Hello MQL5 Community!

I am new here but I have been trading for many many years and found great success in trading in the direction of order flow, so I want to share!

I am launching two complementary order flow indicators here on MQL5.com for MetaTrader 4:

First, what is order flow?

Order Flow is the cumulative result of a basket analysis, which is a type of analysis that looks at the WHOLE picture instead of a singularity.

For example if I want to know the order flow of EUR I have to see how EUR is performing against ALL the other major currencies: USD, CAD, CHF, GBP, AUD, NZD and JPY, and not just USD (EUR/USD).

To determine the order flow of the 28 major currency pairs the FX Signal 28 Scanner applies two important moving averages, one fast (5) and one slow (12), they are used to determine whether the direction of a currency pair is bullish, bearish or neutral. Example, when measuring the strength of EUR, the model scans through all EUR related pairs (EUR/USD, EUR/CAD, EUR/CHF, EUR/GBP, EUR/NZD, EUR/AUD, EUR/JPY) to see what pairs are trading with, against or neutral with EUR (basket analysis) and score the order flow of EUR accordingly. If for example EUR/USD is trading positive, then that will be +1. If EUR/USD is trading negative, then that will be -1. If EUR/USD is neutral then that will be a 0. EUR is measured against 7 other major currencies, so the score range from -7 to +7.

- +7 is the highest score possible and means that EUR is making gains against all major currencies. Therefore the order flow is strong because EUR is being bought on a global scale. There is a genuine interest to purchase EUR across the world.

- -7 is the lowest score possible and means that EUR is decreasing in value against all major currencies. Therefore the order flow is weak because EUR is being sold on a global scale. There is no interest in purchasing EUR, only selling.

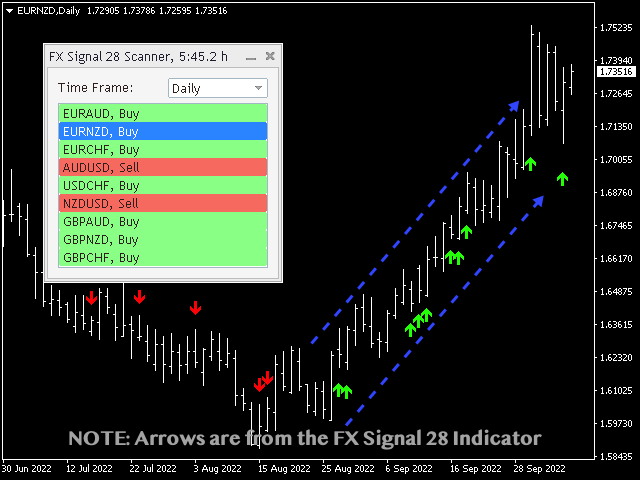

When the scanner have performed the order flow analysis on all currencies it will automatically combine the strongest against the weakest and display the resulting pairs on a dashboard. These will be the pairs with least resistance and the best pairs to trade. You can double-click on the pairs listed on the dashboard to open a new chart. In parameters you can decide what template the new chart opens with!

FX Signal 28 is a complementary indicator that paints an arrow on the candle that had positive or negative order flow. The indicator does NOT REPAINT and you can see the FULL HISTORY of order flow signals directly on the chart.

Basic Entry Strategy

Buy when price trades above the signal bar to avoid false signals.

I recommend to place a stop loss below the signal bar.

Take profits when the arrows disappear, this means order flow is no longer strong.

If you have questions you can PM me!