Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin returned to its acquainted value vary over the week after a dip final weekend introduced its value to simply beneath $99,000. This was adopted by a bounce to the $106,000 value degree, which has given bulls a motive to stay hopeful.

Nevertheless, on-chain knowledge reveals some deeper cracks are forming beneath the floor. The newest on-chain knowledge from analytics agency Glassnode reveals rising indicators of fatigue in each spot and futures markets. These are situations that will once more trigger Bitcoin value to retest $99,000.

Value Assist Holds, However Momentum is Clearly Fading

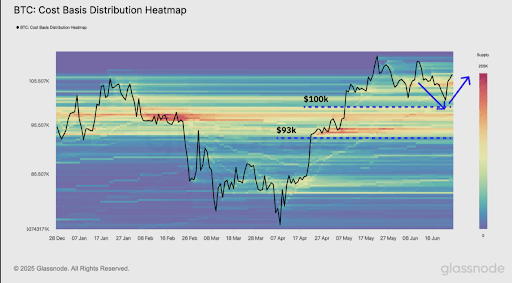

Bitcoin has gone by means of a number of value swings in latest days, however it has discovered its means again to the slim $100,000 to $110,000 band that has outlined market construction since early Might. On-chain knowledge from Glassnode reveals that robust accumulation between $93,000 and $100,000, which is seen on the Cumulative Quantity Delta (CBD) Heatmap, has to date served as a buffer zone that helped Bitcoin’s costs bounce throughout the most up-to-date geopolitical volatility. Nevertheless, market quantity signifies that this structural help might quickly face extra strain.

Associated Studying

Based on the most recent weekly report by Glassnode, investor profitability and engagement surrounding Bitcoin are cooling quickly. Particularly, a 3rd main wave of profit-taking is inflicting the 30-day realized revenue common to taper, and on-chain exercise has decreased considerably. The 7-day shifting common of on-chain switch quantity has dropped by about 32%, from a peak of $76 billion in late Might to $52 billion over the latest weekend. Present spot quantity buying and selling, which is now at simply $7.7 billion, is much under the volumes seen throughout earlier rallies.

The shortage of robust shopping for enthusiasm on the spot market reveals that bullish sentiment has been changed by warning. As such, the chance of a breakdown under $99,000 grows except one other wave of demand re-enters.

Futures Market Additionally Cooling Off

The slowdown in sentiment is not restricted to the spot market. Though Bitcoin is attracting curiosity on derivatives exchanges, there are clear indicators that futures sentiment is waning. Open curiosity dropped by 7% over the weekend, from 360,000 BTC to 334,000 BTC, and funding charges have been declining steadily since Bitcoin hit its Q1 2025 all-time excessive.

Associated Studying

Futures market contributors had been very lively by means of Bitcoin’s climb to $111,800 in Might, however their conviction seems to be fading now. An additional indication of a rising reluctance to carry lengthy positions is the sharp decline in each the annualized funding price and the 3-month rolling foundation.

With out stronger directional conviction, the futures markets might not present the upside wanted to push Bitcoin to new highs. This example might as an alternative contribute to extra downward strain.

Thus far, Bitcoin has revered the $93,000 to $100,000 help zone, which was closely accrued throughout the Q1 2025 prime formation. Nevertheless, with low spot volumes, on-chain exercise slowing, and fading futures sentiment, this help may develop into examined once more. If market contributors with a price foundation on this zone start to promote, the ensuing strain may drag Bitcoin under $99,000 once more subsequent week.

On the time of writing, Bitcoin is buying and selling at $107,100.

Featured picture from Pixabay, chart from Tradingview.com