Most Learn: Japanese Yen Evaluation & Setups – USD/JPY, EUR/JPY, GBP/JPY; Breakdown Forward?

Gold costs (XAU/USD) climbed on Thursday, pushing previous the $2,040 threshold and reaching their highest degree since early February at one level through the buying and selling session, though beneficial properties appeared to be capped by a strengthening U.S. greenback.

The dear steel’s optimistic efficiency was fueled, partially, by falling U.S. Treasury yields, which reacted to an in-line financial report. Particularly, January’s core PCE deflator clocked in at 0.4% m/m and a couple of.8% y/y, simply as projected.

US PCE DATA

Supply: DailyFX Financial Calendar

Buyers, rattled by the latest CPI and PPI information, braced for additional inflation ache, however had been relieved when the Federal Reserve’s favored worth gauge landed exactly on its anticipated mark. This gave gold bulls an excuse to reengage lengthy positions.

Wanting forward, merchants shouldn’t be greatly surprised if Thursday’s rally proves to be short-lived. When markets come to phrases with the truth that sluggish progress on disinflation and looser monetary situations may immediate the Fed to delay the beginning of its easing cycle, bullion could face renewed downward strain.

For an intensive evaluation of gold’s elementary and technical prospects, obtain our complimentary quarterly buying and selling forecast now!

Really helpful by Diego Colman

Get Your Free Gold Forecast

GOLD PRICE FORECAST – TECHNICAL ANALYSIS

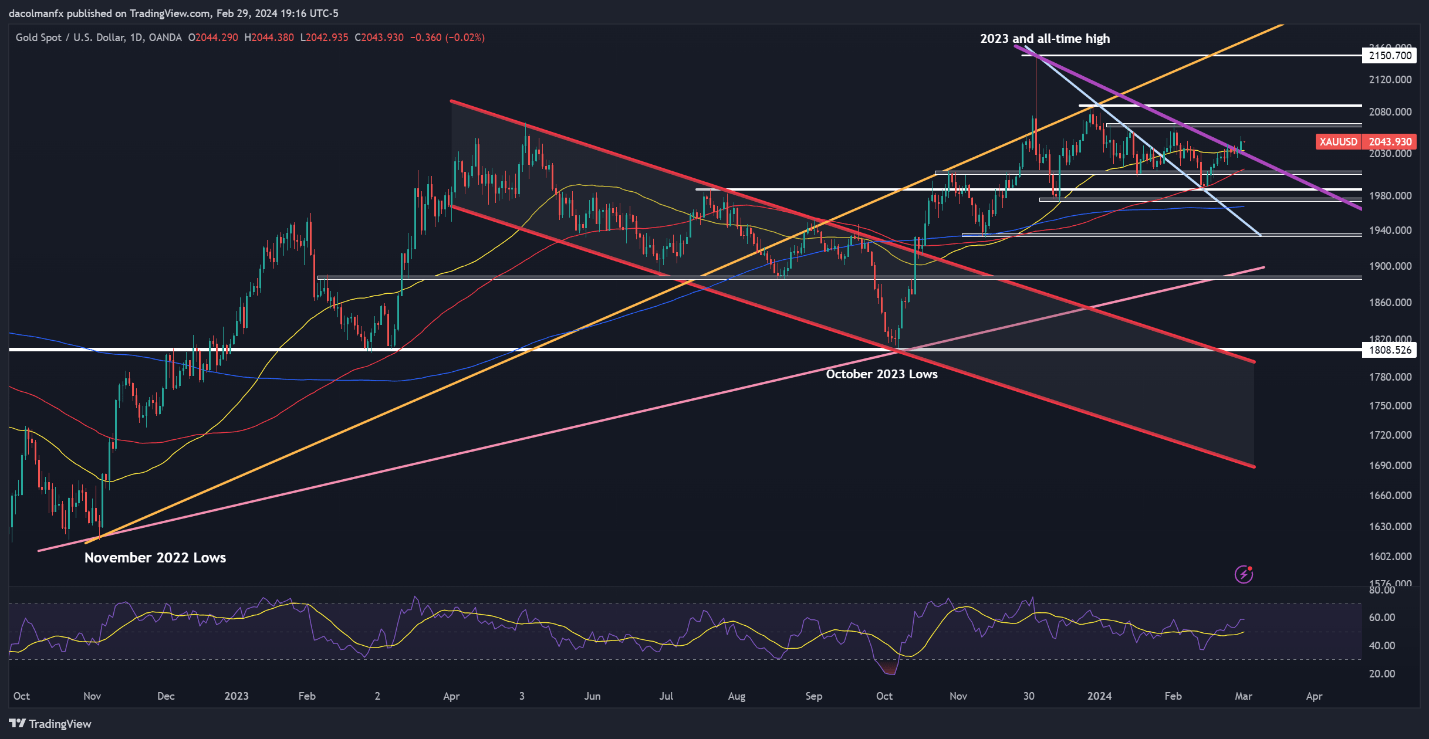

Specializing in gold’s outlook, technicals and elementary evaluation are at present at odds. That stated, Thursday’s bullish breakout, which noticed XAU/USD push previous trendline resistance and the 50-day easy shifting common at $2,035, is clearly a optimistic signal. Ought to this transfer be sustained, a rally in direction of $2,065 could also be on the horizon. Above this space, all eyes will probably be on $2,090.

Quite the opposite, if sellers return and spark a bearish reversal beneath $2,035, sentiment towards the yellow steel may rapidly bitter. Underneath these circumstances, bears could achieve confidence to mount an assault on the 100-day easy shifting common, positioned round $2,010/$2,005. Additional declines beneath this help zone may pave the way in which for a retreat in direction of $1,990.

Questioning how retail positioning can form gold costs? Our sentiment information offers the solutions you’re in search of—do not miss out, get the information now!

| Change in | Longs | Shorts | OI |

| Each day | -7% | 9% | 0% |

| Weekly | -16% | 24% | -1% |

GOLD PRICE (XAU/USD) PRICE CHART

Gold Value Chart Created Utilizing TradingView