bankrx/iStock by way of Getty Photos

2023 has arrived. The yr has began nicely, with Geron Company (NASDAQ:GERN) producing very good information, information that makes imetelstat approvable after over a decade of trial work and relative obscurity. Information revealed at this time reveals that the IMERGE trial beat the placebo with excessive statistical significance. If we have been to do a cross-trial comparability, imetelstat has roundly overwhelmed the closest rival, Bristol-Myers Squibb’s (BMY) newly permitted Reblozyl, in each comparable metric.

This has been a very long time coming. For imet, it has been simply over a decade and a half, and a decade since Dr. Ayalew Tefferi’s ASH13 presentation, the place he first claimed imet “clearly confirmed anti-myeloproliferative exercise,” which grew to become controversial later when a few of his information couldn’t be replicated within the IMBARK trial. That declare initially led Johnson & Johnson (JNJ) to accomplice with Geron, and the IMBARK information triggered them to depart. Good factor that Dr Tefferi’s claims have been borne out by IMERGE information.

IMERGE was a part 3 randomized double blinded trial throughout 118 medical websites in 17 nations. 178 sufferers have been enrolled, with low- or lntermediate 1- threat MDS who have been relapsed/refractory to ESA or EPO. Different baseline traits included:

• Transfusion dependent: ≥4 items RBCs each 8 weeks over 16-week pre-study • Non-deletion 5q • No prior remedy with lenalidomide or HMAs.

Sufferers have been ringed sideroblast agnostic. That is vital as a result of ringed sideroblast optimistic accounts for less than 25% of the post-ESA MDS inhabitants. Being agnostic opens up a bigger market than Reblozyl, which solely enrolled ringed sideroblast-positive sufferers. Main endpoint was 8-week RBC Transfusion Independence (TI). Key Secondary Endpoints have been 24-week RBC TI, Length of TI and Hematologic Enchancment Erythroid (HI-E).

Information confirmed that the first endpoint of 8-week TI was met by 47 sufferers within the drug arm, which is 39.8%, versus 9 sufferers within the management arm, which is 15.0%, and this represents a p-value of <0.001, which is extremely statistically important. Sufferers had a steady sustained transfusion independence, with 83% of 8-week responder sufferers displaying such a steady TI. As to a key secondary endpoint of TI period, Median TI period was 51.6 weeks for imet versus solely 13.3 weeks for placebo, which had a hazard ratio of 0.23 and a statistically important p-value of <0.001. Not less than 3 imet sufferers had TI of greater than two years. 33 imet sufferers, or 28% of n, met the important thing secondary endpoint of 24-week TI, versus simply 2 sufferers or 3.3% of the placebo group, which has a p-value of <0.001. A take a look at drug is pretty much as good because the “unethicality” of not giving it to placebo sufferers, and if that’s true, imet is an excellent drug certainly.

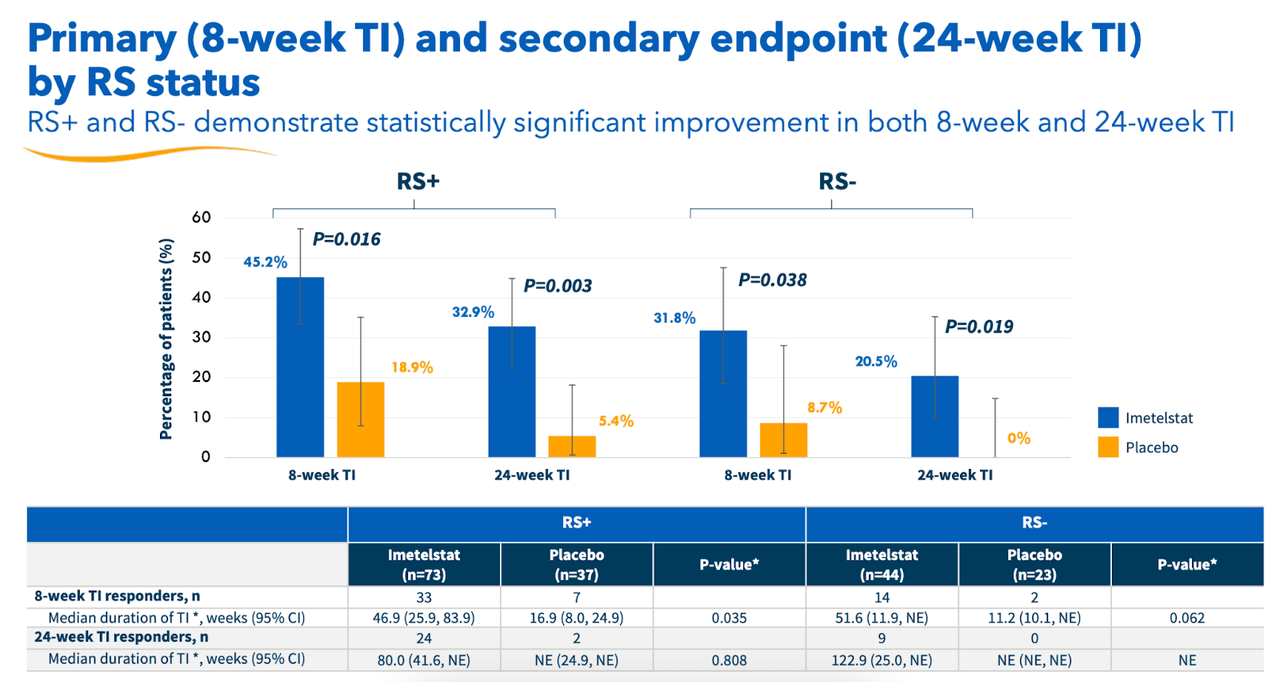

Information additionally confirmed a statistically important enchancment in haemoglobin ranges amongst imet sufferers versus placebo. “HI-E per IWG 2018 standards demonstrated a extremely statistically important (p<0.001) and clinically significant enchancment for imetelstat-treated sufferers versus placebo.” This reveals that imet met all the important thing endpoints of the trial. Each RS+ and RS- sufferers confirmed statistically important enhancements, as you’ll be able to see beneath:

Geron RS information (Geron web site)

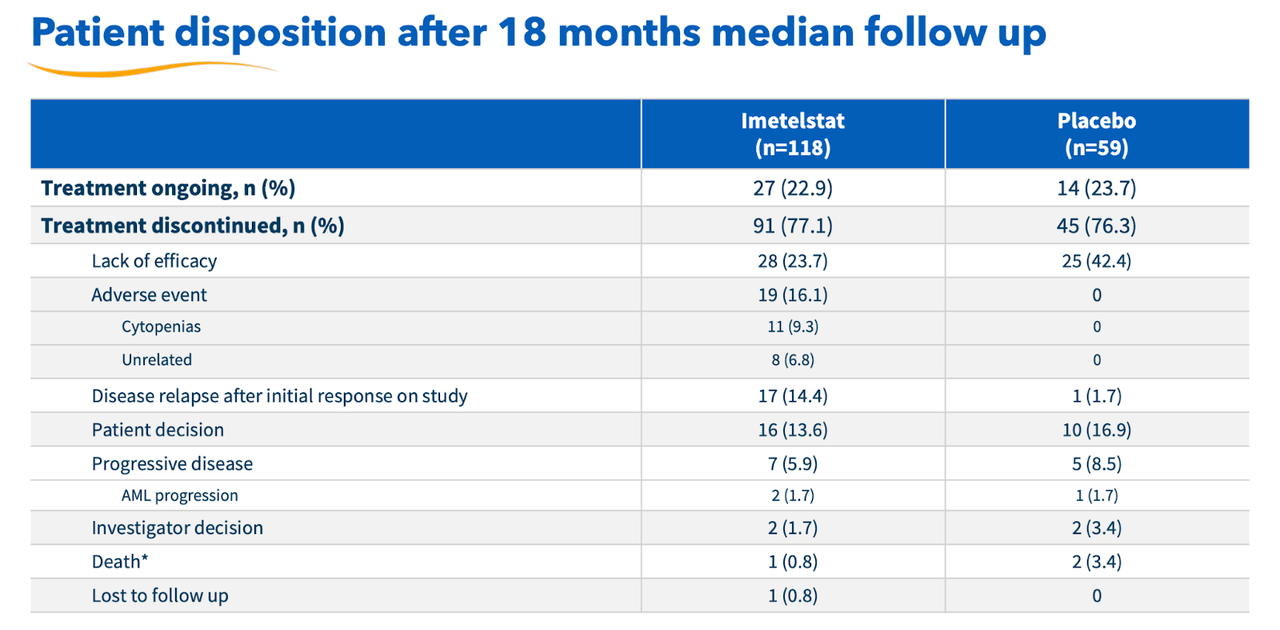

There may be some minor concern with security right here. I need to say that Geron has been very upfront with all of it, and has highlighted the important thing situation – discontinuation charges – even earlier than it mentioned the precise trial. Right here’s the info desk:

Geron discontinuation charges (Geron web site)

There’s a really excessive discontinuation fee in each imet and placebo group. Nevertheless, trying on the granular information reveals that the speed is analogous throughout each teams, there’s double the speed within the placebo group for lack of efficacy, whereas very excessive comparative charges for opposed occasions within the imet group. Geron has assured us that the majority of those opposed occasions have been rapidly resolved, and went down from grade 3 to 2 or decrease on administration. Generally, given the excessive illness burden, the security seems okay.

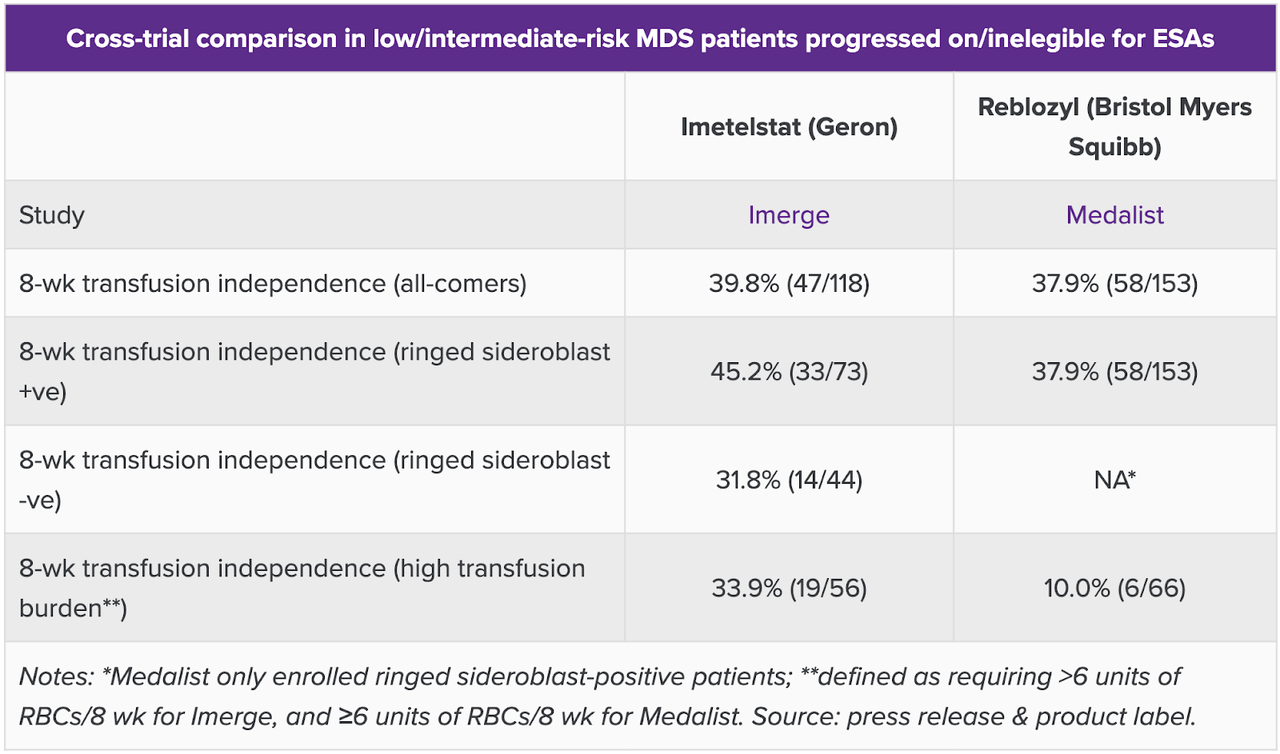

I noticed on Consider, cited earlier than, that they’ve in contrast this information to Reblozyl’s MEDALIST trial information. Right here’s the snapshot, which says all of it:

GERON comparability information (Consider)

Whereas TI charges have been related, the place imet scored significantly better was at higher-risk sufferers with larger transfusion burden, outlined as requiring larger than 6 items of RBC per 8 weeks for imet, and equal to or larger than 6 items of RBC per 8 weeks for Reblozyl. That little factor really makes a whole lot of distinction if we knew what number of have been equal to and what number of have been larger than 6 items. Even when we have no idea that granularity, the distinction is putting, and constitutes one of many two key differentiating identities of IMERGE. The opposite one, after all, is the RS agnosticity of the trial, which Reblozyl doesn’t have. Clearly, imetelstat is the winner. There’s no different competitors on this affected person inhabitants.

Jacob Plieth mentions one other distinction:

However an additional complication is Reblozyl’s Instructions trial – in MDS sufferers naive to ESAs – which was toplined optimistic in October. If this provides Reblozyl an earlier-line label then medical doctors will need to know the way imetelstat performs in sufferers who progress on the BMS drug, and right here there’s little to go on.

Additionally, Adam Feuerstein, who has typically been a critic of Geron for years, cited the trial information positively on Twitter. Nevertheless, he talked about the discontinuation fee as a adverse, with out going into the element I simply mentioned.

“Right now is a good day for decrease threat MDS sufferers who’re dwelling with the burden of transfusions. The outcomes from the IMerge Section 3 research have been resoundingly optimistic, presenting compelling sturdiness of transfusion independence, delivering on the promise of imetelstat and telomerase inhibition for these sufferers,” stated John A. Scarlett, M.D., Geron’s Chairman and Chief Government Officer. “This milestone is the primary of many upcoming catalysts for Geron, with deliberate U.S. and EU regulatory submissions in 2023, in addition to preparations for a possible U.S. business launch. As well as, in 2024, we count on an interim evaluation of the IMpactMF Section 3 trial of imetelstat in relapsed/refractory myelofibrosis.”

Talking of milestones, the corporate has these plans, because the CEO stated, and these have been mentioned within the convention name. The corporate additionally talked about that Quick Monitor designation in decrease threat MDS allows rolling submission of U.S. NDA and eligibility for precedence assessment. Such a request for rolling submission of NDA was made, and granted by the FDA. The corporate claims a peak market alternative of $1.2bn by 2030 on this indication alone. There are a complete of 32,700 US sufferers who could also be eligible for imetelstat.

Financials

GERN at this time has a market cap of $919mn. Aside from that, the whole lot I stated final month stands:

GERN has … a money and marketable securities steadiness of $195mn. The corporate expects to have one other $121mn from the potential train of the at the moment excellent warrants and as much as $50 million from the present debt facility with Hercules Capital.

Analysis and growth bills for the three months ended September 30, 2022, have been $24.6mn, and SG&A have been $15.6mn. The corporate had negligible revenues however round $2mn of curiosity revenue. At this fee, it has money for round 7-8 quarters, or by way of 2024. If all goes to plan, not solely will imet be permitted in LR-MDS by that point, however IMpactMF Section 3 trial in refractory MF may even produce interim information.

Backside Line

Geron has a robust following on social media, together with right here on Looking for Alpha. Over time, I’ve come to know quite a lot of them. I typically maintain a net-negative opinion of inventory followers, nevertheless, on this case, Geron appears to have paid off for its followers. I want them nicely, and I imagine if Geron can ship on its guarantees for the subsequent 3-4 quarters, that there’s important upside from present ranges.