greenbutterfly

Overview

I nonetheless consider Freshworks (NASDAQ:FRSH) is undervalued at the moment. My thesis stays that FRSH supplies companies with user-centric SaaS options, they usually prioritize ease of use and buyer wants in its product growth. A key aggressive benefit is that FRSH’s options are designed to be simply carried out and scaled, permitting companies to bear digital transformation rapidly and effectively. The fear about FRSH inventory was its SMB publicity and the impression it can get from the underlying layoffs on the buyer degree, each of which have brought about the inventory to be rangebound. The 1Q23 quarter proved that regardless of the difficult macro surroundings, FRSH is ready to execute nicely and generate income. FRSH’s earnings and income for 1Q23 have been each above expectations, and the corporate additionally surpassed its personal steerage for EBIT margin by 880 foundation factors. Though a tough labor market will seemingly proceed to sluggish FRSH’s growth, we should not ignore the truth that NRR improved as the corporate gained floor within the upmarket. To be truthful, it isn’t like FRSH’s progress has slowed down, both; the corporate’s new enterprise momentum persists, particularly as clients place larger emphasis on whole value of possession and velocity to worth. Moreover, this quarter’s robust execution demonstrated the improved gross sales execution introduced on by a 1Q23 restructuring that extra carefully synchronized FRSH land and expanded GTM motions. I proceed to remain lengthy on the inventory.

Enterprise overview

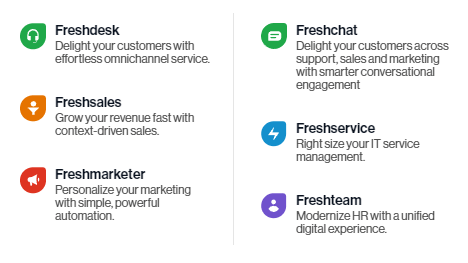

FRSH supplies companies of all sizes with cutting-edge, user-centric SaaS options. FRSH’s major choices include Freshdesk, a buyer expertise product, in addition to Freshservice and different buyer relationship administration options.

FRSH web site

All kinds of companies must bear a digital transformation of their advertising, gross sales, and customer support methods with the intention to sustain with the calls for of recent shoppers. Regardless of the heavy expenditures invested by legacy companies on infrastructure, they’re nonetheless struggling to maintain up with the rising expectations of their clients and employees. In my view, all companies must bear digital transformations in the event that they wish to meet and even exceed the expectations of their clients and staff.

Financials / Income

FRSH delivered strong outcomes, with 1Q23 fixed forex income progress of 23% topping steerage for 21% fixed forex progress. The robust 1Q23 efficiency has led to administration revising their FY23 steerage for $580 million to $592.5 million income. Notice that the rise is the scale of the 1Q23 outperformance, which signifies that administration expectations for the remaining FY23 has not modified. I consider the advance in EBIT margin is the most effective takeaway for this quarter, which was pushed by a collection of extreme value optimization initiatives. For example (based on the 1Q23 earnings name), hiring course of has been revamped, efficiency administration tradition has been improved to drive a lesser new rent, and advertising and back-office capabilities are consolidated (that is vital because it reduces value of retraining/rehiring, which implicitly will increase profitability). Basically, the margin enchancment was as a consequence of value minimize, which is nice because it reveals that administration is conscious of the fat to chop. Nonetheless, what ought to be famous is that this margin enchancment isn’t as a consequence of scale or FRSH progress, as such I don’t anticipate this magnitude of enchancment to occur once more. If this new lean construction is the optimum kind, I consider we are going to see robust working leverage forward. Administration stays dedicated to driving working leverage and guided EBIT margins of 1% in FY23.

NRR

I believe it is vital to focus on NRR’s glorious efficiency because it tells us how profitable FRSH is at with up/cross-selling, buyer churn charges, and in addition penetration into upmarket. NRR ended the quarter at 108%, exceeding FRSH’s personal steerage of 107%. In my view, the 108% continues to be decrease than the 110% achieved within the earlier quarter, so I believe there may be room for enchancment right here. Although 1Q23 NRR was nonetheless beneath stress as a consequence of fewer rent because of the tight labor market, you will need to word that churn improved as a consequence of stronger upmarket momentum offsetting weaker SMB developments. That is vital because it tells us that FRSH is discovering the in routes to the upmarket – which is a unique market than SMB – and if traction continues, it may scale back the cyclicality of the SMB market and in addition lengthen FRSH progress runway. On account of the still-present macro headwinds, administration has projected a 2Q23 NRR of 105%, with the determine stabilizing within the second half of the 12 months. With time and a greater macro surroundings that encourages progress, I consider FRSH can positively get again to the 110-115% NRR vary.

Valuation/AI

I consider the profitable incorporation of AI into FRSH enterprise might assist drive multiples structurally larger than the place it has traditionally traded at. On the present 5x ahead income a number of, this means a ahead PE a number of of 20x ahead PE (assume FRSH can obtain 25% internet margin, which is feasible given gross margin is 81% and rising). For enterprise that’s nonetheless rising within the high-teens (a lot larger than the market), with potential to additional speed up progress and enhance margins by the adoption of AI, I believe it deserves a better premium to the S&P (which is buying and selling 18.4x ahead earnings at the moment).

The widespread bear case about AI is which will scale back the demand for brand spanking new staff amongst FRSH’s underlying clients, thereby lowering the variety of seats that may be bought by the corporate. I believe that is the fallacious lens to make use of, although, as a result of FRSH’s administration has already talked about the existence of a pricing construction for bots that’s primarily based on the variety of periods or interactions. Which means that progress isn’t depending on the variety of hires, however somewhat on the workload, and it could flex upwards if elevated use of AI reduces the quantity of seats. It is seemingly that with the assistance of AI, companies will have the ability to tackle extra work, which is nice information for FRSH. From the shopper’s viewpoint, if the entire value of possession (AI + FRSH answer) is lower than the price of hiring an worker, then the mixture will seemingly be adopted. Subsequently, I believe that progress in AI is nice for FRSH in the long term.

Conclusion

I nonetheless assume FRSH stays undervalued. The corporate’s give attention to user-centric SaaS options and its means to prioritize buyer wants and ease of use give it a aggressive benefit. Regardless of issues concerning the firm’s publicity to SMBs and potential impacts from buyer layoffs, FRSH’s efficiency in 1Q23 demonstrated its means to execute nicely and generate income. Earnings and income exceeded expectations, and the corporate surpassed its personal steerage for EBIT margin. The improved NRR and the rising upmarket momentum are constructive indicators of FRSH’s growth. The corporate’s value optimization initiatives have led to improved EBIT margins, though you will need to be certain that the cuts weren’t extreme and won’t hinder future progress. NRR, although barely decrease than the earlier quarter, reveals potential for enchancment, significantly as FRSH positive aspects traction within the upmarket phase. The usage of AI in FRSH’s options has the potential to extend effectivity and workload capability, providing long-term advantages. Total, I keep a constructive outlook on FRSH and stay a purchase ranking on the inventory.