German Dax 40, FTSE 100 Newest:

- German Dax builds in a stable vary that has continued to carry over the previous few weeks.

- FTSE 100 dips under the 20-day MA (transferring common) – strikes over wages within the UK rise however shares maintain regular (no less than for now).

- Fairness indices stay resilient forward of central financial institution conferences and dampened sentiment.

Really helpful by Tammy Da Costa

Get Your Free Equities Forecast

European equities are holding regular in a stable vary with Dax and FTSE each stalling at resistance.

As markets put together for the subsequent batch of price choices, political and financial turmoil has been overshadowed by expectations that inflation could have peaked.

With the ECB (European Central Financial institution) and BoE (Financial institution of England) anticipated to implement one other 50 basis-point improve on Thursday, the FOMC is anticipated to announce a 25-basis level price hike later as we speak.

DailyFX Financial Calendar

Though earnings have been blended, there was a notable deceleration in development forecasts over the previous yr. Nonetheless, with the elemental backdrop largely priced in, international inventory indices have remained resilient, rising to ranges final seen earlier than the onset of the struggle in Ukraine (which started on 24 Feb 2022).

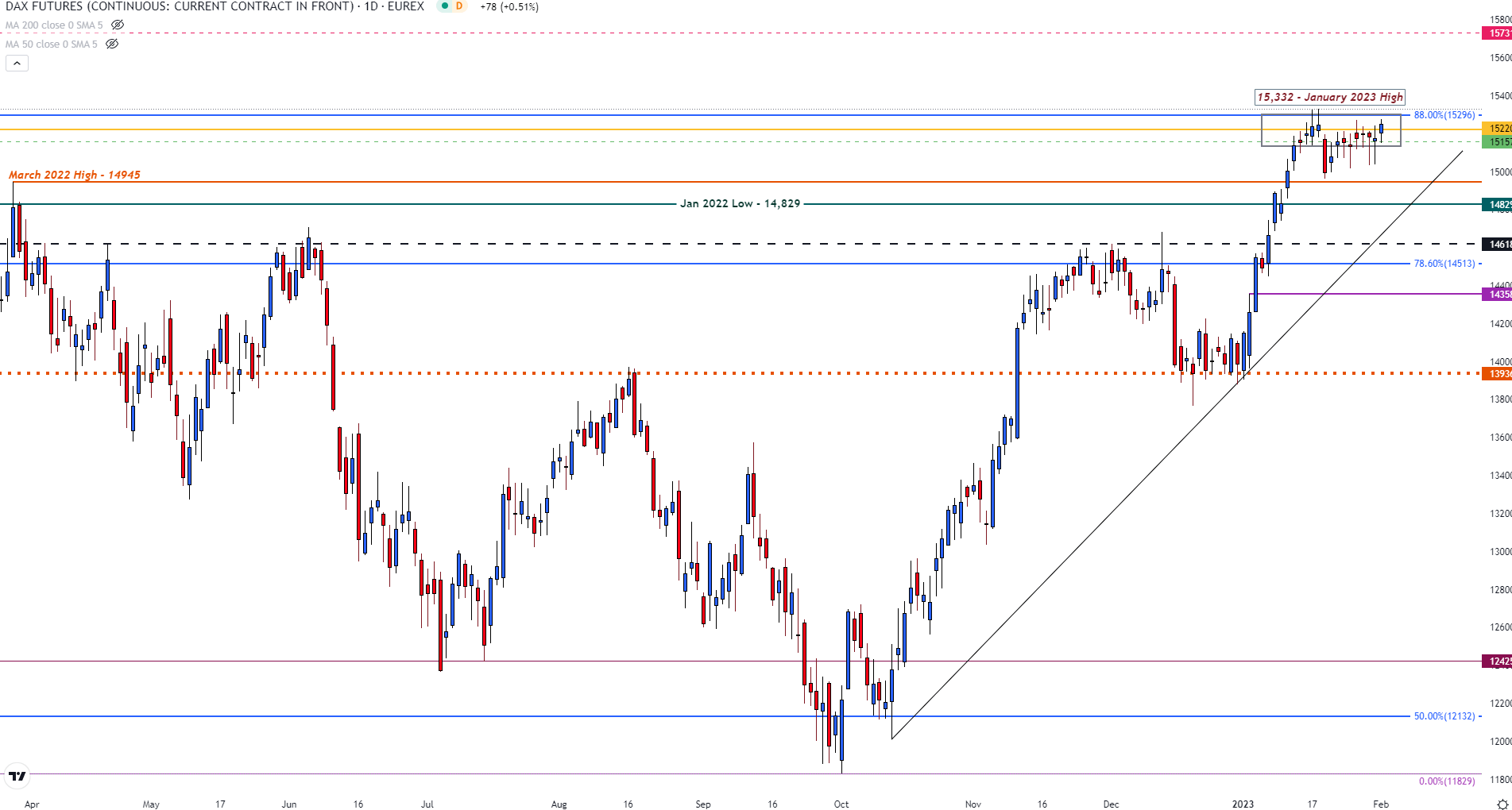

Dax 40 Technical Evaluation

On the time of writing, Dax futures are buying and selling marginally greater, barely above 15,220. With current worth motion buying and selling in a decent zone of assist and resistance between 15,150 & 15,280; the 88% Fibonacci retracement of the 2020 – 2021 transfer has shaped a further barrier at 15,296.

Dax Every day Chart

Chart ready by Tammy Da Costa utilizing TradingView

Really helpful by Tammy Da Costa

Futures for Inexperienced persons

Since reaching a excessive of 15,332 final month, bullish momentum eased, driving Dax in direction of psychological assist at 15,000. However, after rebounding off this degree, costs stabilized within the present vary. As stress continues to construct, bulls have just a few hurdles to clear earlier than costs can retest the 2022 excessive of 16,274.

With the 15,300 psychological degree hovering above, a break of 15,400 might open the door for the Feb 2022 excessive of 15,731.

Quite the opposite, a transfer under 15,150 and a break of 15,000 might gas bearish momentum in direction of the Jan 2022 low at 14,829.

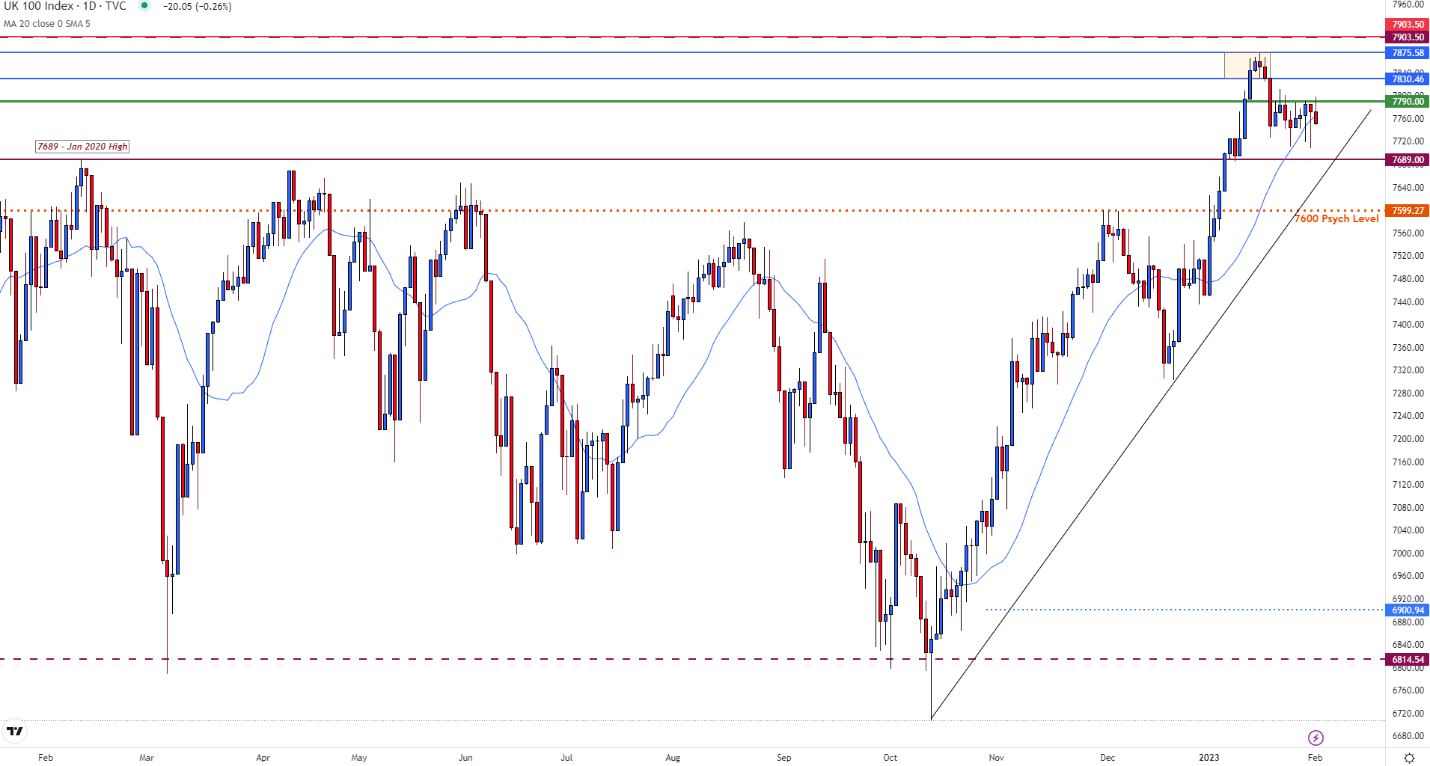

FTSE Technical Evaluation

Regardless of the unrest over wages within the UK, the FTSE 100 continues to commerce above 7,750. Whereas the 20-day MA (transferring common) holds as assist at 7764, a break of seven,689 (January 2020 excessive) could permit bears to drive costs in direction of 7,600.

FTSE 100 Every day Chart

Chart ready by Tammy Da Costa utilizing TradingView

For the upside to prevail, bulls have to clear 7,800 in an try to interrupt the January excessive of seven,875.58.

| Change in | Longs | Shorts | OI |

| Every day | 8% | -3% | -1% |

| Weekly | -5% | -2% | -3% |

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and comply with Tammy on Twitter: @Tams707