Article by IG Senior Market Analyst Axel Rudolph

FTSE 100, CAC 40, Russell 2000, Evaluation and Charts

Beneficial by IG

Get Your Free Equities Forecast

FTSE 100 tries to get well amid barely higher month-on-month GDP studying

The FTSE 100, which Thursday dropped to the 200-day easy transferring common (SMA) at 7,573 on a higher-than-expected US CPI inflation studying, tries to get well on the final buying and selling day of the week amid a good month-on-month efficiency on UK GDP which was negated by a drop of the 3-month common.

Resistance sits finally week’s 7,635 to 7,647 lows forward of Thursday’s 7,694 excessive. Draw back strain ought to stay in play whereas 7,694 isn’t overcome. Above it lies resistance between the September and December highs at 7,747 to 7,769.

A fall by way of Thursday’s 7,573 low would put the 55-day easy transferring common (SMA) and October-to-January uptrend line at 7,548 to 7,546 on the map.

FTSE 100 Every day Chart

| Change in | Longs | Shorts | OI |

| Every day | -5% | -1% | -3% |

| Weekly | 4% | -10% | -3% |

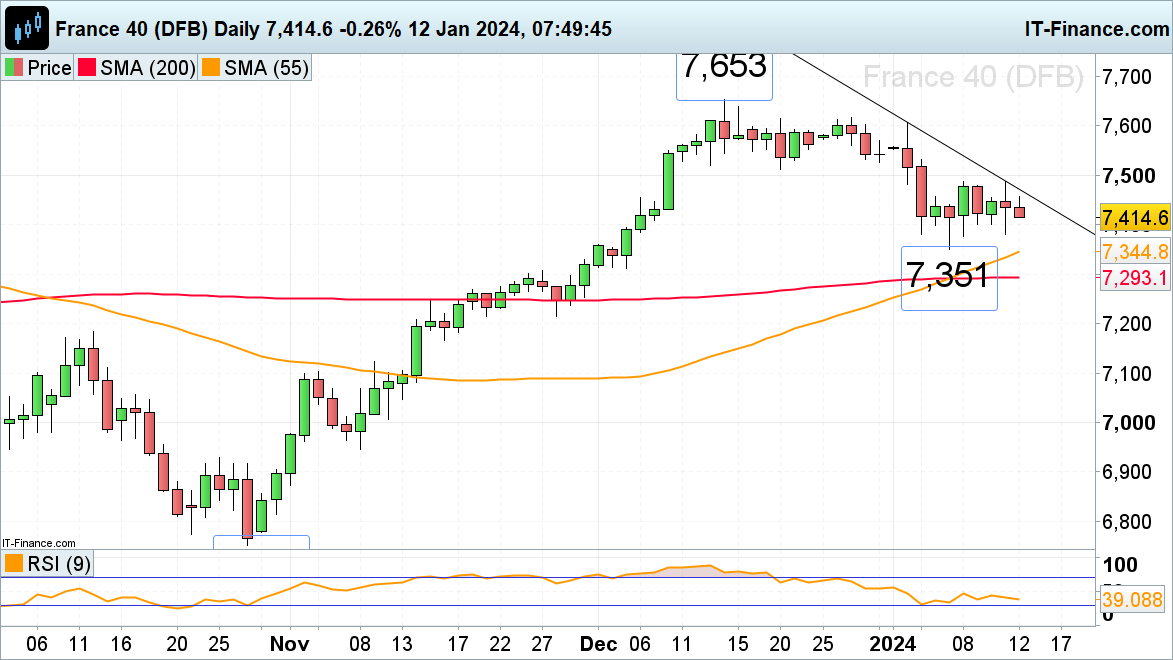

CAC 40 drops in direction of this week’s low

The French CAC 40 inventory index continues to vary commerce in a decent band between 7,488 and seven,351 amid pared again price minimize expectations.

The index targets Thursday’s low at 7,415, under which lies final week’s low at 7,351. It ought to proceed to take action whereas it stays above Friday’s 7,457 intraday excessive. This degree would should be exceeded for the current highs 7,686 to 7,687 to be revisited.

CAC 40 Every day Chart

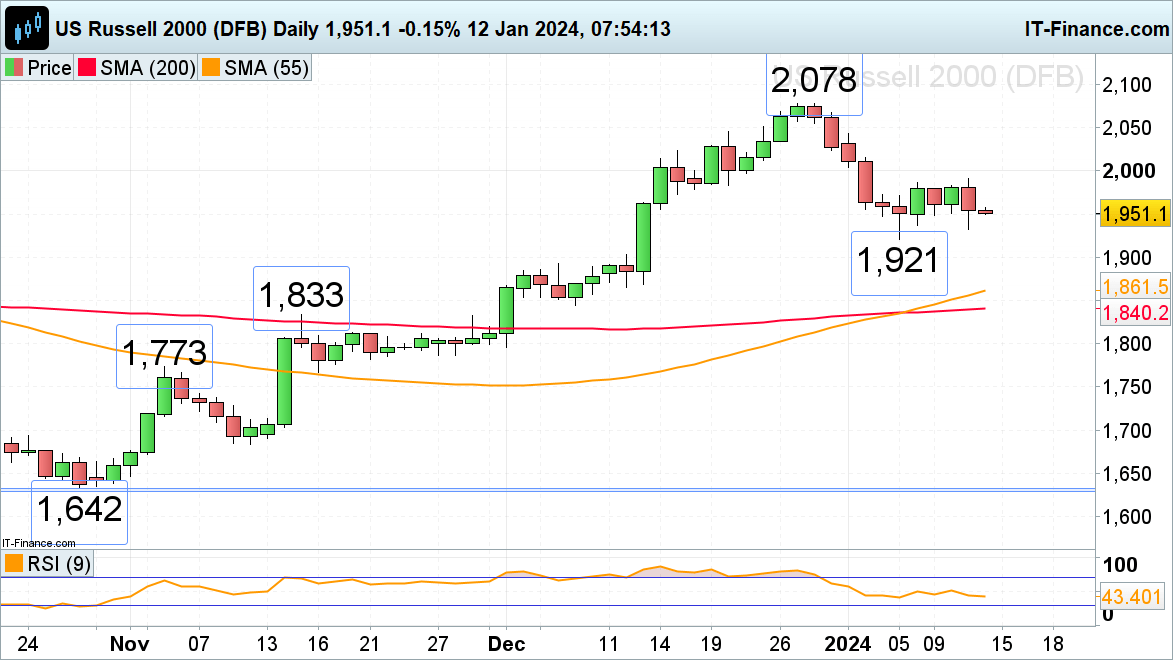

Russell 2000 slips again submit higher-than-expected US CPI studying

The Russell 2000 continues to sideways commerce in a comparatively tight vary because it awaits US PPI knowledge and the start of This fall earnings season.

Thursday’s uptick in US CPI inflation took the index again down from its one-week excessive at 1,992 to Thursday’s 1,933 low. This degree might be revisited on Friday, a fall by way of which might seemingly have interaction final week’s 1,921 low.

Resistance now sits between this week’s highs at 1,986 to 1,991 highs. This space would should be bettered for a continuation of the medium-term uptrend to achieve traction.

Russell 2000 Every day Chart