DAX (German 40) Talking Points

- Dax 40 rejected by Fibonacci resistance as prices fall back towards long-term psychological support holding at 12,000.

- Dax futures remain bound between 12,000 and 12,400, providing support and resistance for the major stock index.

- Hot US Inflation buoys further Dollar strength as rate expectations rise

Recommended by Tammy Da Costa

Get Your Free Top Trading Opportunities Forecast

DAX Futures React to Heated Inflation But Bulls Bounce Back

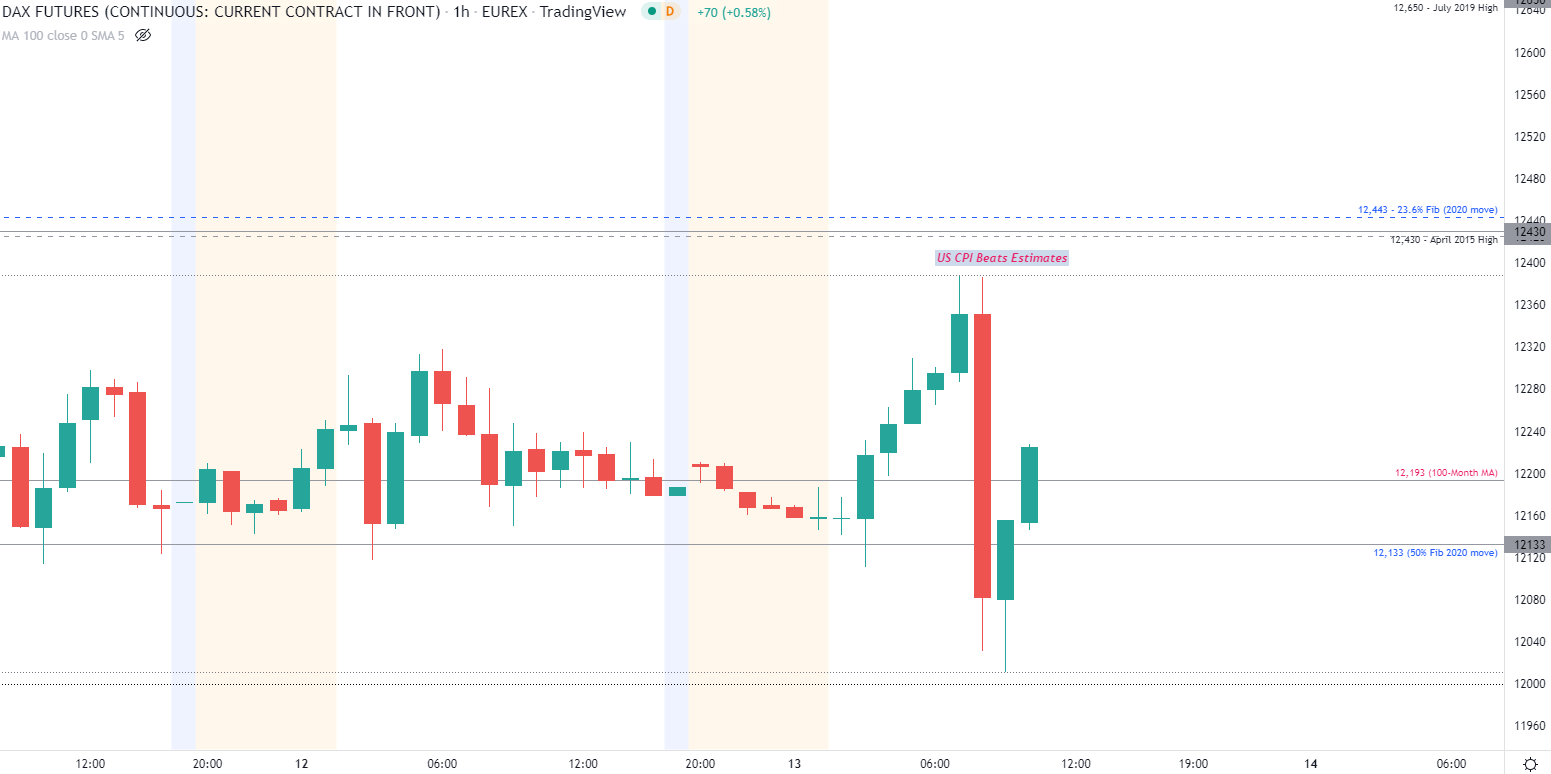

Dax futures have fallen back towards 12,000 after another heated US inflation print raised expectations of more aggressive rate hikes for the foreseeable future. With both the US inflation rate (YoY) and Core CPI beating estimates, the Federal Reserve remains a key catalyst for global markets.

DailyFX Economic Calendar

In response to the data release, German equities reacted almost instantaneously, driving DAX 40 lower. With prices falling short of the 12,400 handle earlier today, Dax futures made a major U-turn at resistance before finding support at 12,011.

DAX 40 (Futures) Hourly Chart

Chart prepared by Tammy Da Costa using TradingView

With prices currently whipsawing between the 12,000 and 12,400 zone, key zones discussed in Monday’s analysis continue to hold. For the bullish move to gain traction, a hold above 12,133 (50% Fibonacci of the 2020 move) and above the 100-month MA (moving average) at around 12,190 could drive prices back towards the April 2015 high at 12,430. A move higher brings 12,443 (the 23.6% retracement) and 12,600 as the next key zones of resistance.

What is range trading? Visit DailyFX Education to find out

Dax 40 (Futures) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

On the contrary, a break of 11,900 could drive price action towards the June low of 11,829 opening the door for 11,718 (February low). If both levels are broken, it may be possible for Dax 40 to continue towards the 38.2% retracement of the 2020 move at 11,558.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter:@Tams707