damircudic/E+ by way of Getty Pictures

Intro

We wrote about Fluor Company (NYSE:FLR) in mid-2021 after we said that the corporate’s bullish forward-looking fundamentals on the time wanted to lastly make themselves recognized within the inventory’s financials. The reason is is that Fluor’s working money stream on the time was coming in damaging as the corporate continued to really feel the brunt of the Covid-19 pandemic. Suffice it to say, with ebook worth falling, administration was grappling with how you can make investments as effectively as potential whereas on the similar time chopping prices to the bone with the intention to shield the financials. This can be a tough process even in the most effective of instances particularly when contemplating Fluor’s low single-digit revenue margins being repeatedly pressured by rising prices. Fluor’s eager valuation (The place gross sales have been buying and selling for pennies on the greenback) and robust backlog have been the principal calling playing cards in the inventory on the time. Buying and selling circumstances (The place Fluor may run by means of its workload at a a lot quicker clip) merely wanted to stack up although for the corporate to comprehend its potential.

Quick ahead roughly 22 months and we see that shares have managed to rally over $10 a share which is sort of a 50% achieve (Higher than 25% annualized) since our mid-2021 commentary. Beneficial properties truly surpassed 80% up till early March however elevated volatility over the previous six weeks or so has seen Fluor come properly off its 2023 highs.

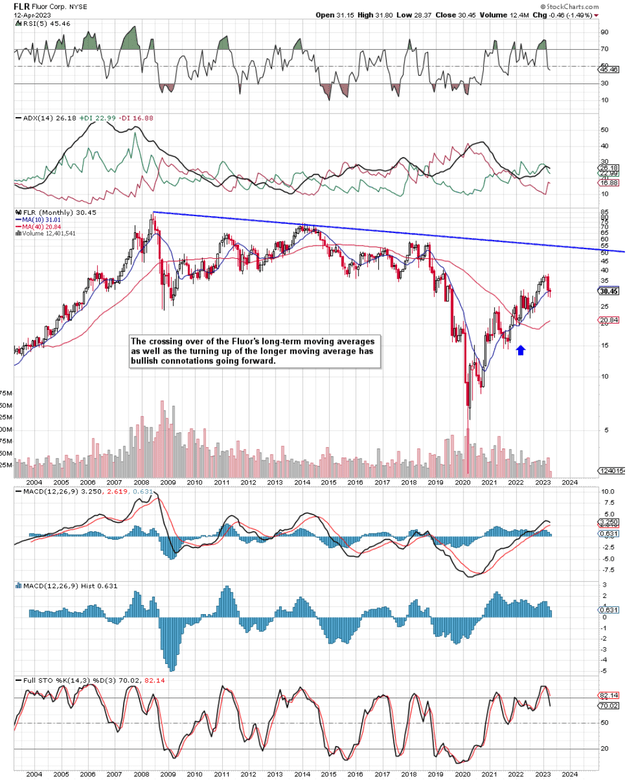

Nevertheless, if we have a look at Fluor’s long-term chart, we see two technical particulars that are bullish in nature. First is the crossing over of the inventory’s 10-month transferring common above its corresponding 40-month counterpart (Which led to a powerful rally). Extra importantly, nevertheless, is the turning up of that 40-month transferring common which is a transparent demonstration that Fluor’s long-term pattern has modified right here. Suffice it to say, if current developments can proceed, there’s each risk that Fluor ultimately assessments its higher multi-year pattern line proven under. Tendencies from the corporate’s newest fiscal 12 months can present us clues on whether or not this can be a risk on this regard.

Fluor Lengthy-Time period Technicals (Stockcharts.com)

The important thing pattern we witnessed in fiscal 2022 was the return to profitability regarding bottom-line GAAP earnings. Web revenue got here in at $145 million (First worthwhile 12 months since 2018) with sturdy bottom-line development anticipated to proceed in fiscal 2023 & past. Causes for this fast turnaround in fortunes for Fluor comprise of the next.

Reimbursable Backlog % Continues To Rise

Pulling in receivables ($2+ billion on the finish of fiscal 2022) in a well timed method has at all times been a tough process on this trade particularly when demand tapers off considerably. Moreover, having to file swimsuit with the intention to gather funds excellent can current an infinite alternative value, particularly in instances of excessive inflation. Administration went to work on this lately by focusing extra on offers that offered much less danger to its stability sheet and we are able to see the fruit of this endeavor in Fluor’s present backlog. The corporate’s reimbursable backlog got here in at 63% on the finish of fiscal 2022 so the extra this key metric grows, the upper the likelihood that liquidity ratios will proceed to enhance. Having an improved risk-adjusted backlog allows administration to strengthen the stability sheet which is what we’ve got seen seeing. On the finish of fiscal 2022, Money & ST investments improved to $2.62 billion and long-term debt dropped to $978 million. Suffice it to say, the entire above developments are conducive to the sustained technology of money stream over time as soon as legacy offers may be handled in full.

“New Awards” On The Improve

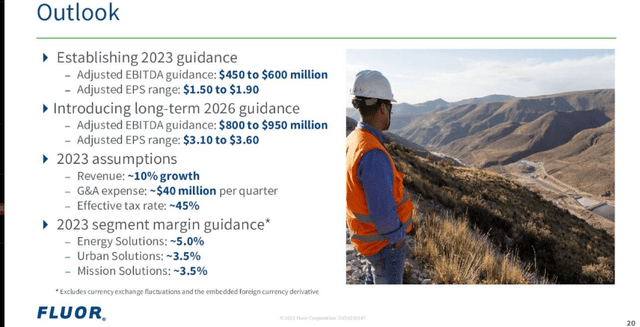

Secondly, the route of the corporate and administration’s resolution just a few years again to diversify Fluor past the standard oil and gasoline sector is now starting to bear fruit with respect to what we see coming down the monitor right here (Pipeline). The City Options enterprise for instance (Mining & Metals, Superior Applied sciences and Life Sciences & Infrastructure) all confirmed promise in fiscal 2022 the place ample alternatives exist for a major degree of repeat enterprise from present clients. Moreover, Power Options, Power Transition & Mission Options segments all elevated their “new awards” in 2022 with important potential to bid for giant offers going ahead. This implies traders shouldn’t be stunned by the corporate’s fairly spectacular steering for fiscal 2023.

Fluor Ahead-Trying Outlook (Looking for Alpha)

Suffice it to say, given Fluor’s degree of development exercise in the precise areas (The place demand stays elevated), we see shares persevering with to make long-term positive aspects right here. From a gross sales standpoint, shares stay ultra-cheap (Ahead gross sales a number of of 0.29), and now with profitability on the rise, the market ought to proceed to cost shares larger right here.

Conclusion

Subsequently, to sum up, Fluor shares proceed their ascent regardless of current volatility. Ahead-looking earnings expectations stay encouraging with growing new awards throughout a complete host of segments now turning into the norm. Let’s have a look at what Q1 brings. We look ahead to continued protection.