Wipada Wipawin/iStock by way of Getty Photographs

By Sherifa Issifu

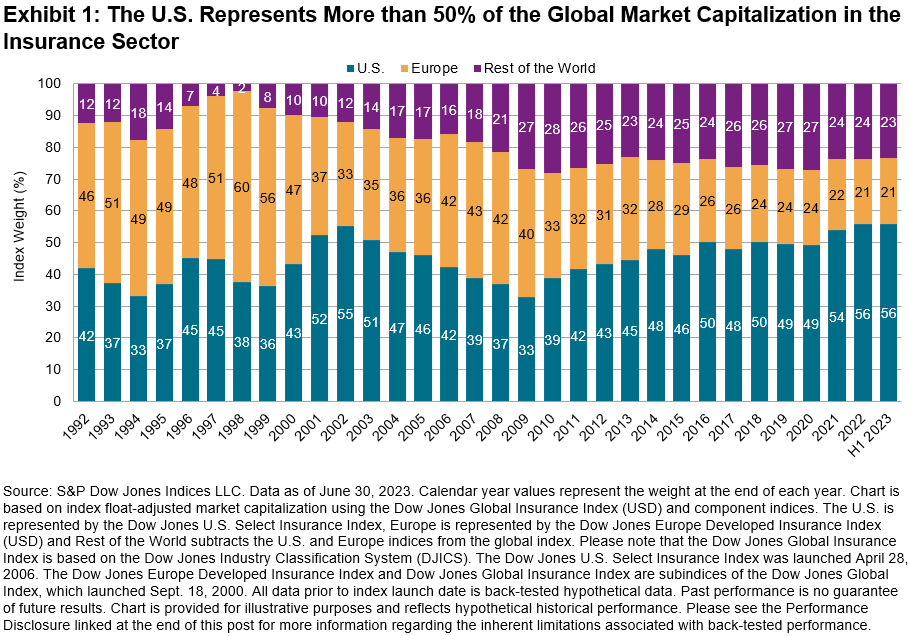

The worldwide insurance coverage market capitalization has grown considerably over the previous three a long time, rising from almost USD 350 billion on the finish of 1992 to USD 2.7 trillion as of H1 2023. This development was accompanied by a shift in international management. For instance, Exhibit 1 reveals that European insurance coverage corporations made up a better proportion of the insurance coverage market than their U.S. counterparts within the early Nineties. These days, the U.S. accounts for almost all of the market capitalization, whereas Europe’s weight has diminished.

The Dow Jones U.S. Choose Insurance coverage Index captures an investable portion of the world’s largest insurance coverage market. As with different indices within the Dow Jones U.S. Choose Sector Speciality Index Collection, the index is designed to measure the efficiency of chosen subsectors of the Dow Jones Business Classification System (DJICS). Constituents should additionally meet liquidity and market capitalization thresholds. The index makes use of a float-adjusted market capitalization (FMC) weighting scheme with some high-level diversification capping guidelines utilized and is rebalanced quarterly in March, June, September, and December.1

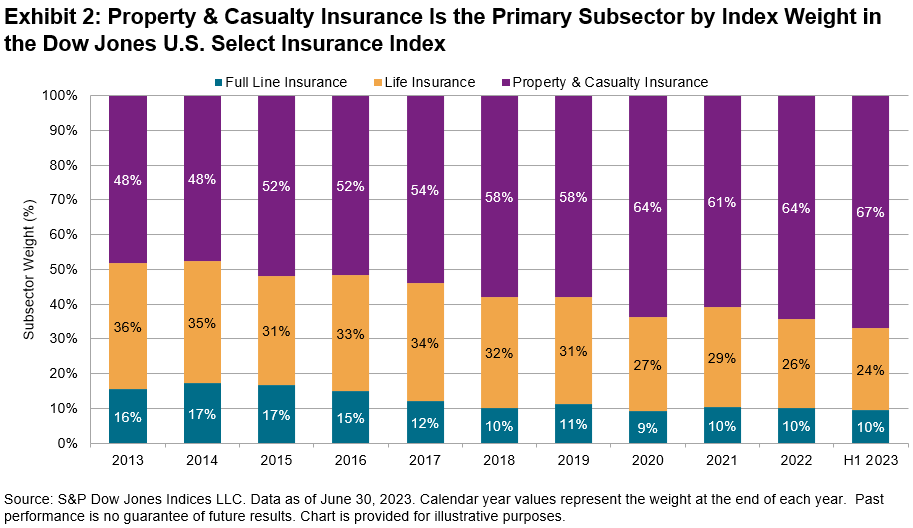

The Dow Jones U.S. Choose Insurance coverage Index contains shares from the Dow Jones U.S. Broad Inventory Market Index which might be labeled underneath DJICS as Full Line Insurance coverage, Property & Casualty Insurance coverage and Life Insurance coverage, and excludes corporations whose principal enterprise actions are labeled as Reinsurance and Insurance coverage Brokers. Exhibit 2 reveals that Property & Casualty Insurance coverage is the first subsector, making up 67% of the index as of June 30, 2023, adopted by Life Insurance coverage at 24% and Full Line Insurance coverage because the smallest slice at simply 10%.

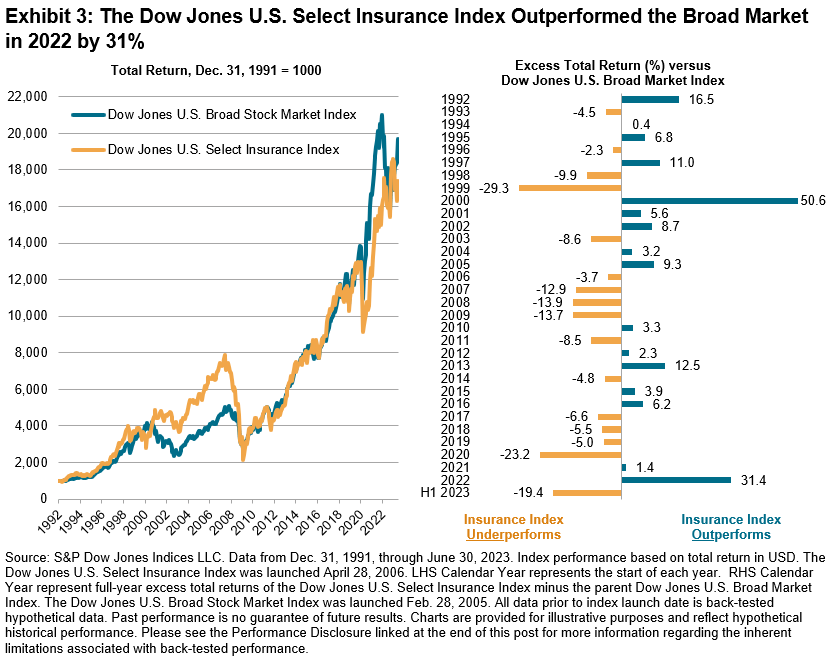

Insurance coverage corporations are usually thought of non-cyclical or “defensive” provided that the services and products supplied by insurance coverage corporations are sometimes wanted whatever the part of the enterprise cycle. The historic efficiency of the Dow Jones U.S. Choose Insurance coverage Index seems to mirror this attitude.

Exhibit 3 reveals that, whereas the Dow Jones U.S. Choose Insurance coverage Index posted related efficiency to the Dow Jones U.S. Broad Market Index because the finish of 1991 (an annualized 9.5% vs. 9.9%, respectively), the insurance coverage index outperformed in turbulent environments. For instance, the broad market declined by 19% in 2022, whereas the Dow Jones U.S. Choose Insurance coverage Index gained 12%, outperforming by 31%. In H1 2023, the insurance coverage index underperformed, as tech shares propelled the market increased.

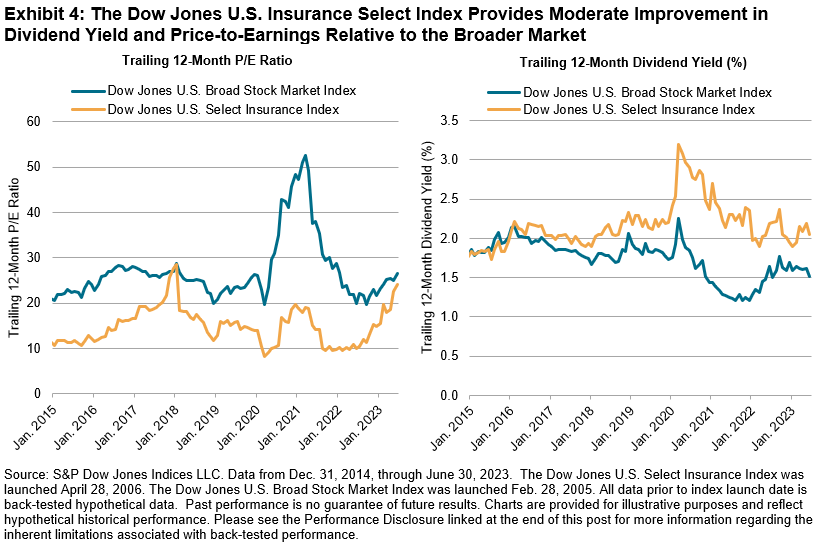

The Dow Jones U.S. Choose Insurance coverage Index usually had a decrease trailing 12-month P/E ratio than the Dow Jones U.S. Broad Inventory Market Index, that means market contributors usually paid much less for each greenback of earnings obtained. The index additionally had a reasonably increased realized dividend yield than the Dow Jones U.S. Broad Market Index, displaying that insurance coverage corporations paid extra dividends relative to their share worth.

1 For additional particulars, please see the Dow Jones U.S. Choose Sector Speciality Indices Methodology.

Disclosure: Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P World. All rights reserved. This materials is reproduced with the prior written consent of S&P DJI. For extra data on S&P DJI, please go to S&P Dow Jones Indices. For full phrases of use and disclosures, please go to Phrases of Use.

Unique Submit

Editor’s Be aware: The abstract bullets for this text had been chosen by Searching for Alpha editors.