Spencer Platt/Getty Pictures Information

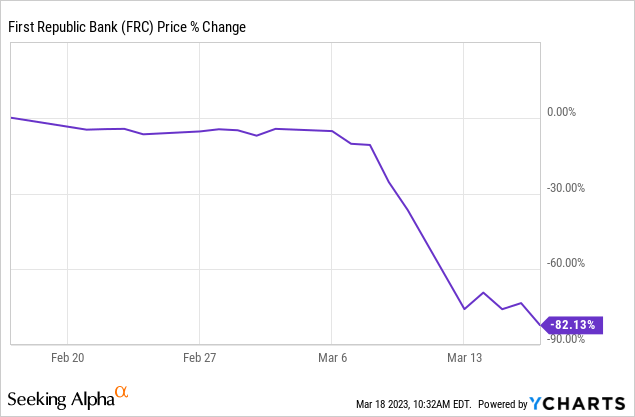

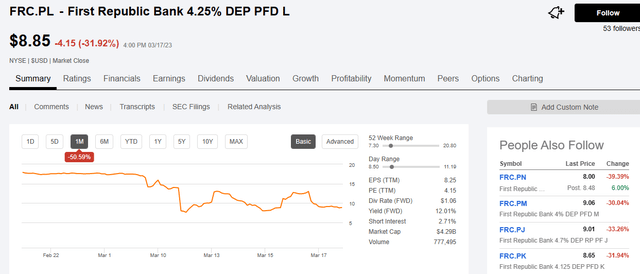

In case you are not confused, you do not know what’s going on. That quote in all probability summarizes the present state of affairs in regional banks at present. Simply 4 weeks again everybody believed that inflation could be the most important difficulty of 2023 and we ramped up expectations for the terminal Fed funds charge. Since then Silicon Valley Financial institution (SIVB) and Signature Financial institution (SBNY) have turn into skidded off the fairness exchanges and First Regional Financial institution (NYSE:FRC.PK) has turn into the proud recipient of 80 headlines. FRC is our matter of debate at present and we are going to summarize the important thing occasions up to now and go over your funding decisions.

Length Threat

Way back to March 2021, we had warned buyers concerning the stupidity of shopping for extraordinarily lengthy period belongings for a paltry return. We dodged all of the landmines within the bond sector and anticipated the aggressive Federal Reserve strikes. What we didn’t see coming was the brutal massacre in regional banks. This was a transparent failure on our half because the pattern of paying retail deposits 0.00% curiosity with Treasury charges close to 5% was clearly unsustainable. We noticed this as compressing financial institution earnings as they ramped up deposit charges, however missed that it may create a disaster. Mea Culpa.

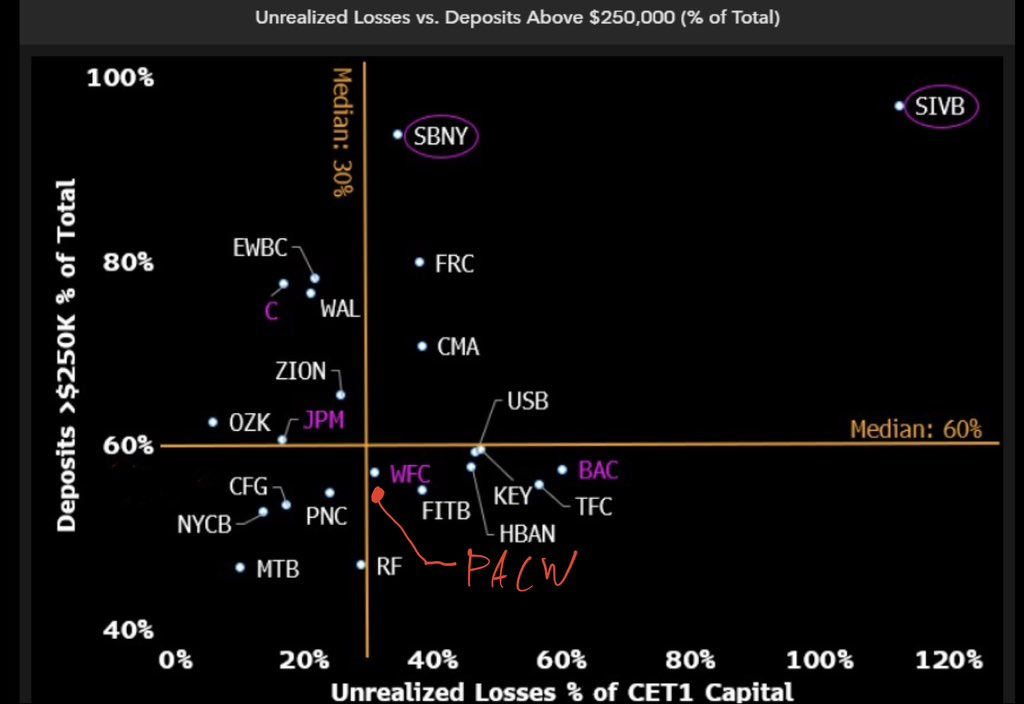

FRC whereas not the worst of the bunch, is definitely on the flawed aspect of the median strains for 2 objects. Unrealized losses as a proportion of CET1 ratios and uninsured deposits are each a bit excessive for consolation.

Michael Burry-Twitter

In fact that’s placing issues mildly as FRC inventory has declined by 82% simply within the final month.

A continued capital flight received a minimum of 10 mega banks to offer assist for FRC.

The most important banks, together with JPMorgan (JPM), Financial institution of America (BAC), Citi (C) and Wells Fargo (WFC) will contribute $5 billion of deposits every, whereas Goldman Sachs (GS) and Morgan Stanley will present $2.5 billion every, in accordance with an announcement on Thursday. PNC Monetary (PNC), Financial institution of New York Mellon (BK), Truist (TFC), U.S. Bancorp (USB) and State Road (STT) will every contribute $1 billion.

Supply: Looking for Alpha

It’s attention-grabbing that these have been structured uninsured deposits somewhat than interbank loans. At this level the bulls are rightly contending that such a giant transfer by the mega-cap banks could be underneath the “too massive to fail” umbrella. The repercussions if these establishments lose cash on this gamble could be catastrophic for the viability of the system. The bull play is that this can be a “no matter it takes” second. If $30 billion must turn into $100 billion, it is going to turn into $100 billion.

What’s Incorrect With Simply Shopping for FRC Widespread Shares?

Readers ought to observe that we don’t make any argument right here that FRC goes to zero. Neither are we suggesting that FRC shouldn’t be going to go up. What we’re suggesting is that bulk of the losses from the height should not coming again. Our pondering right here is that whereas the banks are lined as much as assist, they’re solely right here to forestall contagion and get FRC to repair its personal issues rapidly. Therefore FRC suspended their dividend. Capital retention is essential. So if the shares rally on any “excellent news”, like growth of FDIC insurance coverage, or dedication of “limitless assist” from these similar banks, guess what is going to that be adopted by?

In the event you mentioned “a large fairness elevate”, you nailed it. Mixed with promoting some belongings which have appreciated with this bond rally, FRC is more likely to de-risk its place quickly on any optimistic developments. In all probability, this fairness elevate will come near the lows. So for the danger you’re taking, that’s the potential of extreme losses from even right here, your upside is comparatively poor.

How To Play

When the risk-reward doesn’t make sense you must both select to not play or to make use of instruments to deliver the risk-reward in your favor. On this regard, choices do a fantastic balancing act. We go over some decisions which buyers may discover interesting.

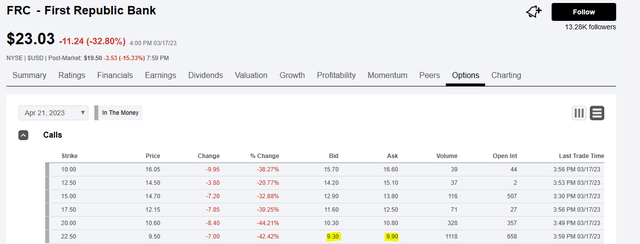

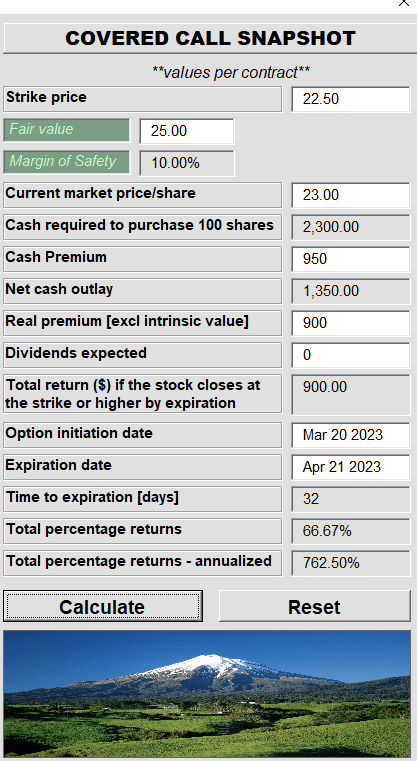

First up is the April 2023, $22.50 Lined Name.

Looking for Alpha

That primarily based on closing costs (do observe the after hours quote is fairly wild) creates an annualized yield of 762.50%.

Creator’s App

The honest worth above is a required enter within the calculator and never essentially a mirrored image of what we expect that is price at present. This return if it does pan out, provides you a strong return for the danger. We’ll observe that this degree of choice volatility usually doesn’t final. It is sort of a 105 diploma fever. Both it responds to ice baths and antipyretics or the affected person is finished. It doesn’t ever turn into regular state.

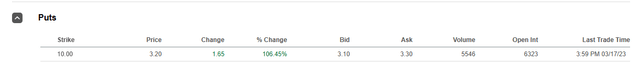

A extra defensive selection, proven from the opposite aspect, could be to promote the $10 money secured places.

Looking for Alpha

The annualized yield is a bit decrease however the breakeven level ($6.70) is half as a lot.

Creator’s App

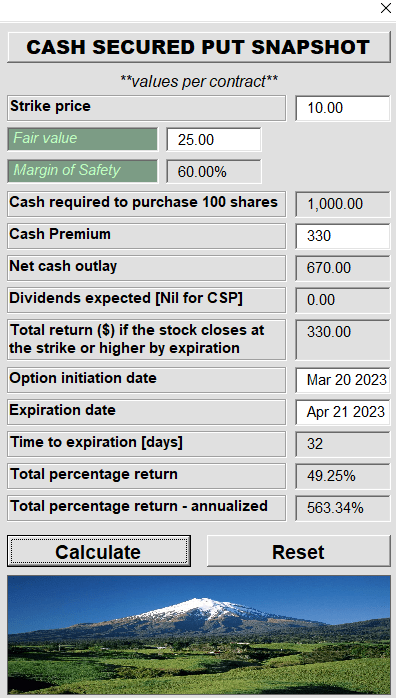

Most well-liked Shares

FRC has a legion of most popular shares buying and selling.

1) First Republic Financial institution DEP SHS RP PFD H (NYSE:FRC.PH)

2) First Republic Financial institution 5.5% NON CUM PERP REP SER I (NYSE:FRC.PI)

3) First Republic Financial institution 4.7% DEP RP PF J (BOIN:FRC.PJ)

4) First Republic Financial institution 4.125 DEP PFD Okay (NYSE:FRC.PK)

5) First Republic Financial institution 4.25% DEP PFD L (NYSE:FRC.PL)

6) First Republic Financial institution 4% DEP PFD M (NYSE:FRC.PM)

7) First Republic Financial institution DEP SHS REP 1/40TH PERP PFD (NYSE:FRC.PN)

They’ve all been overwhelmed down relentlessly.

Looking for Alpha

Our tackle these is that they’re an inexpensive viability play, however buyers have to understand that par worth of those most popular shares could be very near the market worth of the widespread fairness. We usually are hesitant to leap into most popular shares when the fairness thickness defending them is weak. So whereas there are eventualities the place preferreds can do higher (a brokered marriage with a bigger financial institution), they’re nearly as dangerous because the widespread shares.

Verdict

Shopping for and holding the widespread shares seems to be like a poor play on the state of affairs. You may get upside however it is going to be capped. Wipeout dangers nonetheless exist and we expect close to time period choices provide one of the best risk-reward for these bullish on the corporate, or simply bullish on its continued existence. Most well-liked shares are nonetheless paying their dividends and solely the widespread dividend has been suspended, to this point. We nonetheless assume that choice strikes on the widespread have a barely higher threat profile than an extended place on the popular shares. In fact the adventurous may attempt an extended place on the popular shares with a unadorned, out of the cash, name on the widespread. Tell us within the feedback.

Please observe that this isn’t monetary recommendation. It could seem to be it, sound prefer it, however surprisingly, it’s not. Buyers are anticipated to do their very own due diligence and seek the advice of with an expert who is aware of their targets and constraints.