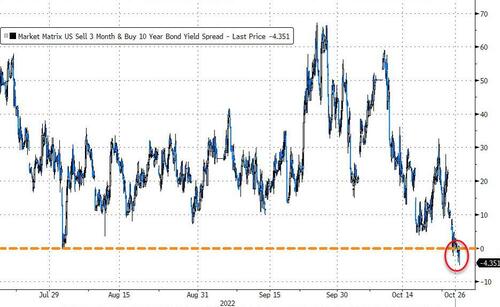

The last four days have seen 10Y yields plunged almost 35bps from their highs while the 3m bill yield has crept higher by around 12bps…

Source: Bloomberg

Which has left the much-watched (and Fed-blessed) indicator of recessions (the 3m10Y Treasury yield spread) has finally gone negative… after watching every other segment of the curve invert…

Source: Bloomberg

Why is this yield curve indicator so important?

Simple – while 2s10s and so on are much discussed, they are quickly shrugged off by the permabull crowd as being overly sensitive – “predicting 10 of the last 5 recessions” for example; in the case of the 3M10Y spread, no lessor venerable institute than The Federal Reserve Bank of New York has blessed this as their preferred recession signal:

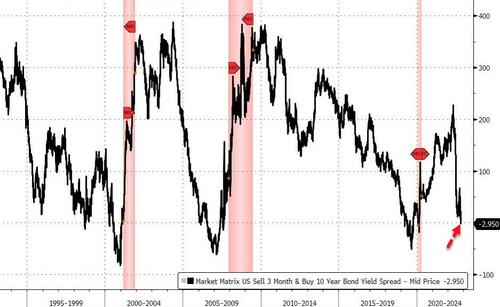

“Our preferred combination of Treasury rates proves very successful in predicting the recessions of recent decades.

The monthly average spread between the ten-year constant maturity rate and the three-month secondary market rate on a bond-equivalent basis has turned negative before each recession in the period from January 1968 to July 2006″

Since then it has also been successful at predicting recessions…

The NYFed concludes:

“As for why the yield curve is such a good predictor of recessions, we have reviewed a number of possible reasons, each of which may play an important role at different times. The consistency with which these explanations relate a yield curve flattening to slower real activity provides some assurance that the indicator is valid.“

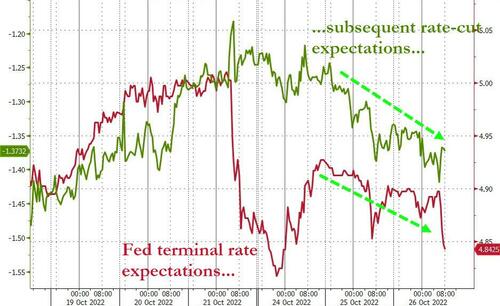

Crucially, while 2s10s spreads have been popular, they are unlikely to have worried The Fed; but the inversion of the 3M10Y spread is a different matter that may, just possibly, feed the ‘pause’ (or even ‘pivot’) narrative because of its recessionary predictive ability.

Just don’t tell The White House.