or a 195% upside potential.

Writer’s calculations

As a conservative investor, I’ll use the extra conservative situation to find out my goal worth. Adjusting the present $29 share worth by 195% offers me a goal worth of $85.

Dangers to think about

After such a large and fast rally, there’s all the time a considerable danger that some traders may begin taking earnings and promoting off their shares. This can inevitably result in a inventory worth drop, and new traders ought to know that. Making use of a dollar-cost-averaging method and a long-term mindset is a wonderful mixture to handle this danger.

Working an digital commerce platform signifies that GCT faces substantial cybersecurity dangers. The corporate possesses prone data like clients’ knowledge, cost particulars, and transaction historical past. Any breach or compromise of this knowledge damages the belief between GCT and its clients and exposes them to potential id theft, monetary fraud, and different malicious actions. If GCT fails to safeguard delicate knowledge, it would result in a considerable status loss and even litigation from its companions.

The corporate’s aggressive income development is each a promising indicator and a major managerial problem. Whereas fast development indicators a bullish trajectory, it additionally presents complexities in administration. Such growth might inadvertently end in overly optimistic gross sales forecasts, doubtlessly resulting in inflated stock ranges if precise income falls in need of projections. Moreover, pursuing aggressive development can immediate extreme capital expenditure, which dangers changing into redundant ought to the corporate fail to keep up its development momentum.

Backside line

To conclude, GCT is a “Sturdy Purchase”. The corporate’s sturdy monetary standing grants it vital flexibility to maintain substantial investments in future development initiatives. GCT displays formidable momentum in increasing throughout essential enterprise metrics, with its profitability growth indicating its capability to generate substantial working leverage and ship constant efficiency. Moreover, even regardless of a large current rally, I believe the inventory nonetheless has the potential to develop by multiples of its present worth.