Whereas the world has been obsessively targeted on crude oil and gasoline in current weeks, we as an alternative alerted readers to a much more dire situation enjoying out in diesel, a supply of vitality which is totally crucial in retaining the “simply in time” world working on time.

As a reminder, listed below are a number of the articles we’ve got revealed on the subject in current weeks, many even earlier than the Ukraine conflict:

Quick-forward to right now, when our warning was echoed by the heads of one of many largest commodity buying and selling homes and the most important unbiased oil dealer who had been talking on the FT Commodities International Summit in Lausanne, Switzerland on Tuesday.

The company leaders estimated that as a lot as 3 million barrels of oil and its merchandise a day might be misplaced from Russia on account of sanctions, in keeping with earlier estimates, and warned that international markets face a squeeze on diesel with Europe most prone to a “systemic” scarcity that might result in gas rationing.

“The factor that everyone’s involved about shall be diesel provides. Europe imports about half of its diesel from Russia and about half of its diesel from the Center East,” mentioned Russell Hardy, chief of Switzerland-based oil dealer Vitol. “That systemic shortfall of diesel is there.”

These imports imply that Russian provides account for about 15% of Europe’s diesel consumption, in accordance with the FT which carried their feedback.

Hardy mentioned the shift to extra diesel consumption over gasoline in Europe had helped to create shortages of the gas. He added that refineries may enhance their diesel output in response to increased costs on the expense of different oil-derived merchandise to shore up provide, however warned that rationing was a chance.

Torbjorn Tornqvist, co-founder and chair of Geneva-headquartered Gunvor Group, added: “Diesel isn’t just a European downside; this can be a international downside. It truly is.”

Tornqvist additionally warned that European gasoline markets had been not functioning correctly as merchants confronted big calls for from banks for money to cowl hedging positions. “I feel it’s damaged. It truly is,” he mentioned. “I by no means thought that someone may say ‘ah, gasoline has fallen under 100 per megawatt hours is de facto low cost’.”

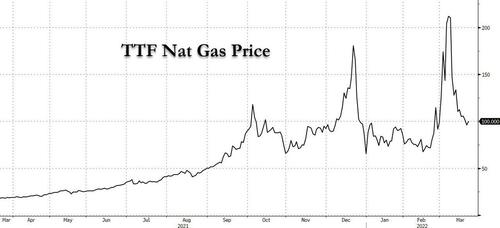

Fuel futures linked to TTF, Europe’s wholesale gasoline value have swung from about €70 a megawatt hour earlier than Russia’s invasion of Ukraine to about €230 two weeks in the past after which slid under €100 this week. Earlier than Could 2021, European gasoline costs had been under €20 a megawatt hour.

As famous final week, Europe’s largest vitality merchants referred to as on governments and central banks to offer emergency liquidity help to maintain gasoline and energy markets functioning as sharp value strikes triggered by the Ukraine disaster have strained commodity markets. Hardy mentioned that to maneuver a cargo equal to 1 megawatt hour of liquefied pure gasoline priced at €97, merchants should present €80 in money, straining their capital necessities.

Worse, confirming that Europe faces an excellent colder winter, Tornqvist mentioned European utilities would battle to fill gasoline storage for subsequent winter given the “paralysed” state of the spot marketplace for gasoline except policymakers stepped in to offer ensures to guard consumers in opposition to value swings.

However going again to diesel, Bloomberg’s Javier Blas tweeted a handful of the scariest quotes from the vitality CEOs at right now’s FT commodities summit:

-

Trafigura CEO Jeremy Weir: “The diesel market is extraordinarily tight. It’s going to get tighter and will most likely lead into inventory outs” referring to when gas stations run dry.

-

Gunvor CEO: “Europe is so wanting diesel”

-

Vitol CEO: “The factor that everyone’s involved about shall be diesel provides”

Evidently, with out diesel, not solely will site visitors in Europe grind to a halt, however a lot if not all US truck based mostly logistical help and provide chains will quickly be paralyzed. The implications for the worldwide financial system shall be dire.