Federal Reserve Chair, Jerome Powell, tried his finest to speak up the prospect of a higher-for-longer rate of interest coverage story, however the market didn’t imagine him yesterday and will likely be even much less inclined to take action after right this moment’s private revenue and spending report.

The 0.2% month-on-month deflator end result (consensus 0.3%) is one other inflation shock with the year-on-year charge slowing to five% from 5.2%. That is vital as it’s the Fed’s favored measure of inflation and with pipeline worth pressures, akin to import costs and , additionally persevering with to melt after we received the delicate core print, it poses actual challenges to the Fed’s narrative on inflation.

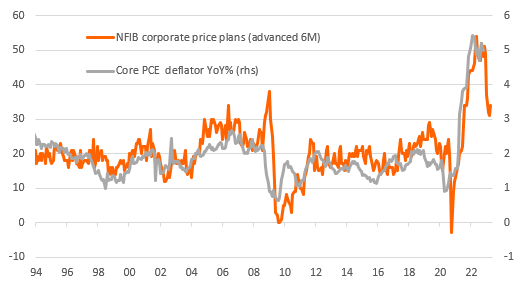

The truth is, the state of affairs might get even trickier for the Fed with the chart under plotting the core PCE deflator in opposition to the Nationwide Federation of Impartial Companies worth plans survey. It exhibits that the proportion of corporations trying to increase their costs over the following three months has dropped sharply very not too long ago, presumably reflecting some proof of softening demand and rising stock ranges. This relationship suggests the core PCE deflator might head down to three% by the tip of 1Q, which might argue that we’re getting near the highest for the Fed funds goal charge.

Furthermore, if the financial system does fall into recession as many concern, that company pricing energy story will weaken a lot additional and will contribute to inflation getting near the two% goal by the tip of 2023.

NFIB Company Worth Plans, Core PCE Deflator

Exercise Nonetheless Holding Up for Now

For now although, the exercise aspect is holding up nicely with actual shopper spending rising 0.5% MoM in October, the strongest acquire since January. The information on the Black Friday/Cyber Monday retail gross sales has additionally been good and signifies that actual shopper spending is on observe to rise at a 4% annualized charge within the present quarter. We additionally anticipate to see a robust jobs quantity tomorrow given that job vacancies exceed the full variety of unemployed People by an element of just about two. The Fed will seemingly level to those components as justifying an ongoing hawkish place insofar as demand exceeding provide will preserve the inflation menace alive.

A 50bp rate of interest hike for December nonetheless seems a certainty and we proceed to anticipate a ultimate 50bp hike in February. For any extra hikes we’re going to have to see sturdy demand proceed, however with US CEO confidence on the lowest degree because the World Monetary Disaster and the housing market deteriorating quickly, it isn’t our base case.