German Dax 40 Latest:

- Dax 40 rises above prior resistance turned support at the key psychological level of 13200

- German equities push higher as the index aims for its fifth consecutive week of gains

- Can Dax futures break the next barrier of technical resistance holding at the September high of 13572?

Recommended by Tammy Da Costa

Get Your Free Equities Forecast

DAX Futures Continues Higher as Prior Trendline Resistance Turns Into Support

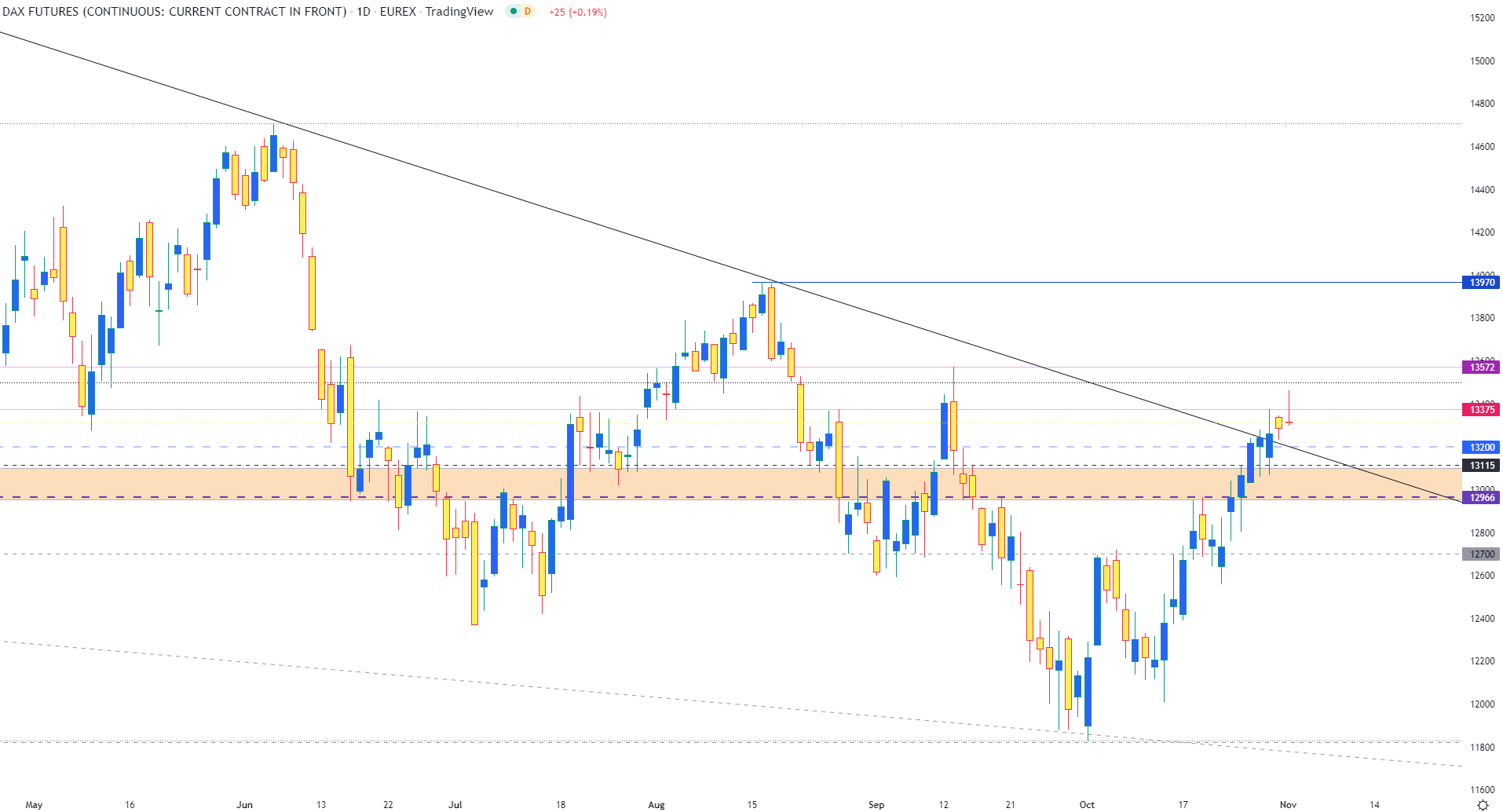

The German Dax could be heading for its fifth consecutive week of gains after an impressive rally drove the major European index above the descending trendline taken from the January 2022 high at 16274.

With price action trading comfortably above the key psychological level of 13200, additional gains may allow for a potential retest of the September high holding as resistance at 13572.

After sinking to a low of 11829 last month, a bounce off support allowed bulls to drive DAX higher, resulting in the formation of a falling wedge. As the major European index continues to stage an impressive recovery, a rise above prior trendline resistance has assisted in driving the bullish breakout that could see the index fully recover losses incurred during the September sell-off.

Recommended by Tammy Da Costa

Get Your Free Top Trading Opportunities Forecast

DAX Futures Weekly Chart

Chart prepared by Tammy Da Costa using TradingView

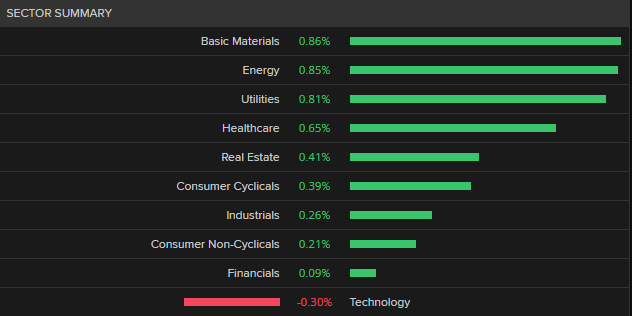

While majority of sectors within the German index remain in the green, the question is whether buyers can maintain the bullish momentum necessary to drive Dax higher.

Source: Refinitiv

With a potential formation of a doji candle on the daily chart, Dax bulls aren’t in the clear just yet. After reaching a high of 13464 in today’s session, a strong retaliation from sellers drove prices back towards another big level of technical support at 13375.

As price action looks for a fresh catalyst to drive the imminent move, additional selling pressure may open the door for a retest of 13200 which could see prices fall back towards that zone of Fibonacci confluency (from the historical and 2020 – 2021 move) forming between 13115 and 12966.

Dax 40 Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Meanwhile, if Dax futures rise above 13500 and retest 13572, bullish continuation could see German equities drive price action back to the next layer of psychological resistance at 13700.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707