Markets:

- Gold down $22 to $1919

- US 10-year yields down 5 bps to 2.14%

- WTI crude oil up $1.74 to $104.72

- S&P 500 up 50 factors, or 1.2%, to 4452.

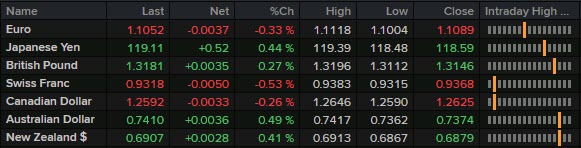

- AUD leads, JPY lags

The tone in Europe was unfavorable and US fairness futures have been slated for declines however the temper in New York picked up, regardless of the hawkish feedback from Waller that have been adopted by extra from Barkin (and even Kashkari). It’s important to surprise if the market is definitely inspired that the Fed is stepping up and the takeaway is that inflation will not be an issue down the road due to that, and terminal charges will finally be decrease.

I believe that is a fairly large leap however it additionally matches with the current sample of greenback weak spot. For its half, the greenback fared a bit higher in the present day after slumping for the reason that Fed choice. However even with that, the slide to 1.1004 in EUR/USD was halted by bids on the determine and there was a 50 pip bounce from there.

The pound completed larger towards the greenback and has almost worn out the post-BOE losses regardless of a seemingly more-negative tone in Ukraine.

Commodity currencies remained bid and completed at one of the best ranges of the week. Oil chopped round and different commodities have been more-steady (although the drama continued in nickel, which was limit-down). AUD/USD added one other 40 pips to 0.7411.

AUD/JPY continues on its monster one-way run because the yen struggles broadly. The market is sensing a pickup in inflation (and charges) in all places however Japan. I am tempted to consider t

hat larger costs globally may even embrace Japan however everybody who has wager on larger Japanese inflation for the previous 30 years has been carried out penniless so nobody needs to make that wager and I do not assume they’ll any time quickly both.

USD/JPY might be my chart of the week. The pair is poised to shut above 119.00, which can break the spike excessive in late 2016 and be a six-year closing excessive. That leaves some blue skies above for the yen commerce, which has already run for awhile. It additionally continues to level to larger yields and shares.

It is superb how rapidly market sentiment can change from the dire temper on Monday to 4 +1% rallies in a row within the S&P 500.