The release of meeting minutes from the on Sept. 20-21 produced another round of hawkish rhetoric from the world’s top central bank. The comments, while not allowing the markets to develop a rebound from the multi-month lows, did not come as a shock either. The reaction adds to the picture that rather negative expectations are priced in.

The FOMC is convinced that even more restrictive policy is needed because the slowdown of is slower than predicted, and there is still upward pressure on prices due to the tight labor market. In central banker’s language, such a statement indicates a willingness to tighten conditions until business begins to bear significant losses by reducing the number of job openings and halting wage growth.

At the same time, the Fed admits that the could rise above the currently projected 4% – a significant increase from the current 3.5%, suggesting job cuts. This is a striking addition to Powell’s words that we need to “embrace economic pain.”

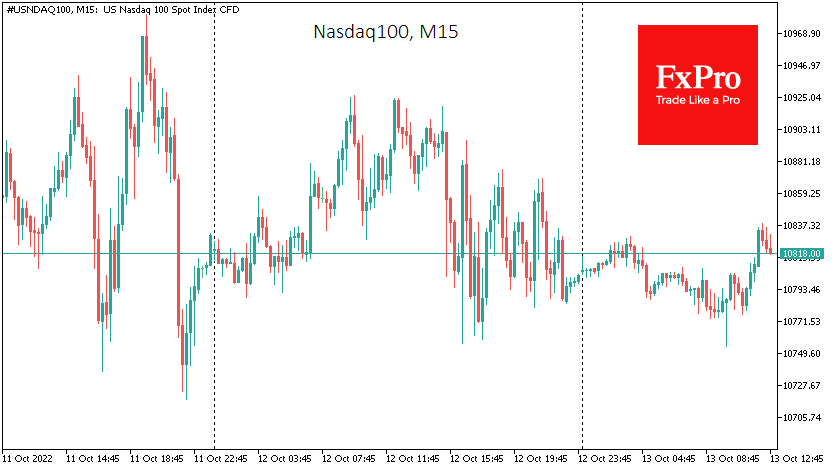

Surprisingly, financial markets took the minutes very neutrally. It may well be that too much negativity is already embedded in prices. News about stronger-than-expected growth and the hawkish tone of the FOMC minutes did not cause the US indices to update their multi-month lows.

On the contrary, the has posted higher intraday lows, and the index futures are adding 0.3% since the start of the day on Thursday, experiencing an influx of buyers on declines towards 10700.

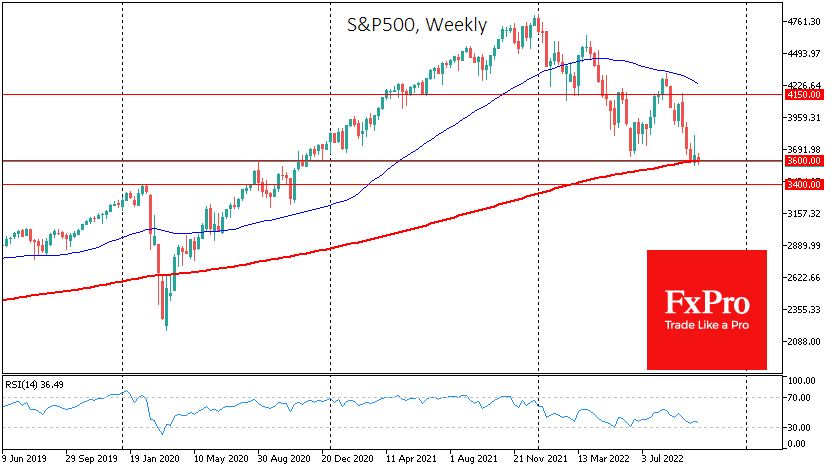

Since the beginning of October, the is getting apparent support on the declines under the 3600. The 200-week moving average now passes near that mark, a decisive dip below which would force markets to rethink the entire paradigm of the past decades.

The fundamental principle that ”stocks only go up” in the long term will be called into question, as it was with the housing market 12 years ago. History knows examples of when the market failed to generate returns for decades, but market participants still hope that regulators will not let that happen this time.