GBP/USD OUTLOOK

- British pound positive factors towards the U.S. greenback following strong UK employment knowledge, regardless of hotter-than-expected U.S. CPI numbers

- Market consideration now shifts to UK inflation figures on Wednesday

- This text seems to be at key GBP/USD technical ranges to regulate over the approaching classes

Really useful by Diego Colman

Get Your Free GBP Forecast

Most Learn: US Greenback Outlook Put up Inflation Upside Shock, Setups on EUR/USD & USD/JPY

GBP/USD (cable) gained floor on Tuesday after UK employment numbers topped estimates, however its upside was capped by stronger-than-expected January U.S. CPI figures, a consequence that boosted Treasury yields throughout tenors, however totally on the entrance finish.

When market members absolutely digest the current U.S. inflation knowledge, expectations for the Fed’s terminal price might settle a little bit greater, making a constructive atmosphere for the U.S. greenback, a minimum of within the very close to time period. This might jeopardize the pound’s restoration, particularly if price differentials begin to undermine the British foreign money once more, however this has not occurred because the starting of the month, as seen within the chart under, the place UK/US bonds spreads have gotten much less and fewer unfavorable within the 2- and 10-year stretch of the curve.

GBP/USD VS UK-US RATE DIFFERENTIALS

Supply: TradingView

To higher assess the near-term outlook for the trade price, merchants ought to maintain a detailed eye on knowledge releases on either side of the Atlantic. That mentioned, the following key financial report price watching is the UK shopper worth index, due for launch on Wednesday morning. When it comes to expectations, January headline CPI is seen cooling modestly to 10.3% y-o-y from 10.5% in December. The core gauge, for its half, is forecast to clock in at 6.2% y-o-y from 6.3% beforehand.

Negligible progress within the combat towards inflation might add strain on the Financial institution of England to reassess its dovish stance adopted this month when the establishment deserted its pledge to proceed to lift borrowing prices forcefully.

Whereas policymakers might be compelled to regulate their steerage and maintain mountain climbing if inflationary forces don’t abate extra quickly, reactionary financial tightening is not going to be enough to maintain the pound on a restoration path sustainably, significantly if markets doubt the financial institution will stay steadfast in its dedication to revive worth stability. For that reason, it’s troublesome to be bullish on GBP/USD over the medium time period.

| Change in | Longs | Shorts | OI |

| Every day | -9% | -3% | -6% |

| Weekly | -20% | 23% | -3% |

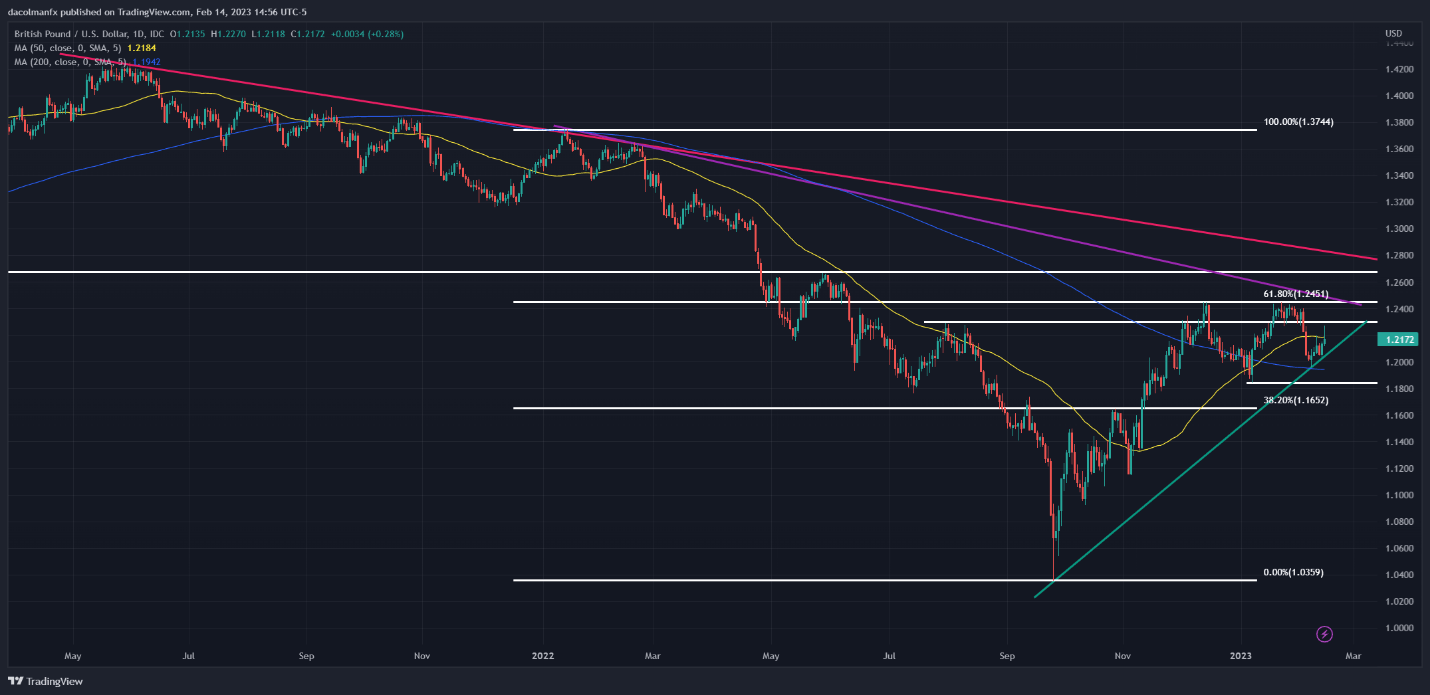

GBP/USD TECHNICAL ANALYSIS

GBP/USD climbed above its 50-day easy transferring common on Tuesday, however did not maintain the breakout decisively, an indication that purchasing strain could also be easing. With momentum weakening, sellers might wrestle management of the market from bulls any second, creating the correct circumstances for a reasonable pullback. If the bearish situation performs out, a retrenchment towards trendline assist at 1.2050 appears doable. On additional weak spot, the main focus shifts to the 200-day easy transferring common, adopted by January’s low. Quite the opposite, if proceed greater and above the 50-day easy transferring common, GBP/USD might recapture the psychological 1.2300 degree after which 1.2450, which corresponds to the 61.8% Fib retracement of the 2022 sell-off.

GPB/USD TECHNICAL CHART

GBP/USD Technical Chart Ready Utilizing TradingView