GOLD PRICE OUTLOOK

- Gold costs retreated this week however are nonetheless up greater than 5% in March

- The Fed’s financial coverage announcement will take heart stage within the coming week

- This text examines XAU/USD’s technical outlook and key value ranges

Most Learn: EUR/USD Ranges Off at Help Forward of Key Fed Resolution – Outlook & Evaluation

Gold costs (XAU/USD) retreated this week, falling about 1.05% to $2,155, dragged decrease by the rebound in U.S. Treasury yields and the U.S. greenback. Regardless of this setback, the valuable steel maintains sturdy bullish momentum, mirrored by its March efficiency thus far, which has produced a acquire of round 5.5% and led to latest all-time highs.

GOLD, US DOLLAR & US YIELDS PERFOMANCE

Supply: TradingView

Earlier this month, bullion climbed sharply on bets that the Federal Reserve would quickly begin chopping rates of interest. The rally accelerated after Fed Chair Jerome Powell indicated in an look earlier than Congress that policymakers had been “not far” from gaining larger confidence within the inflation outlook to pivot to a much less restrictive stance.

Markets bought overexcited by Powell’s feedback, offering bullish traders with a cause to drive XAU/USD upwards. Nevertheless, the image has begun to vary over the previous few periods, with a brand new storyline unfolding within the wake of disappointing shopper value information, revealing a stark actuality: progress on disinflation is stalling and probably even reversing.

Keen to realize insights into gold’s future path? Uncover the solutions in our complimentary quarterly buying and selling information. Request a replica now!

Really useful by Diego Colman

Get Your Free Gold Forecast

With upside inflation dangers beginning to materialize, as seen within the final two CPI and PPI reviews, merchants shouldn’t be shocked if the central financial institution begins to undertake a extra hawkish posture, signaling that extra endurance is required earlier than eradicating coverage restraint and that fewer charge cuts than initially anticipated will seemingly happen as soon as the method will get underway.

We are going to know extra in regards to the Federal Reserve’s plans subsequent week (Wednesday) when the establishment proclaims its March resolution. Whereas policymakers are seen maintaining their coverage settings unchanged, they might present completely different steerage and forecasts in response to new data on the macroeconomic entrance; in any case, data-dependency has been the tenet.

Within the newest Abstract of Financial Projections, the Fed hinted that it might ship 75 foundation factors of easing this yr and market pricing has converged to this estimate of late. If policymakers had been to point an intention to ship fewer cuts than what’s presently discounted, we might see bond yields and the U.S. greenback push greater. This must be bearish for gold costs.

Questioning how retail positioning can form gold costs? Our sentiment information gives the solutions you’re on the lookout for—do not miss out, get the information now!

| Change in | Longs | Shorts | OI |

| Day by day | 1% | -3% | -1% |

| Weekly | 14% | -2% | 5% |

GOLD FORECAST – TECHNICAL ANALYSIS

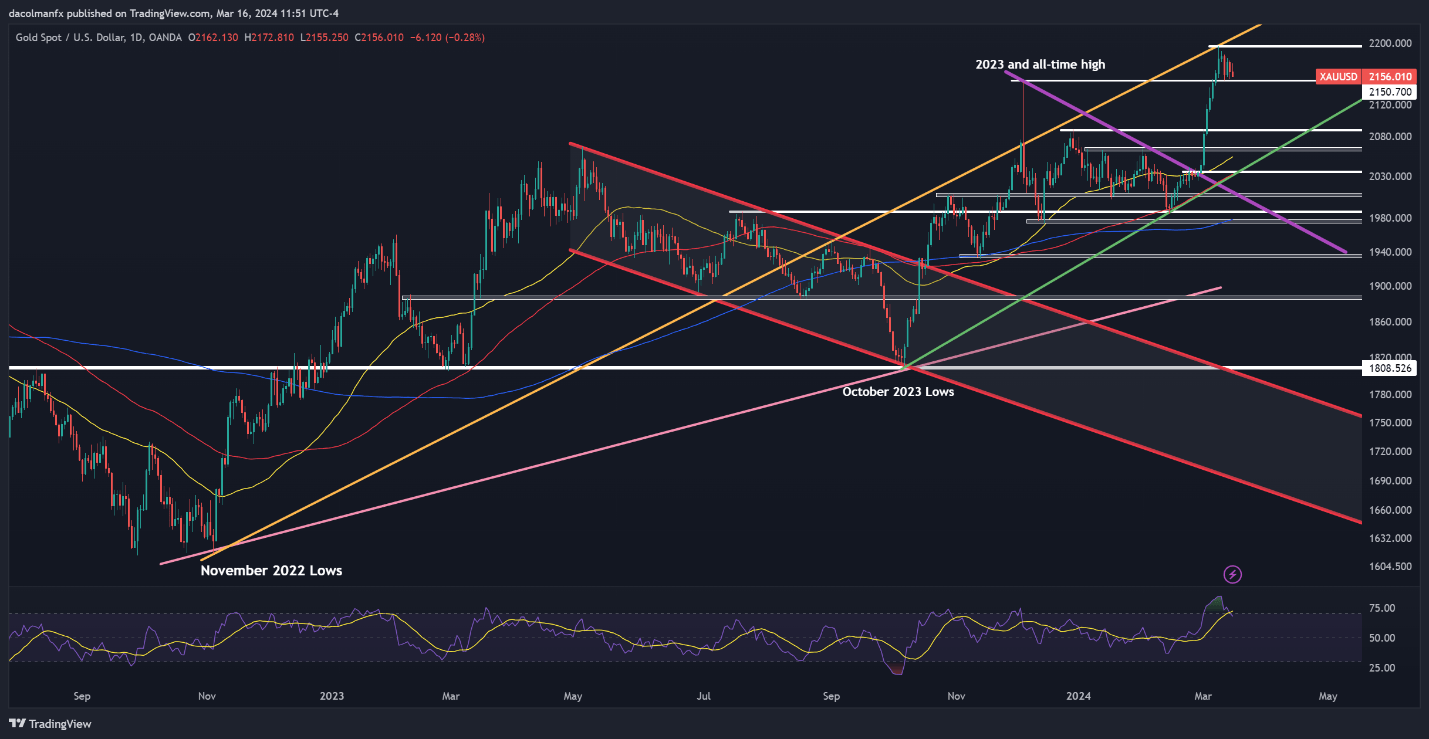

Gold costs fell this week, however managed to carry above help at $2,150. Bulls should actively shield this technical zone to forestall an escalation of promoting stress; failure to take action might set off a pullback in the direction of $2,085. In case of additional weak point, the highlight will likely be on $2,065.

On the flip aspect, if consumers regain decisive management of the market and spark a bullish reversal from the steel’s present place, the primary impediment lies on the document peak established earlier this month at $2,195. Additional upward motion will draw consideration to trendline resistance close to $2,205.

GOLD PRICE TECHNICAL CHART

Gold Worth Chart Created Utilizing TradingView