USDIndex on Wednesday [11/10] fell -0.04% and recorded a 2-week low, whereas declining bond yields on Wednesday weakened the greenback because the yield on 10-year T-notes additionally fell to a 2-week low. As well as, the energy of shares restricted liquidity demand for the greenback. The greenback’s decline was restricted after the US PPI in September rose greater than anticipated, which is a hawkish issue for Fed coverage.

The minutes of the FOMC assembly on 19-20 September had been barely hawkish and bullish for the Greenback.

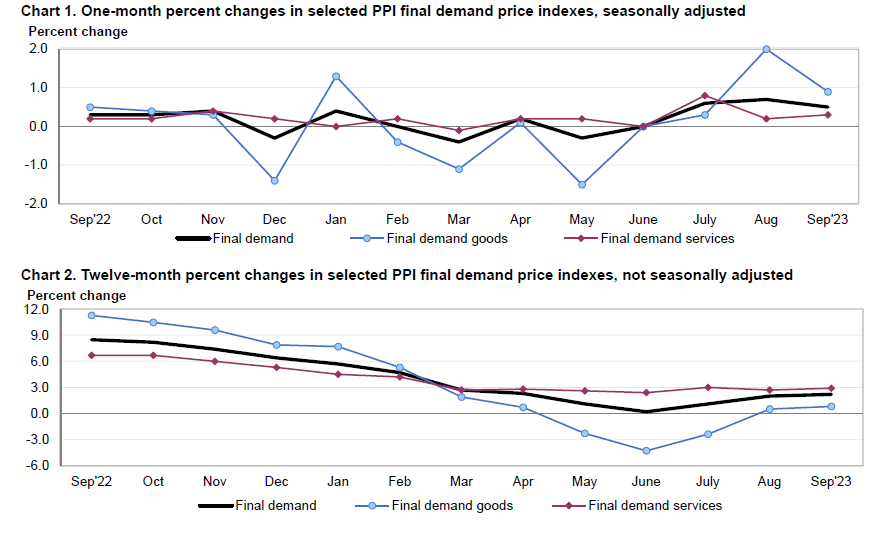

US PPI for closing demand rose 0.5% on a month-to-month foundation in September, above expectations of 0.4%. Meals, power and commerce providers PPI elevated 0.2% m/m, the 4th consecutive enhance. Items PPI rose 0.9% m/m whereas providers PPI rose 0.3% m/m. For the 12-month interval, PPI rose 2.2% y/y, above expectations of 1.6% y/y. It was the most important annual enhance since 2.3% y/y in April. PPI for meals, power and commerce providers rose 2.8% y/y.

The minutes of the 19-20 September FOMC assembly said that individuals usually judged that with restrictive financial coverage, the dangers to reaching the committee’s goals grew to become extra two-sided. The minutes additionally famous {that a} majority of Fed officers noticed another price hike as more likely to be applicable, whereas some stated no additional hikes had been wanted.

Fed feedback on Wednesday had been combined towards the Greenback. On the draw back, Fed Governor Waller stated the Fed is lastly getting inflation underneath management and is able to watch and have a look at rates of interest. As well as, San Francisco Fed President Daly stated tighter monetary situations might imply the Fed doesn’t must do a lot to rates of interest. In the meantime, Fed Governor Bowman stated, regardless of current enhancements, inflation continues to be effectively above the FOMC goal of two%. Home spending continues at a excessive tempo and the labour market stays tight. This means that the coverage price could have to be adjusted and stay restrictive for a while to return inflation to its goal.

Total, the Fed is able to proceed with warning, and a cautious method is critical as there may be nonetheless excessive uncertainty, particularly because of the volatility of financial information and potential information revisions, which was additionally indicated within the assembly minutes.

On Wednesday the USDIndex was nonetheless correcting after 5 consecutive days of declines, however the vary narrowed as merchants awaited the discharge of the minutes of the final FOMC coverage assembly for additional clues on the central financial institution’s rate of interest outlook for the approaching months. However after the FOMC assembly, the Index additionally didn’t transfer removed from the early day opening.

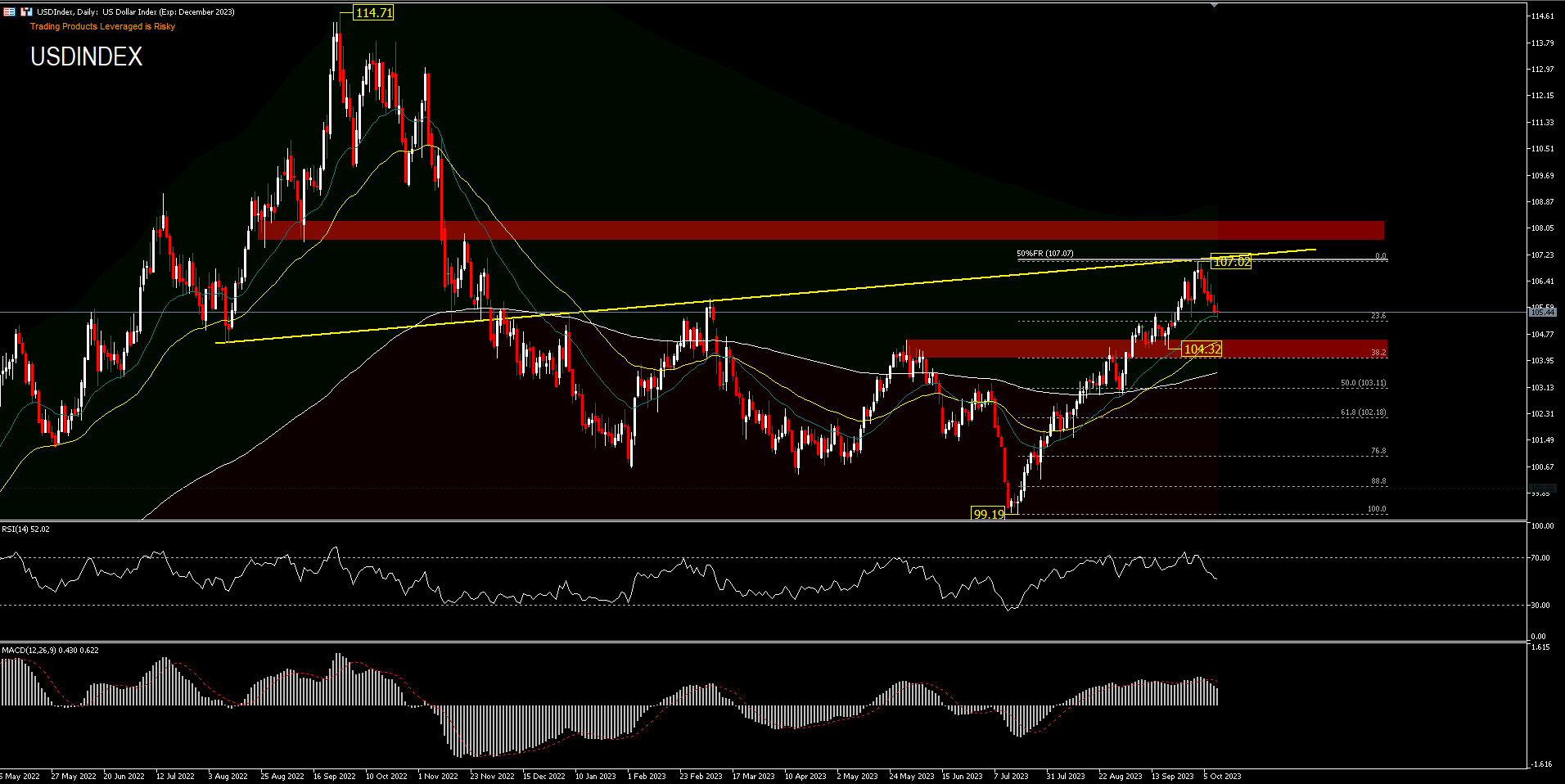

The pullback from 107.02 was briefly stalled on the 23.6 FR% stage [from 99.19-107.22 pullback] which stored the draw back restricted for two consecutive days. Oversold situations on the each day chart are contributing to a doable consolidation state of affairs earlier than a recent push decrease, as greenback sentiment is cut up by Fed policymakers’ feedback.

The Greenback is more likely to come underneath renewed stress, if the sentiment deteriorates and modifications to dovish sooner or later, with a drop to check the worth ranges under 105.00. Nonetheless, a bounce above the 106.00 barrier would strengthen the short-term construction. The worth common moved above the 52-day EMA and held on the 26-day EMA. The oversold stage on the RSI and the MACD sign crossover briefly validate this week’s value motion. Of word, current US financial information has been optimistic and suggests the energy of the financial system might help the Greenback to carry for longer.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is offered as a common advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or ought to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.