The inventory market declined yesterday, coinciding with an increase in charges on the and Treasuries to their highest ranges since 2007. Forward of the assembly, the bond market is signaling that charges will seemingly stay excessive for an prolonged interval.

That is additional evidenced by the Fed Fund Futures, which counsel that charges are anticipated to remain above 4% by way of 2028. I anticipate that the dot plots will echo an analogous sentiment.

Fed Fund Graph

Fed Fund futures for December 2024 and 2025 present charges of 4.7% and 4.24%, respectively, that are up massively over the previous couple of months. I’d count on the Abstract of Financial Projections tomorrow to replicate 2024 and 2025 Fed Funds price just like these worth, if not even barely larger.

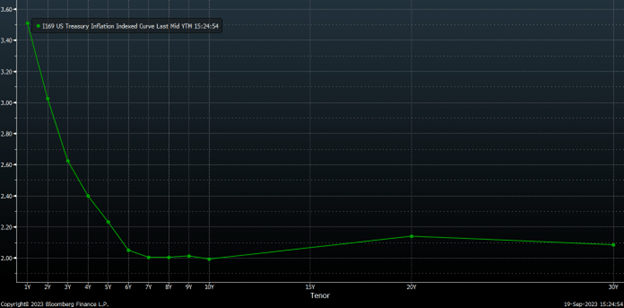

In the meantime, nearly the whole actual yield curve is above 2% out to 30-years, and if we assume a targetted inflation price of two%, then it will suggest that nominal charges keep round 4% for a really very long time.

US Treasury Inflation

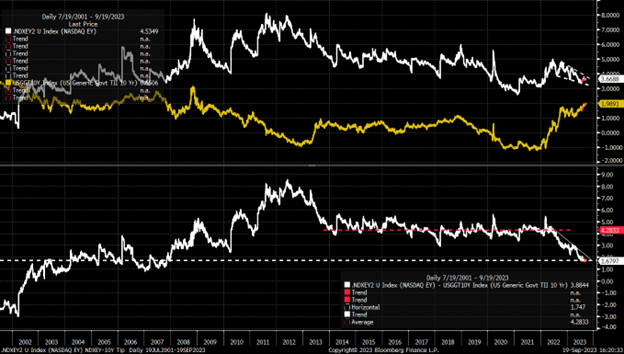

Nevertheless, the slim unfold between the earnings yield and the 10-year actual yield signifies that the fairness market is just not anticipating the Federal Reserve to take care of excessive rates of interest for an prolonged interval. Moderately, it means that the market anticipates the Fed will transfer to chop charges aggressively within the close to future.

NDX-Day by day Chart

This suggests that the unfold between the earnings yield and the (Treasury Inflation-Protected Securities) should widen. For this to occur, the Nasdaq 100 earnings yield should start to rise in parallel with each nominal and actual yields.

Moreover, we’ve noticed that for the reason that finish of July, the Nasdaq 100 earnings yield has been rising alongside the 10-year TIP. Moreover, it seems the Nasdaq incomes yield could also be breaking out of a bull pennant, suggesting that the earnings yield of the Nasdaq 100 might proceed to rise additional, together with the 10-year actual yield.

NDX-Incomes Yield Chart

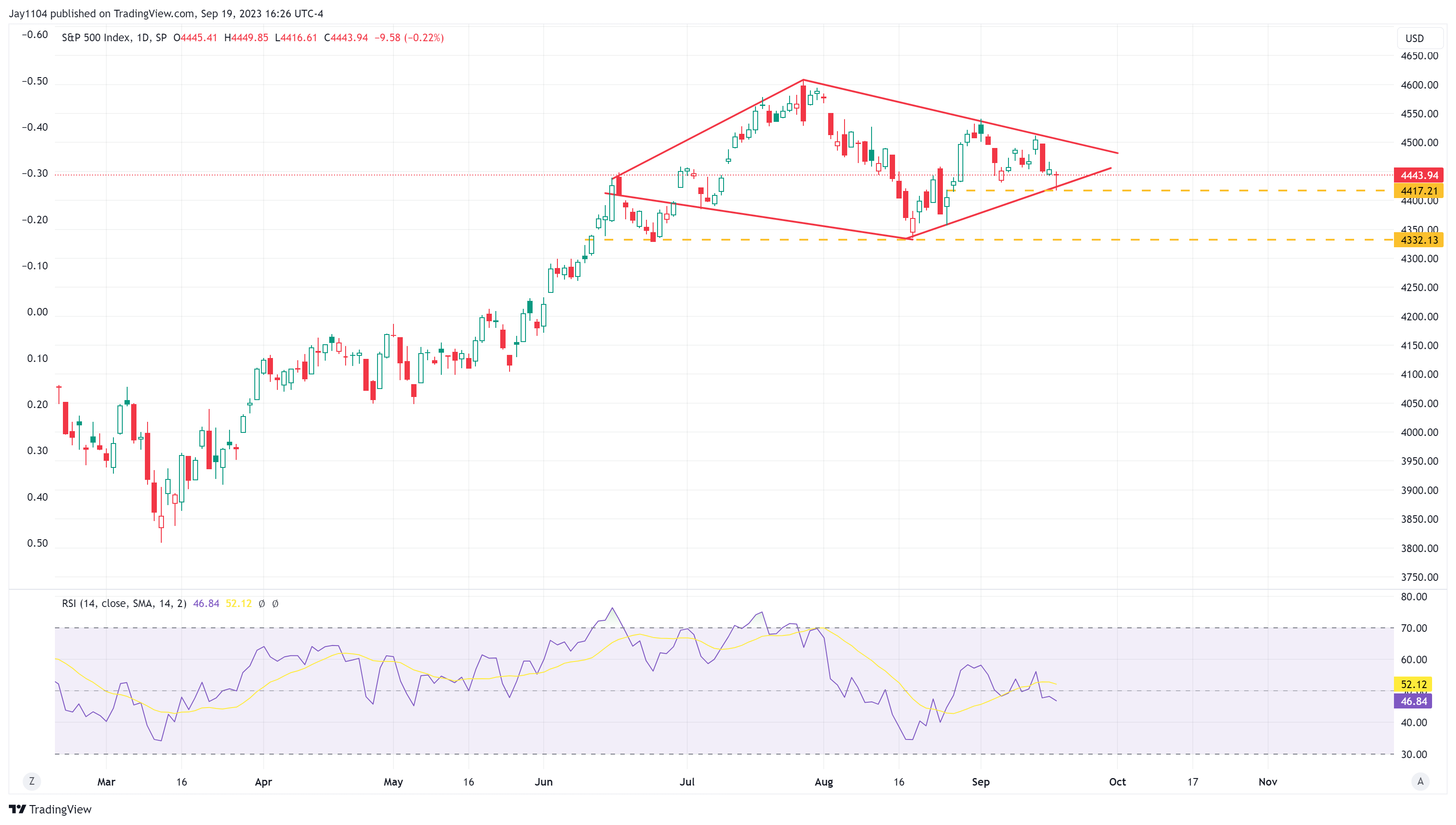

S&P 500 to Return Under 4,200?

As we speak, the declined to a assist degree of round 4,420, which led to a bounce within the index. The “put wall” for the S&P 500 can be located at 4,400, offering extra assist. For the S&P 500 to interrupt decrease, as I anticipate, we would wish to see the put wall begin to transfer downward. Nonetheless, I nonetheless consider {that a} diamond reversal sample has shaped, which seemingly signifies a return to ranges under 4,200.

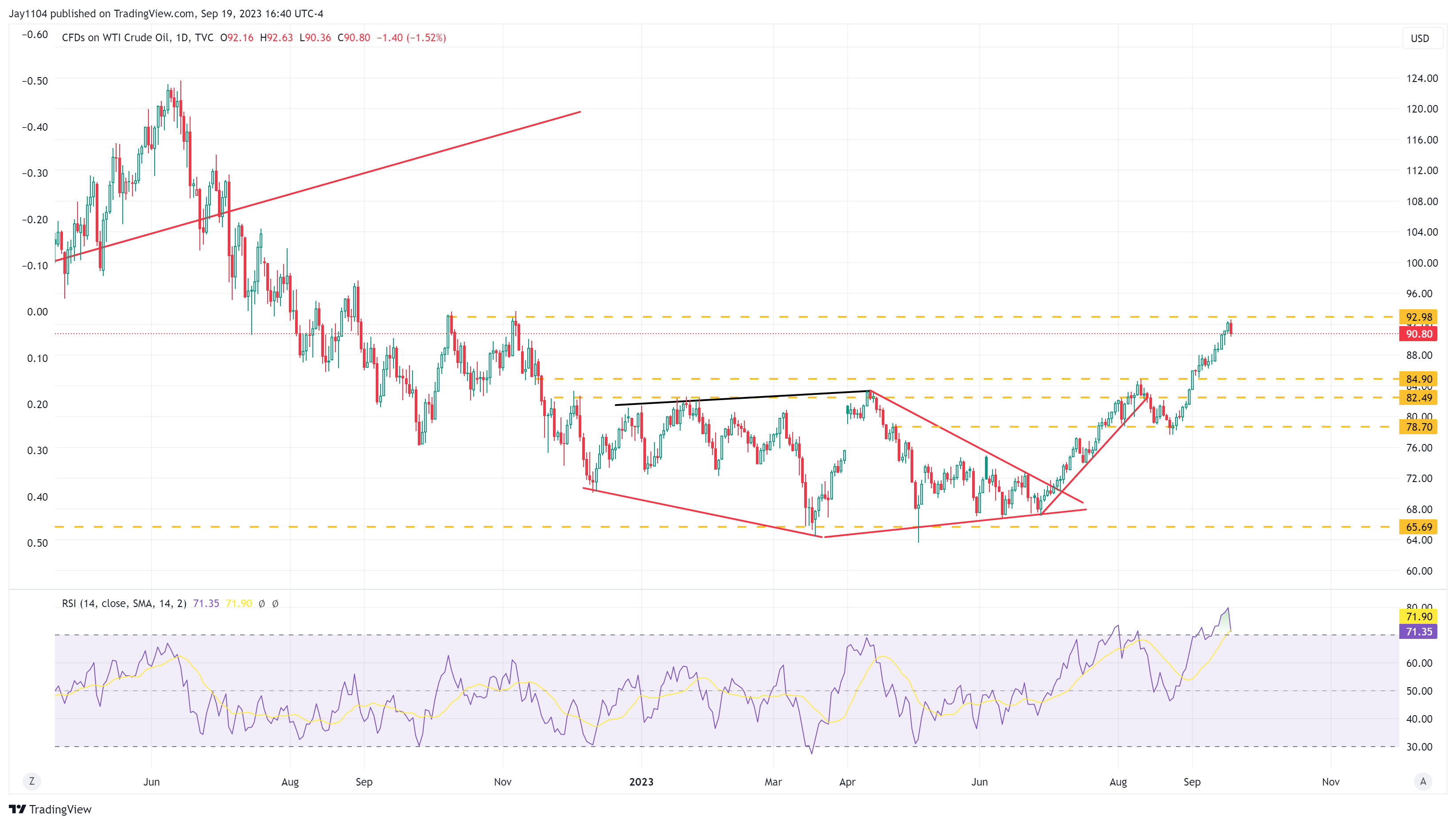

Oil Costs to Take a Breather

costs surged into the resistance zone between $92 and $93 earlier than experiencing a pointy reversal. This zone represents vital resistance, and a transfer above this degree might result in a pointy improve in oil costs again in direction of $97. Nevertheless, given oil’s current robust efficiency, it wouldn’t be stunning to see it plateau or pause at these ranges.

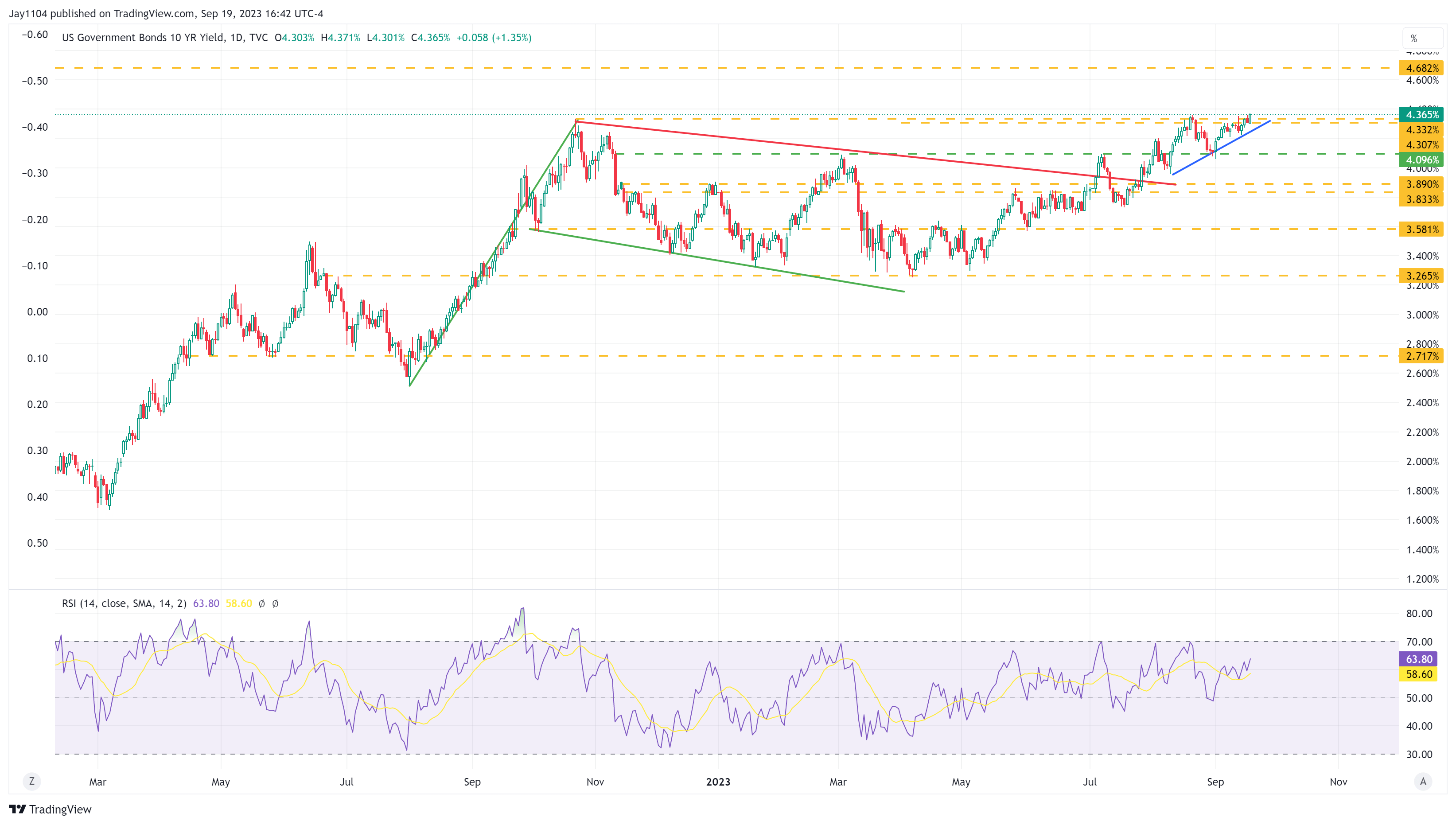

US 10-12 months Price Might Proceed Climbing

Moreover, at the moment the 10-year price broke above a resistance degree, closing at its highest level since 2007 at 4.37%. At this juncture, an extra climb appears believable, maybe even to 4.7% over time, notably if the bond market continues to entertain the concept of a sustained 4% nominal price.

Company Bonds Consolidate: What’s Subsequent?

In the meantime, the has been in a consolidation part for a number of months, and it seems that this part is nearing its conclusion. Not too long ago, I’ve noticed some bearish choices exercise within the HYG. This means that if the consolidation resolves to the draw back, we might see widening credit score spreads.

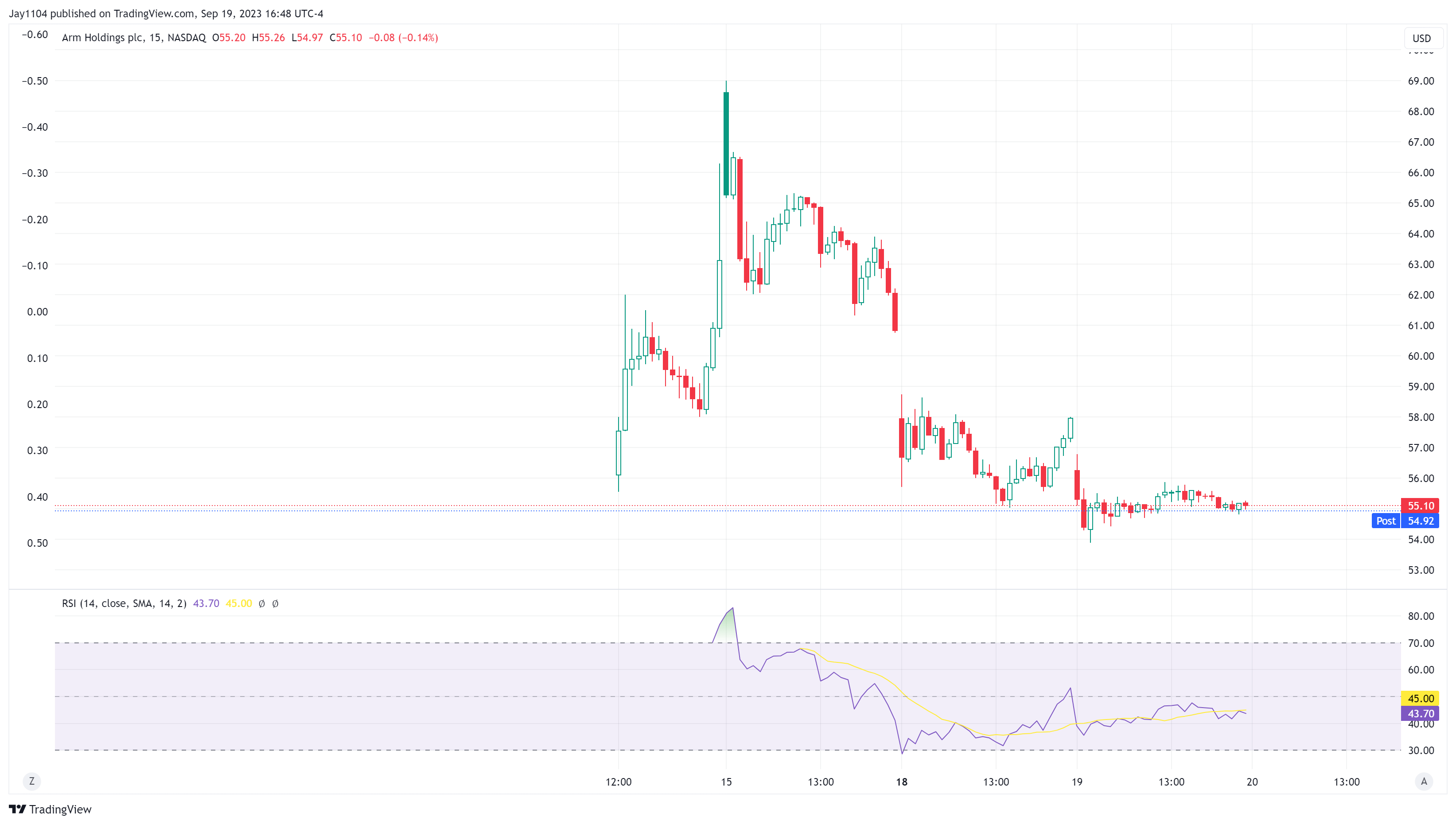

ARM Inventory’s Breakdown Is a Key Sentiment Indicator

Lastly, Arm Holdings (Nasdaq:), which went public final week and was priced at $51, has seen a pointy decline in its inventory value over the previous few days. Presently buying and selling at $55, down considerably from its excessive of $69, this might function a major sentiment indicator.

If the inventory breaks under its IPO value of $51, it will strongly point out that the deal was overpriced. This might result in additional declines if traders shedding cash from the providing determine to exit their positions, making $51 crucial to observe.

Unique Put up