We Are

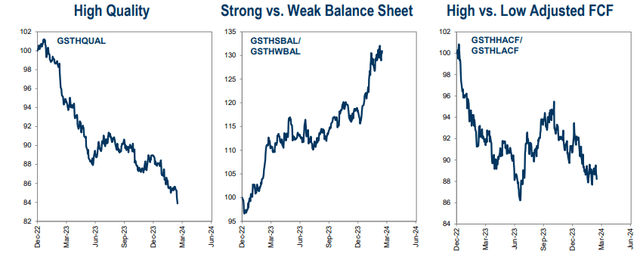

There’s numerous chatter and plenty of compelling narratives surrounding the significance of free money circulate era on this period of upper rates of interest. Corporations that may produce actual earnings obtainable to shareholders within the right here and now are presupposed to be stable funding candidates. Sadly, actuality has not matched general sentiment in favor of the excessive free money circulate issue. In keeping with Goldman Sachs’ newest weekly report, excessive vs. low adjusted FCF shares have produced adverse alpha since Q3 final yr.

Certainly, the Pacer World Money Cows Dividend ETF (BATS:GCOW) has underperformed each the S&P 500 and the All-Nation World Index over the previous yr. I had a tactical promote ranking on the fund again in August of 2022, forward of the ultimate flip decrease within the bear market that yr, however am now upgrading the fund to a maintain based mostly on valuation, publicity to cyclical sectors, and a few promising technicals.

Excessive FCF Issue Drifts Down Since Q3 2023

Goldman Sachs

In keeping with the issuer, GCOW is a strategy-driven ETF that makes an attempt to supply a steady stream of revenue and capital appreciation over time by screening for firms with a excessive free money circulate yield and a excessive dividend yield. Free money circulate is the money remaining after an organization has paid bills, curiosity, taxes, and long-term investments. It’s the supply from which dividends are paid.

GCOW has grown considerably since I first coated the fund in Q3 2022. Whole property underneath administration has swelled from $660 million to almost $2 billion, as of March 18, 2024. It’s not a really low cost product with an annual expense ratio of 0.6%, however its trailing 12-month dividend yield is excessive at 5.2%. Share-price momentum is lackluster, incomes the ETF a lukewarm C+ ranking, worse than an A- ranking from six months in the past, whereas threat metrics are likewise not significantly interesting. Liquidity is wholesome with the fund, although, given common every day buying and selling quantity of greater than 410,000 shares and a median 30-day bid/ask unfold of simply three foundation factors.

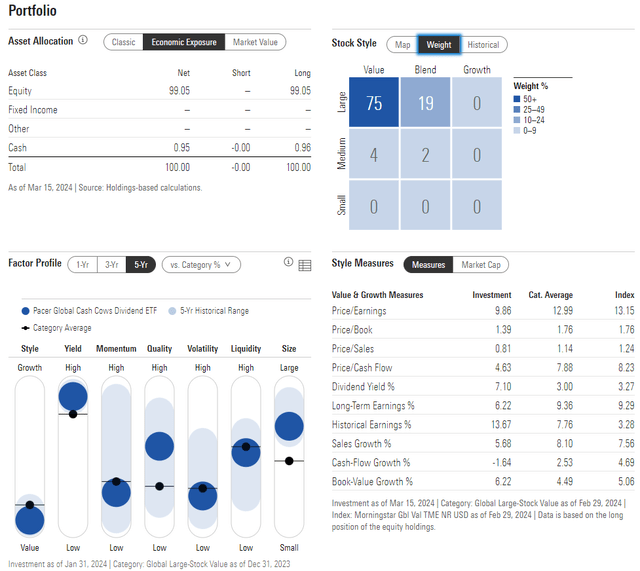

The three-star, Impartial-rated ETF by Morningstar is closely allotted to the large-cap worth nook of the fashion field, so there isn’t a lot diversification with the portfolio. Simply 6% of GCOW is taken into account mid-cap, and there’s no progress publicity. With a price-to-earnings ratio underneath 10 and long-term earnings progress of 6.2, it is an inexpensive absolute valuation, however adjusted for typical progress, and the fund is just not a screaming purchase contemplating the PEG ratio. However, volatility is mostly held in examine with GCOW and it has a downright low cost price-to-sales a number of.

GCOW: Portfolio & Issue Profiles

Morningstar

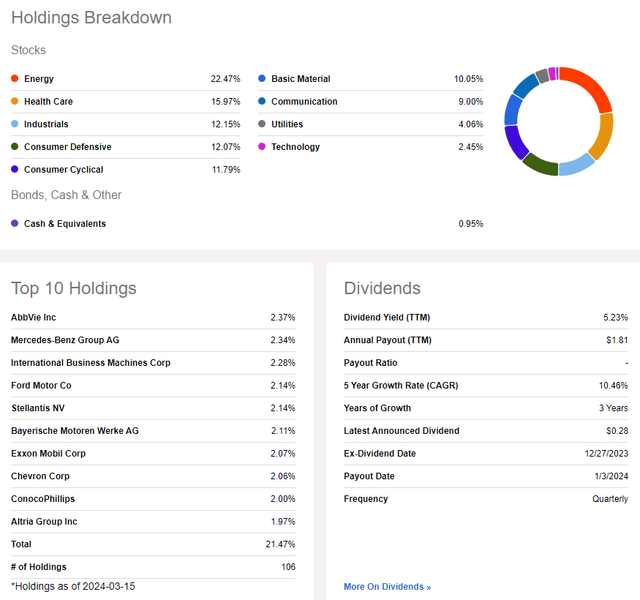

Driving the P/E ratio down is a excessive 22.5% publicity to the Vitality sector – the least costly slice of the worldwide market. The diversified Well being Care sector is 16% of the ETF, whereas the cyclical Industrials house is 12% adopted by defensive Shopper Staples. With its modified equal-weight method, the highest 10 positions account for simply 21.5% of the allocation.

GCOW: Holdings & Dividend Data

Searching for Alpha

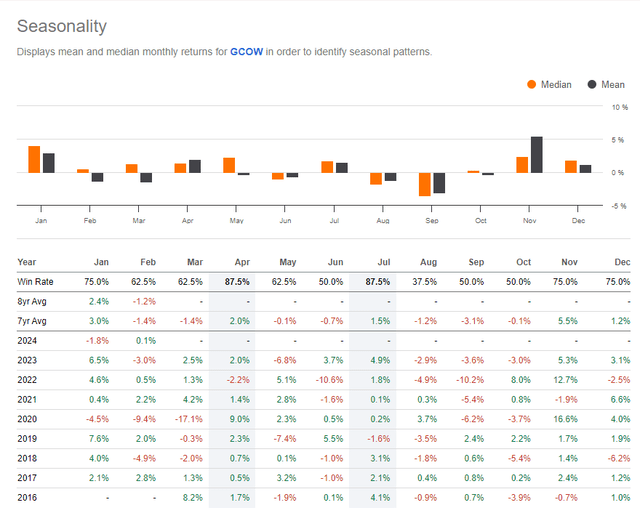

Seasonally, GCOW’s finest month is April, although losses have traditionally been seen throughout Might and June earlier than a powerful begin to the second half of the yr.

CGOW: Bullish April Developments

Searching for Alpha

The Technical Take

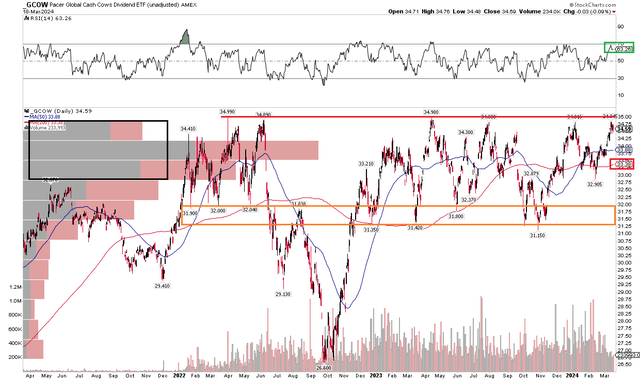

With a low valuation and excessive publicity to Vitality, which can be breaking out technically, GCOW’s chart reveals some potential. After all, key resistance stays in play slightly below the $35 stage. That has been an ongoing space of promoting stress over the previous two years. Whereas the worldwide inventory market has rallied to all-time highs, GCOW has been a relative laggard since early final yr.

Additionally check out the long-term 200-day transferring common. It’s principally flat in its slope, suggesting that there isn’t any actual development possession from both the bulls or the bears. What’s encouraging, although, is that the RSI momentum gauge on the prime of the chart has been in elevated territory since final December. With a key help vary between $31 and $32, a breakout above $35 would portend an upside measured transfer value goal to almost $39, so maintain that value in your radar.

Total, GCOW has been an underperforming ETF, however with key resistance being examined once more, the bulls might quickly take the reins.

GCOW: Key Resistance at $35

Stockcharts.com

The Backside Line

I’ve a maintain ranking on Pacer World Money Cows Dividend ETF. I see the fund as a stable worth with first rate technicals, however excessive publicity to the Vitality sector stays a threat ought to that group fall out of favor. GCOW is an lively guess on what has been an underperforming set of things.